Rising prices for firm frequency response at the tail end of 2019 brought more providers back into play, according to National Grid ESO.

Meanwhile Triad avoidance reached a multiyear high – with batteries driving the shift – and Stor procurement is suspended while Grid works out how to bring procurement in line with new EU requirements.

The Power Responsive annual report provides a detailed breakdown of services procured during the year, plus a view of incoming developments.

Overall, it provides a positive outlook, though flags that changes to embedded benefits will hit some flexibility providers, and that Ofgem’s decision to allow DNOs to provide some services could damage competition.

Triad: Batteries drive bigger shift

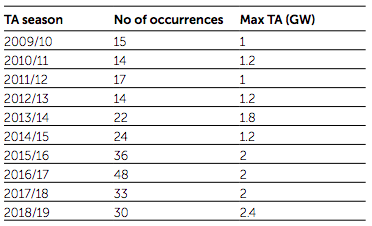

Last winter saw businesses shift up to 2.4GW of demand during evening peak periods in a bid to cut transmission charges, known as Triad avoidance.

The largest loadshift for at least a decade, the ESO puts it down to the growing number of batteries deployed at large end user sites.

Per the report: “Last winter, for the first time, we saw frequency deviations in the settlement period before expected Triad avoidance activity. National Grid ESO believes this is as a result of batteries switching.”

Stor

The report shows Short Term Operating Reserve (Stor) utilisation significantly decreased in 2019. However, of what was used, demand-side flexibility (DSF) provided a higher proportion than normal, as DSF tends to accept lower utilisation prices than traditional providers, such as larger power generators.

Meanwhile, they are also more willing to forego availability fees and tender into the flexible Stor market – where they can decide not to deliver without penalty if a better opportunity comes up.

MCPD – no impact on diesel

The Medium Combustion Plant Directive (MCPD) was expected to have a significant impact on the number of diesel generators providing Stor services.

The Directive stipulates generators that take on balancing services contracts have to meet strict emissions limits, which unabated diesels cannot do.

However, the ESO said it had “only seen only a small decrease in the proportion of diesel generators being tendered in”, with around 598MW of diesel generators still providing services in 2019, versus 616MW in 2019.

For now, Stor is suspended, as the EU’s clean energy package requires the ESO to make changes in it is procured. Under the package, contracts must be procured no more than a day ahead – and can be for no longer than a day.

Frequency response: Prices rise, change ahead

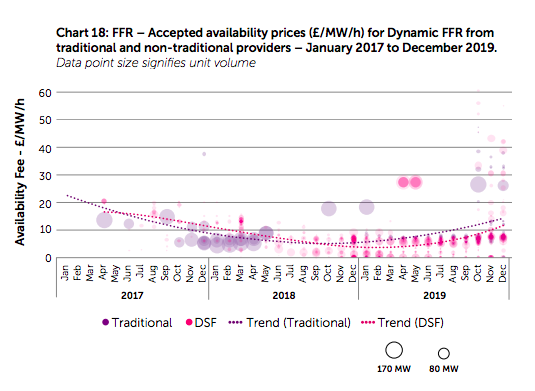

Rising prices at the back end of 2019 bought more traditional providers back to the dynamic frequency response markets. Meanwhile, the ESO had a higher requirement – 1719MW versus 1400MW after bringing some of the mandatory market into the FFR envelope.

While prices for dynamic FFR averaged £4.76/MW/h for the majority of 2019, the higher volume requirement later in the year saw average accepted prices rise to £11.50/MW/h.

That bought the large traditional assets back into play, but the report states that DSF providers still won the lion’s share, achieving three times the capacity of traditional units in the dynamic service.

National Grid is now trialling a weekly frequency response auction. While early days, the ESO said it provides a view of relatively stable prices across different day parts. A years’ worth of results should give investors some confidence as around pricing, it stated. In the longer term, FFR services will migrate to that auction platform. Meanwhile, a new Dynamic Containment product will also reduce FFR volumes.

The auction ultimately aims to move to day ahead auctions – but as yet, there is no firm timetable.

New services ahead

The Power Responsive report outlined a number of tender opportunities for the year ahead.

These include stability, voltage and constraint pathfinder projects. Meanwhile, the ESO will start to procure Dynamic Containment, designed to quickly bring frequency back within its permitted parameters, “before summer”.

Dynamic Moderation, designed to manage sudden imbalances in supply and demand, and Dynamic Regulation, designed to correct small, continuous frequency deviations, are set to follow.

Meanwhile, wider access to the Balancing Mechanism and Terre will likely “significantly change requirements for reserve services”, according to the document.

Terre, the trans-European replacement reserve service, is still scheduled to go live in June.

See the full report here.

Related stories:

CLASS action: Is Ofgem opening a can of worms?

National Grid mulls footroom options as demand drops

National Grid and UKPN combine on regional reactive power market

Coronavirus and the power system: Keep calm and put the kettle on

Ofgem: DNOs must make progress with flexibility this year

Fintan Slye: Inertia has been taken for granted, it will become much more important

National Grid outlines plans to go 100 per cent renewables by 2025

National Grid outlines plan to buy inertia

Fintan Slye: Inertia will become much more important

National Grid launches Mersey reactive power tender

National Grid signs deal to measure inertia

National Grid: Two generators cause big frequency drop

National Grid outlines plans to go 100 per cent renewables by 2025

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.