Respected energy analysts Cornwall Insight today found themselves at odds with Britain’s embroiled prime minister, as they revealed research predicting that volatile gas prices could persist into the next decade, without long-term corrective action from Britain’s government.

In his soothing untruth uttered in September, premier Johnson told Brits that soaring wholesale prices then sending dozens of UK suppliers to the wall were ‘a temporary problem’.

Four months later, estimates of April’s impact of a revised price cap caused by still volatile wholesale gas estimate rises of nearly 50% on average homes’ energy bills. Cornwall predicts 46%.

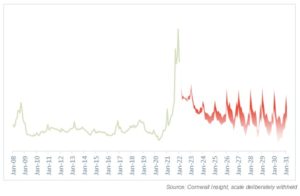

The firm’s Benchmark Power Curve looks at energy investment and operational decisions over a 30-year period. Its latest output predicts that from 2026 prices could become increasingly volatile, jumping by £95 per MWh between summer and winter.

By 2030 the seasonal differential will increase to nearly £120 per MWh, the firm predicts.

A combination of just-in-time purchasing of energy, an overreliance on insecure energy imports, increased weather risks and a reduction in nuclear and coal power stations will leave the UK energy prices vulnerable to instability into the next decade, unless action is taken, the analysts conclude.

Figure 1: Historic and forecast range average monthly Day-Ahead prices (£/MWh)

Johnson’s phone call scheduled yesterday with Vladimir Putin, including over Russia’s gas supplies to Europe, didn’t happen.

Gassing at a ‘gathering’

It clashed with the Premier offering his latest semblance of contrition to Parliament for as many as twelve lockdown-busting parties at No10, including those he admits attending.

Tom Edwards, Cornwall Insight’s senior modelling consultant foresees “many years of boom-and-bust energy pricing in the UK”, unless the state plays a significant role in delivering greater focus on resilience and efficiency needed to guide Britain’s economy through changes required to deliver the Net Zero changes promised to the electorate.

“With all the focus of the recent energy crisis being on wholesale prices for the short-term and the imminent price caps, you would be forgiven for thinking that volatile energy markets are simply a problem for the present, not the future”, Edwards writes.

“Looking ahead to the start of the 2030s, we can see that once the nuclear power stations start to retire in greater numbers and the coal fired power stations have closed for good, there is a new period of volatile pricing coming to the UK energy market.

Over the next 20 to 30 years, policy makers must understand that market designs cannot rely on stable economic, geopolitical, or ecological systems, Edwards argues.

“Our overreliance on imported energy will also leave us vulnerable to variable pricing, with supply chain disruptions, geopolitical tensions and economics shifts, all having the potential to spill over into our market.

“Increasing the UK’s longer-term energy storage facilities could go a long way to reducing seasonal variations, helping to harness the locally generated energy from high renewable output periods for use when it’s still, cold and dark.

“It will also be important to deliver change on the demand side, with investment in energy efficient housing and electric vehicles having the potential to considerably reduce the level of power plant capacity needed”, Edwards concluded.

Criticised by observers for thinking only of sufficient evasions to tide him over until the next crisis, premier Johnson was today flying to Kiev, showing Britain’s support for Ukraine. The Metropolitan Police yesterday confirmed they are looking at around 300 photos and 500 pages of evidence in connection with parties held in lockdown at No10 Downing Street.