SmartestEnergy has outlined its predictions for power bill non-commodity cost increases from next year onwards. The forecasts suggest significant hikes for some pass through charges.

SmartestEnergy has outlined its predictions for power bill non-commodity cost increases from next year onwards. The forecasts suggest significant hikes for some pass through charges.

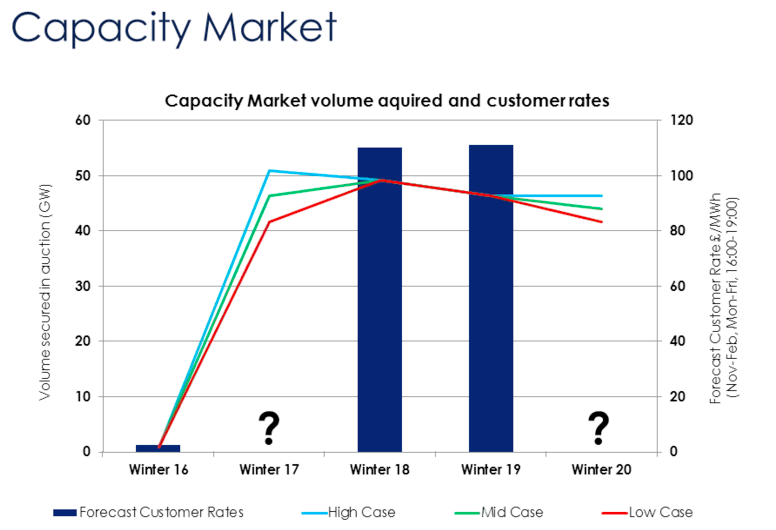

For bills next winter, the greatest unknown is the capacity market charge after the department of energy and climate change decided to bring the market forward by a year. As brokers and suppliers have warned, the impact on bills will only become clear once the result of the auction is published. It is anticipated that the out-turn may be significantly higher than previous auctions as government tries to legislate to prevent diesel and reciprocal gas engines from scooping the pool.

However, there are also some unknowns around Renewables Obligation (RO) costs, which will be set for next year in September. Firstly, how many energy intensive industry (EII) firms will qualify for the exemption on renewable levies. The more that qualify, the higher the scheme costs for everyone else. Secondly, whether Drax is granted late approval for the Contracts for Difference (CfD) support scheme. It is currently supported, via bills, through the RO.

In all scenarios, said SmartestEnergy, the RO will likely increase next year by around £3/MWh, but will then level out as the scheme closes to new entrants. The firm also predicts the impact of the small scale feed-in tariff (FiT) will increase. Although its forecasts were tempered by new caps on the scheme, SmartestEnergy pointed to the general trend of lower underlying UK demand creating a smaller base from which to recover costs.

Meanwhile, although the costs of the CfD scheme currently adds very little to bills, firms will start to feel the impact from next year onwards. SmartestEnergy predicts it could push beyond £9/MWh by 2019/20.

Triad

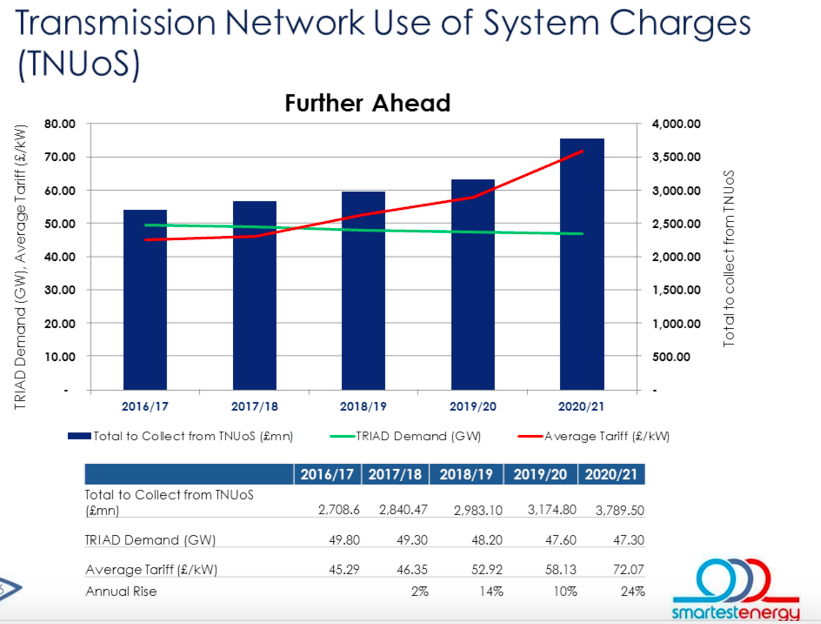

SmartestEnergy said that regional differences in transmission network charges were expected to be more marked in coming years. While firms in Scotland and the north of England could expect to pay less than this year, it predicts increases for all other regions.

The firm also said Triad periods were becoming harder to predict, with many more instances of half hourly demand getting close to the Triad period. That meant firms must double down on sustained energy reduction measures to be sure of hitting Triads. It predicts average Triad costs will increase by 2% next year, but warned firms to expect double digit increases for the following three years.

The company outlined its predictions in a webinar earlier this month. A poll of the audience found 88% considered an exit from the EU would have negative consequences for the energy sector.

Related stories:

Protection for energy intensive will add 7% to other firms’ third party costs

Major changes to capacity market and distributed generation charging regime proposed

Energy brokers and TPIs warn early capacity market could add 5% to power bills

Capacity auction fails to incentivise new gas plant

National Grid, aggregators and suppliers join The Energyst for DSR Event

Early capacity market costs to hit energy bills

Higher credit cover and penalties for capacity market providers

Capacity market closes with no new gas as aggregators warn of £75/MW hour price spikes

Capacity market rule changes create opportunities for businesses that can turn down power use

Major changes planned for capacity market

Energy intensives urge government to broaden renewables cost protection

Energy intensives to be refunded policy costs, says Cameron

Click here to see if you qualify for a free subscription to the print magazine, or to renew.

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.

Great article, it highlights the risk that businesses have to deal with. We’ve undertaken a similar analysis and our forecasts are slightly higher, you can see our workings here – https://www.edfenergy.com/large-business/talk-power/blogs/how-spot-next-leicester-city-scale-surprise-energy-market