The UK electricity market is not functioning effectively and is progressively undermining wholesale electricity markets and creating a perpetual reliance on government decision-making according to a new report from the Energy Systems Catapult (ESC).

Rethinking Electricity Markets is an ESC initiative to develop proposals to reform electricity markets so that they enable innovative, efficient, whole energy system decarbonisation.

The report calls for government policy to mandate clear outcomes for decarbonisation of the electricity grid and allow market forces to determine the best mix of generation, storage and smart technologies to achieve those outcomes. This would create a more innovative and consumer-focused energy system able to unleash innovation to accelerate a net zero economy.

Guy Newey, strategy and performance director at the Energy Systems Catapult, said, “The current government-directed approach to energy is like Boris Johnson telling Steve Jobs how to design the iPhone. The progress on renewables over the past 10 years has been extraordinary, but if we are to finish the job of decarbonising the power sector – and create new businesses and jobs – we need to unleash the potential of our brilliant digital energy innovators to create a more flexible and greener system.

“Government now faces a strategic choice; does it want to make more and more decisions about what the future electricity market looks like? Or does it want to trust British innovators to deliver a net zero economy that works for consumers?”

While Electricity Market Reform (referred to here as EMR 1.0) has been successful in transforming the cost of renewables,(accelerating the share of renewables from 14% in 2013 to 47% in 2020) the context has changed in important ways since they were first introduced, including:

- the new goal of net zero

- new system issues emerging as a result of the rapid growth of renewables

- the inability of demand-side response and storage (‘flexibility’) to keep pace with variable renewables growth

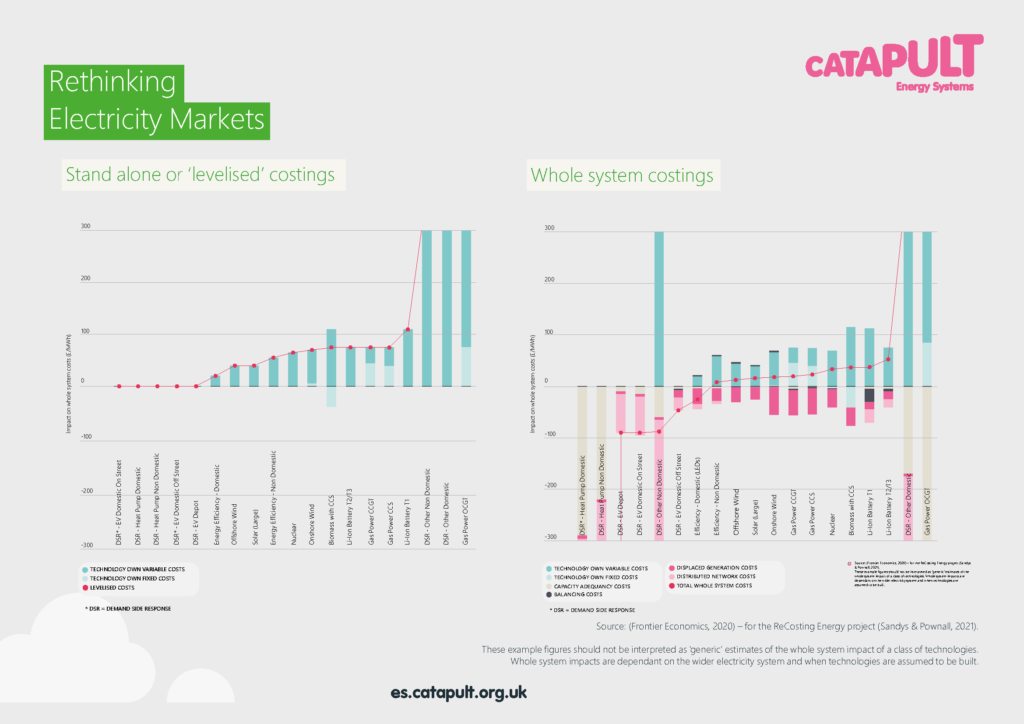

The current framework is now progressively undermining wholesale electricity markets, and creating a perpetual reliance on government decision-making to drive technology choices. Current arrangements such as the Contracts for Difference (CfD) and Capacity Market (CM) risk inhibiting innovation, misallocating investment, causing system inefficiencies, unfairly weighting investment into generation technologies over demand-side and restricting new entrants and innovation.

Indications suggest that emerging policy thinking focuses to a large degree on retaining key elements of the EMR 1.0 policy framework for the foreseeable future.

As part of the project, ESC worked alongside AFRY to:

- identify and characterise key sources of value within electricity markets and how they are reflected in current GB arrangements,

- review approaches taken in other jurisdictions and identify strategic choices for GB electricity policy for improving market signals across time and space,

- consider how to strengthen the evidence base to inform decision-making about improving the coherence of the existing UK market framework.

The recommendations

Rethinking Electricity Markets presents ESC’s view that continued use of the EMR1.0 policies risks inhibiting competition and innovation across the power sector, particularly on the demand-side and for distributed energy resources. In it, ESC makes the case for a market-pull approach to drive investment in decarbonised energy resources and shape a least cost optimal power mix. ESC recommends electricity market reforms (EMR 2.0) to:

- develop more accurateand granular system-reflective market signalsby time and location

- impose outcome-based policy mandates on retailers(for decarbonisation and system/service reliability)and offtakers (for decarbonisation)

- put in place key enabling conditions — agile governance, more effective network regulation, market monitoring and digitalisation, etc.

The six key recommendations in the report are to:

- Make electricity markets work more accurately in time and space

- Phase out centralised contracting (CfDs & CM) by mid 2020s and replace with outcome-based policy mandates on retailers and offtakers

- Evolve policy to support financial market development and contracting for investment

- Redesign innovation and early deployment support for immature technologies

to avoid distorting markets - Overhaul governance and role definitions for industry codes, system operation,

data and digital interoperability - Align electricity sector strategy, regulation and outcome-based policy

mandates with the carbon budget cycle

Now more than ever, we need accurate and granular price signals in the short-term markets to enable efficient integration of variable renewables through flexible energy resources – the last thing we need are policies that dampen these price signals.

Renewables cost structure and variability is not compatible with marginal pricing market design model.

We will make progress if we can do three things: one, remove the price distortions by reforming the current policy framework; two, remove the barriers to demand response and storage; and three, incorporate all costs, including network constraints, into prices so they accurately reflect the state of the power system in real-time and by geography and expose all market actors to those prices.

Policy thinking focuses to a large degree on retaining key elements of the EMR 1.0 policy framework, however, both the Government and the Climate Change Committee (CCC) invite immediate debate on longer term electricity market design.

The Government’s recent Energy White Paper opened the door to further market reform over the coming decade. The Climate Change Committee has also called for a ‘clear long-term strategy as soon as possible, and certainly before 2025, on market design for a fully decarbonised electricity system’. It also states that UK electricity production should be zero carbon by 2035.

Jo-Jo Hubbard, founder and CEO of Electron, said: “Markets are best placed to determine what technologies need to be built and where. Our experience developing local energy markets underlines the cost efficiencies and speed that this approach supports, but only if price signals are not dampened and distorted.

“We fully support this Energy Systems Catapult and urge Government to invest in market frameworks over large, individual capex projects.”

Caroline Bragg, Head of Policy, The Association for Decentralised Energy (ADE): “The centre of gravity of the energy system is well and truly on the move – shifting from large generation and supply to energy users from industry, offices to our homes. To achieve the progress we need in decarbonisation, we need to lean into this with determination and a real optimism for the future.”

Making green energy work for consumers

The report finds that current market arrangements do not incentivise consumer-focused innovations and services, including energy efficiency or demand reduction, particularly with the lack of a market-pull policy driver for heat. Consumers face largely undifferentiated retail offers and dynamic retail tariffs are the exception not the norm.

The report calls on the Government to create a level-playing field between different energy resources (energy demand, generation and storage) and between large and small assets, and to remove barriers to entry for new entrants. Along with the mandates, this will enable retail innovation that will deliver attractive service offers, providing more value to consumers would also unlock the demand-side flexibility that is vital to ensuring the power system can cope with the rapid growth in renewables, EVs and heat pumps necessary to achieve net zero.

Unlocking flexibility to accelerate renewables

Technologies that enable a more flexible energy system are essential as renewables become the main source of power. The International Energy Agency (IEA) has said it is vital that the growth of flexible technologies keeps pace with renewables.

However, the ESC report finds this is not being achieved in the UK, risking increased reliance on network reinforcement, over-capacity of renewable power, curtailment costs (to switch renewables off when there is too much power compared to demand) and the need for inefficient and expensive measures to ensure system reliability. The end result is a more costly and carbon-intensive energy system.

Market barriers and inadequate price signals are hampering investment in low and zero-carbon flexibility and system integration. For example, current price signals do not sufficiently reward innovators delivering flexibility. EMR 2.0 would create stronger, more accurate price signals and unlock investment in flexibility, including in the residential sector,