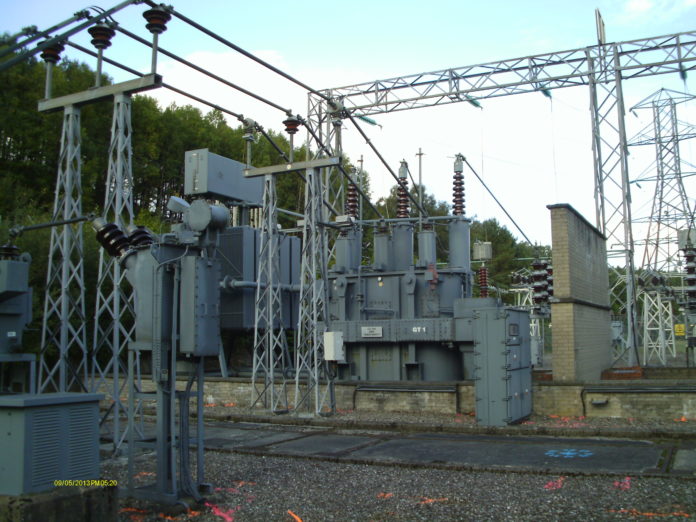

National Grid’s £7.8 billion acquisition of Britain’s largest electricity distribution business has won formal approval from the competition watchdog.

The Competition and Markets Authority announced this morning it has decided against referring the completed takeover of Western Power Distribution from US energy giant PPL Corporation for an in-depth investigation.

National Grid announced the acquisition in March as part of a shift towards electricity and greener energy.

A flurry of deals to pivot its portfolio saw the ESO also announcing the sale of Narragansett Electric Company, its utility business in Rhode Island, to PPL for the equivalent of £2.8 billion.

National Grid revealed at the time it would launch a process later in the year to sell a majority stake in National Grid Gas (NGG).

The moves mean electricity assets will make up around 70% of the group’s assets, compared to 60% before the deals, the operator specified to investors.

In June the CMA had launched a retrospective merger inquiry into the WPD acquisition, even though the deal had already gone through.

National Grid said this morning it was “pleased” the regulator had given the deal the green light. An investors event on November 18 will reveal NG-ESO’s detailed plans for WPD.

By 12:30 National Grid ESO’s share price had risen 0.82%, valuing the group at a whisker short of £34 billion.

The refocusing of National Grid’s business puts it on an electrification path along with the rest of the country as gas boilers are phased out and electric cars become the norm.

According to its own projections, around 27% of the UK’s energy needs will be met by electricity or renewables by 2035, compared to 23% in 2018.