A capacity market price of £8.40/kW in the T-4 auctions is bad news for UK battery storage developers.

A capacity market price of £8.40/kW in the T-4 auctions is bad news for UK battery storage developers.

Significant volumes of battery storage prequalified for the auction, just 153MW of derated capacity took an agreement at that rate. Almost a gigawatt exited as the price dropped.

Last winter, 500MW of batteries secured agreements in the T-4 auction, which cleared at £22.50, although that figure is not directly comparable to the latest auction due to derating factors announced in December.

Capacity market agreements are a small but important revenue stream for battery storage developers because they can provide a 15-year bankable income on which to stack short-term contracted revenues, such as frequency response, or merchant revenues, such as arbitrage.

Aggregators took most of the agreements secured for demand-side response. Some 1.2GW of DSR took agreements versus 1.04GW that exited, of which 978MW was unproven DSR. That volume is broadly similar to last winter’s T-4 auction (1.4GW).

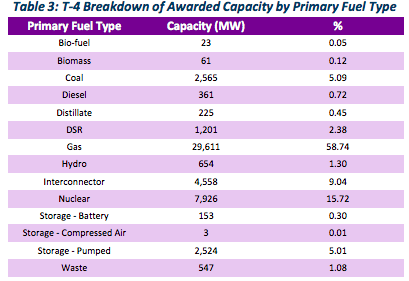

The vast majority of agreements went to existing generation. Gas plant secured agreements for 29.6GW, nuclear 7.9GW, while interconnectors, included in the auction for the first time, secured 4.6GW.

Meanwhile coal secured just 2.6GW compared to 6.1GW of coal and biomass in the previous T-4 auction.

Pumped storage took 2.5GW, DSR 1.2GW, hydro 654MW and energy from waste 547MW. Diesel agreements totalled 361MW, roughly half versus last winter’s T-4 auction.

For a full breakdown of agreements and exits by technology type, see the EMR Delivery Body portal.

Related stories:

T-4 capacity market clears at £8.40, lowest yet

Medium Combustion Plant Directive takes back-up generators out of DSR

Battery storage cut down to size as gigawatts qualify for capacity market

T-1 capacity market auction clears at £6/kW

Demand-side response auction clears at £45/kW

Shifting the balance of power: New, free demand-side response report

Half of small generators ‘could give up capacity market contracts’ after Triad cuts

Businesses ‘shutting down from 4-7pm due to peak power costs

Capacity market ‘buying the wrong stuff because it’s joined up with nothing’

Capacity market too low for large gas, but gigawatts of DSR, batteries and CHP win contracts

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.