The investment managers have raised the cash in the first phase of their NextPower UK ESG fund, a solar-specific infrastructure fund intended to double the technology’s generating assets in the UK.

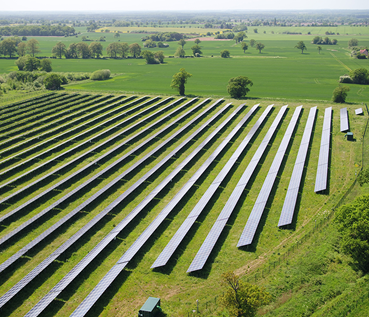

It will pay for construction of up to 60 subsidy-free solar plants, with the capacity to provide up to 2GW of clean electricity every year. That’s enough to power half a million households, equalling in effect the removing of 200,000 carbon-emitting cars from the roads.

Matching the funding commitments of investors secured by Next Energy Capital’s NextPower UK ESG fund is the UK Infrastructure Bank. Opened by Rishi Sunak when chancellor, the UKIB launched in June 2021. In the NPUK ESG fund’s imminent second phase, UKIB’s contribution will top out at a theoretical £250 million.

Cash raised in little over a year so far leaves the NextPower UK ESG fund with only another £173 million to raise on its way to its targeted £500 million. The hard cap is £1 billion, an objective fundraisers intend reaching over twenty-four months from today’s first close.

Local government pension funds are the backbone providers to UK solar in the fund’s first stage. That will give heart to campaigners in the Divest Now movement, seeking to purge Britain’s town halls of dangerous ‘stranded assets’ held in carbon-polluting oil and gas producers.

Support in NextPower’s first round includes, beside tax-payers’ UK Infrastructure Bank, the Merseyside Pension Fund, a consortium of Midlands local councils and the Brunel Pension Partnership, which pools pension pots worth around £35 billion of 10 local authorities in England’s west and south.

Made as long ago as 2013, Lancashire county council’s £12 million loan repayable over 24 years to EU-prize-winning Oxfordshire co-operative Westmill Solar’s joint 5MW combined solar and wind co-operative, blazed a trail in local government’s priming of private support for clean electricity.

Among NextEnergyCapital’s pipeline of identified imminent projects are two already in operation. at Llanwern, south Wales, and Strensham, Worcestershire.

Built for £43 million during lockdown and generating since March 2021, the 75MWp Llanwern plant near Newport is the UK’s largest operating solar farm.

Michael Bonte-Friedheim, NextEnergy Capital’s CEO and founding partner, said: “NPUK ESG is the first UK fund that targets purely new-build subsidy-free utility scale solar.

“I am proud that NextEnergy Group is driving this forward, showing how solar assets in the UK can provide investors with a significant return while reducing the carbon footprint of the UK.

Interest declared: The author has campaigned at various times since 2015 in the Divest Now movement, seeking to strip local councils’ pension pots of stranded assets held in fossil fuels.