Electrification of heat was seen as a key policy objective in the early part of this decade, but appears to have receded in recent years, largely on grounds of cost of meeting winter peak demand.

Electrification of heat was seen as a key policy objective in the early part of this decade, but appears to have receded in recent years, largely on grounds of cost of meeting winter peak demand.

The government and much of industry now talk about a ‘whole systems approach’ that involves greener gases, such as hydrogen and biogas.

Given the relatively low uptake of electric heating systems to date, this could be viewed as pragmatic. However, others believe it will result in the UK failing to meet carbon reduction targets.

Zero emissions or bust

Richard Lowes focuses on heat policy research at the Exeter Energy Policy Group. Prior to that, he spent seven years working for a gas network company, where part of his remit was to determine the future of the gas grid in a decarbonised economy.

“I couldn’t make it work,” he says, “and that was my job”.

Lowes says a hydrogen route, as pursued by some gas companies, will not sufficiently decarbonise heat.

“My concern is that if you take the hydrogen route, you end up in a worst case scenario, because you have spent time and money yet still end up with residual emissions,” he says.

“To meet Climate Change Act and Paris targets, emissions from heat need to be absolutely zero by 2050. That is non-negotiable, because it is possible to get to zero emissions from space heating, whereas other sectors cannot get to those levels.”

Energy efficiency first

Lowes believes electrification of heat and heat networks deployed in urban areas is therefore a better pathway. But he says energy efficiency must be a policy priority.

“We should focus on reducing demand above anything. The UK still has some of the most inefficient buildings in Europe, and high levels of fuel poverty,” says Lowes.

“If we can reduce demand significantly, and the government choses to support that approach, it will be a much bigger driver for carbon reduction. Once you have lower demand, the non-gas solutions become more obvious,” he adds.

Lowes believes heat pumps, storage and smart technologies can then manage peak demand.

“The peak heat aspect is a big thing at the moment, but in 35 years time, if we have done everything we can do to prepare the building stock for decarbonisation, the peak will be much lower,” he says.

“I’m not saying there will not be a big winter peak, but it is a lot smaller than some people will have you believe.”

An electrification pathway would require more low carbon generation as well as major investment in distribution networks.

“More electricity will be needed but I don’t think we should be scared about that; it will just displace gas investment,” says Lowes, who suggests that would also reduce energy security concerns.

“It is not easy – but every way you look it is challenging and I think we have to meet it head on.”

Network investment

Ofgem frowns on speculative investment in network capacity, but does incentivise distribution network operators (DNOs) to make ‘smarter’ investments. It has also sanctioned trials around electrification of heat.

Northern Powergrid has relatively few constraint issues on its network, due to its industrial legacy. But it has started to build a smart grid ‘backbone’ to better manage higher demand or changes to load patterns should transport and heat start to factor.

The £83m ‘Smart Grid Enablers’ project will add communications technology to around 8,000 substations so Northern Powergrid can better monitor and control them, with controls upgrades or replacements planned for 1,900 substations over the five-year project.

Head of trading and innovation, Jim Cardwell, said while heat policy “is very much at a crossroads,” networks must prepare for all outcomes, hence beginning to digitise its grid.

“There are a wide range of scenarios on how decarbonisation may proceed, but our job is to understand all of them and ensure we are prepared to support electrification of heat if it goes that way,” says Cardwell. “But we will ultimately be led by the consumer.”

Heat pump challenges

Northern Powergrid completed one of the UK’s largest heat pump trials in 2014 as part of an innovation project. Around 380 air source heat pumps were installed to understand customer behaviour, economics and network effects.

“We gained an understanding of the impact of electrification of heat load, and trialled tariffs that incentivised customers to stay off peak,” says Cardwell. “Although [tariffs] successfully reduced peak load, the project did identify barriers – particularly retrofitting,” he continues.

“Some of the equipment is quite bulky and requires intrusive internal modifications in people’s homes,” says Cardwell. “So that is a barrier to acceptability.” Moreover, he says, “the operating mode is different; people have to change behavior and the operation of the heating system is quite a dramatic change”.

Cost aside, Cardwell says that presents “some barriers” to electrification of heat, “but we do have investment plans in place to ensure we can support that scenario”.

Nervous energy

However, other DNO projects indicate that even low heat pump penetration could create challenges.

Western Power Distribution conducted an innovation trial with gas network Wales & West Utilities that suggested hybrid heat pump and gas systems might be more manageable and would enable ‘fuel arbitrage’ to avoid peak power costs.

The DNO claimed even a 6% penetration of traditional heat pumps would lead to a 16% increase in peak demand.

At present rates of installs, however, most DNOs have little to fear. Northern Powergrid said current levels of installation are around a third of its assumption for the regulatory period; just 809 were fitted in its region in the last year.

Across the UK around 200,000 dedicated heat pumps have been installed to date (excluding reversible air-to-air heat pumps, see boxout below), with numbers relatively static at around 20,000 installs a year.

Prepare for pick up?

However, changes to the Renewable Heat Incentive may start to take affect over the next couple of years, particularly for ground source heat pumps: If two homes or more share ground loops, they can qualify as district heating and receive 20 year non-domestic subsidies versus seven year domestic RHI payments.

Moreover, payments will be based on deemed heat taken from Energy Performance Certificates, removing the need for metering equipment and its associated costs.

Whether businesses start to look more closely at electrification of their heat load remains to be seen. To date, the lion’s share of non-domestic RHI payments have been made to biomass systems. However, according to the sample of firms surveyed by The Energyst for the 2018 Heat Report, heat pumps figure in their plans more prominently than any other technology.

Heat peak: Over the top?

The 350GW+ winter peak heat load for space and hot water heating often referred to by industry and government came from a 2014 PhD project by Dr Robert Sansom, based on 2010 data

Exeter’s Richard Lowes points out that 2010 was the coldest in 25 years, and while systems must be designed for peaks, he believes increased energy efficiency, smarter controls and storage would significantly smooth those peaks.

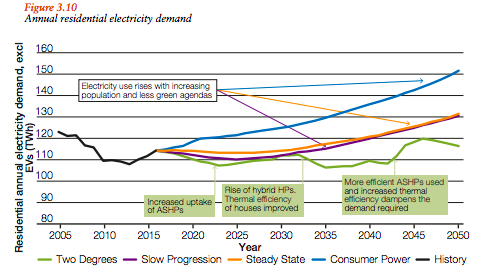

National Grid appears to agree. While its most recent Future Energy Scenarios document outlines annual demand rather than winter peak, it’s ‘greenest’ scenario, Two Degrees, shows the highest uptake of heat pumps and the lowest overall annual electricity demand (from the residential sector).

National Grid appears to agree. While its most recent Future Energy Scenarios document outlines annual demand rather than winter peak, it’s ‘greenest’ scenario, Two Degrees, shows the highest uptake of heat pumps and the lowest overall annual electricity demand (from the residential sector).

However, that assumes a 30% increase in energy efficiency. National Grid said that scenario would require incentives for energy efficiency, support for heat pump adoption and to quickly retire gas boilers.

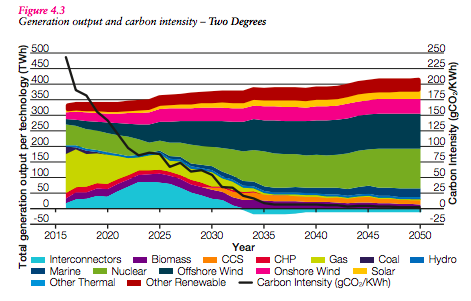

Similarly, National Grid’s Two Degrees scenario does not predict a huge increase in total electricity generation, from roughly 340TWh to 420TWh, with the mix dominated by wind and nuclear power.

Similarly, National Grid’s Two Degrees scenario does not predict a huge increase in total electricity generation, from roughly 340TWh to 420TWh, with the mix dominated by wind and nuclear power.

Reversible heat pump boost

According to latest government data (DUKES), heat pumps contributed 2.1TWh of renewable heat in 2016, roughly 4.6% of all renewable heat, which is dominated by biomass. Overall, DUKES data suggest the UK met 6.2% (46TWh) of overall heat demand (740TWh) in 2016 with heat from renewable sources.

However, only heat from dedicated heat pumps is included in the statistics, making reversible air-to-air heat pumps (RAAHPs), which can provide both heating and cooling, an unknown quantity.

To date, the majority of RAAHPs have been assumed to provide mainly cooling for businesses. However, a recent study for Beis by energy consultancy Delta-ee suggests the majority also provide heating.

Delta-ee’s surveys of large and small companies, plus installers, gave a mean figure of 73% of all RAAHPs being used to provide part or all of the heat load in the buildings in which they are installed.

It suggested in 2016 a total of 8.2 TWh of renewable heat was produced by reversible air-to-air heat pumps, almost four times that contributed by hydronic heat pumps.

Taking Delta-ee’s findings into account, government now believes the percentage of renewable heat in the UK in 2016 was 7%, which may prove useful should EU 2020 targets be enforced post-Brexit.

Free heat report

This article was first published in the Energyst’s latest heat report.

This article was first published in the Energyst’s latest heat report.

The report, sponsored by Baxi Heating, contains a survey of businesses to gauge views on heat, plus views of industry experts about the pathways, challenges and opportunities ahead.

The report is available as a free download. Click here for your copy.

Related stories:

Decarbonising heat: Free report

Cadent plans major hydrogen plus carbon capture and storage push

Hydrogen: The great white hope for decarbonisation?

Emerging solutions: Can wind, rocks, coal mines and salt decarbonise heat?

Northern heat and powerhouse: Energy innovation puts Gateshead on the map

Eon boss: Renewable power is ‘done’, now for heat and transport

Energy minister Claire Perry: Bring on mine water heat projects

Tender launched for 3.15MW geothermal electricity plant

Nottingham County Council goes large on solar, eyes batteries, mulls mine water energy

Hydrogen for heat will create anchor carbon capture and storage projects

Heat networks ‘need regulation and a regulator’

Competition watchdog agrees heat networks should be regulated

Northern Gas Networks and ITM partner on power to gas storage

Climate Change Committee calls for ‘proper’ hydrogen trials

Waste heat a wasted opportunity

Can Epsom salts solve heat storage conundrum?

Click here to see if you qualify for a free subscription to the print magazine, or to renew.

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.