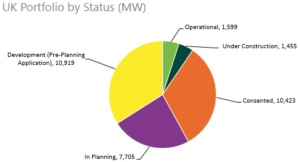

Britain’s ballooning pipeline of grid-scale storage projects has doubled in just twelve months to a total of 32.1GW, new figures from RenewableUK have revealed.

Utility-scale kit now operating to despatch amps within a gnat’s crotchet of a millisecond stands at 1.6GW in spring 2022. Another 1.4GW is under construction, according to the advocate body’s Energy Pulse toll-keeping for the year to March.

A further 10.4GW has received planners’ approval but has yet to see ground broken. Another 7.7GW sits in in-trays, awaiting decisions. A further 10.9GW lingers pre-submission on engineers’ drawing boards.

England has the highest capacity of fully commissioned battery storage projects (1,398MW) and the largest volume of applications outstanding (6,163MW).

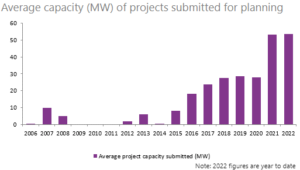

New regulations drive much of the rise. From December 2020 town halls have had power to accept or reject bigger projects. Before then, designs as small as 50MW in England and over 350MW in Wales had their fates decided in Whitehall, a more complex, less certain process which imposed greater risk on financiers and other backers.

New regulations drive much of the rise. From December 2020 town halls have had power to accept or reject bigger projects. Before then, designs as small as 50MW in England and over 350MW in Wales had their fates decided in Whitehall, a more complex, less certain process which imposed greater risk on financiers and other backers.

Changing the process has encouraged developers to seek economies of scale. Now in 2022 the mean capacity per application is 54MW, the trade body notes: ten years ago it was a miniscule 2MW.

Nearly a fifth of the 6.1GW total pipeline of projects shares a site with solar farms, mostly in England (5,320MW). That’s a rocketing threefold rise in PV-colocated capacity, a mere twelve months since the trade group’s last report.

Barnaby Wharton, RenewableUK’s director of future electricity systems, pointed out: “The fact that the battery storage pipeline has doubled within the space of twelve months shows that the enormous appetite among investors for this technology is continuing to grow fast.

“Developers still need access to cheaper capital”, Wharton warned. “Government can help by setting out a long-term vision for the sector, including a clearer and more stable route to market for energy storage. Although we’re making great progress, we’re still some way from delivering the 30GW of operational flexibility which the government requires by 2030”.

More information for non-members of the REA is here.

The global shortage of battery-quality lithium salts becoming obvious only when the price of these salts started escalating wildly in November last year, peaking at 10 times 2020 costs this month, has messed up the price and availability of lithium ion batteries hugely!

Even in February this year, the developers responsible for most of this “pipeline” were still expecting and planning for battery costs this year to be even lower than those completed during 2021.

Instead, completed batteries will be sharply more costly this (and next) year, than in 2021. And all the Asian battery suppliers will be very careful about promising firm deliveries, for many years to come.

The EV market will, increasingly, be the main target for those battery suppliers strong enough to ensure their requirements of lithium salts, preferably those able to avoid costly ESG-compliance measures!

Thanks, Hugh. If you’ve not already read it, gaining lots of views with The Energyst’s readers, is our story in April about Tees Valley Lithium, aiming to satisfy 15% of Europe’s market for lithium as soon as 2025. See