Flow storage struggles to compete against lithium even in long duration applications, suggests Marek Kubik, market director at Fluence Energy.

Flow storage struggles to compete against lithium even in long duration applications, suggests Marek Kubik, market director at Fluence Energy.

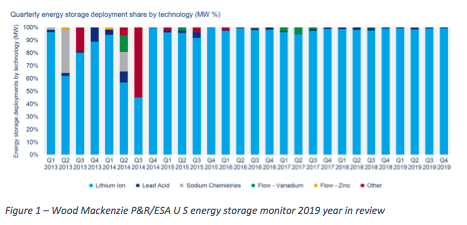

The UK hit a new flexibility milestone earlier this year, with a gigawatt of lithium-ion battery energy storage now estimated to be operational according to Solar Media Research. The trend mirrors a global picture – lithium-ion batteries continue to dominate the global energy storage market, accounting for 99.3% US share in Q4 2019, continuing a long historic trend.

Despite many energy storage technologies vying for market share – including much-hyped alternatives like flow batteries, which position themselves as the long-duration technology of choice – lithium-ion has maintained its leading position in the sector. Why?

To provide some background, Fluence is a horizontally integrated and technology-agnostic energy storage technology company. This means we do not manufacture batteries, electrolytes or similar ourselves nor have any stake in their supply chain, and aren’t placing “bets” on any one storage medium. We approach energy storage from a “job to be done” perspective and deploy what we view as the right technology to do that job at the time.

As a result, we see ourselves as well-placed to pivot once technologies hit a point of maturity. Indeed, over the past 12+ years of deploying and servicing energy storage assets and a fleet approaching two gigawatts operational or awarded globally, we have done so a number of times.

Across this fleet, we have delivered a diverse range of storage chemistries, including variants of NMC and LFP (under the lithium-ion chemistry umbrella), as well as advanced lead acid, sodium sulphur and yes, even flow batteries.

We work with whatever technology is right for customers in terms of price point, energy density and performance today: in almost all cases, that technology is lithium-ion based.

An elusive niche

The reasons lithium-ion has become the workhorse of energy storage is threefold: economies of scale, maturity of the underlying technology, and bankability.

Flow battery manufacturers reference several features they believe position flow batteries for long-term success, notably the lower marginal cost of adding duration (MWh) and the ability to cycle harder due to lack of degradation, with the claim that this leads to a 60% lower total cost of ownership over a 25-30 year lifetime. This niche is, unfortunately, a difficult needle to thread.

A lack of energy capacity degradation is indeed great for heavy cycling and an advantage compared to lithium-ion. However, only relatively short duration (1-2 hour) systems have heavy cycling use cases, for which duration a flow battery setup isn’t cost competitive. On a 25-year time horizon, 10-12% IRRs are being achieved using lithium-ion batteries under heavy use “merchant” trading, according to Dr. Ben Irons of Habitat Energy.

On the other hand, at 6 hours duration, which could be argued as flow’s more natural sweet spot, the maximum possible number of daily cycles is 2 (a 6-hour charge + 6-hour discharge x 2 = 24 hours). The right lithium-ion technology under this duty cycle can also perform for 20+ years. Indeed, lithium-ion is frequently the technology of choice at gigawatt-hour scale for 25-year solar + storage PPAs in the United States.

This is why lithium-ion rather than flow is commonly the pairing of choice for 4-6 hour duration systems coupled with solar – it’s where the economics, and high bankability of the well-proven technology, lead the data-driven investor.

The long haul

At longer durations still, flow batteries today begin to create more of a daylight gap between their economics and those of lithium-ion energy storage, as the marginal cost of adding electrolyte vs. electrochemical batteries starts to tip the balance of the equation. However, very few applications for grid-connected storage require durations greater than 6 hours today, indicating a lack of value being ascribed in the marketplace to these marginal megawatt-hours.

Whilst grid services in the 6 to 12-hour range may emerge as we see demand grow for longer duration storage, flow battery technology may fail as a victim of bad timing. If long-duration storage were in high demand today, there would be a clear niche to carve out; however, the economics of lithium-ion batteries continue to rapidly improve.

Over the past 10 years, the underlying costs of lithium-ion technology have fallen 87% while the density of the technology has tripled; these trends are set to continue. According to Bloomberg New Energy Finance, battery costs at the pack level are set to fall another 36% by 2024.

Conversely, flow batteries are physically constrained by the density of their electrolyte. Whilst they can get cheaper due to scale (production volume bringing down costs), they don’t have the same second order density advantage that lithium-ion does. Density is also a function of cost – as we’ve seen in the field deploying increasingly energy-dense systems – leading to smaller footprint and foundations, fewer containers, less cabling and reductions in these and other associated balance of system costs.

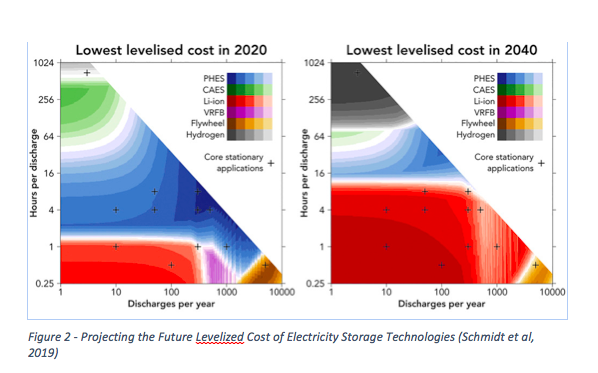

For these reasons, by 2040, even the high-cycling, long-duration applications that suit Vanadium Redox Flow Batteries (VRFB) today are set to be displaced as batteries continue to improve, as highlighted by research from Imperial College.

This research illustrates that the family of lithium-ion chemistries, for which inventor John B. Goodenough received the Nobel Prize in Chemistry last year, is set to play an increasing role in providing power grids the energy storage and flexibility needed to accommodate a cleaner, more resilient grid.

Whilst Fluence believes in the horizontal integration philosophy and continues to monitor promising new chemistries for future deployments, investment will be based on the functions we need storage to provide. At the moment, technologies under the lithium-ion umbrella fit the bill best, with continual strides being made to improve their cost, performance, density and safety.

Related stories:

Fluence: Lithium ion batteries can deliver 6 hour grid services

Avalon founder: Flow storage ‘can be much cheaper than lithium’

Habitat boss predicts ‘breakthrough year’ for energy storage

Energy storage ‘will wipe out battery storage’

UK Power Reserve takes 120MW of storage from Fluence

Siemens and AES launch global energy company called Fluence

Don’t forget, Li-ion batteries also age while not cycling so simply extrapolating from cycle life tests will overestimate their longevity. See Schmalstieg at al. 2014.

https://www.researchgate.net/publication/260440758_A_holistic_aging_model_for_LiNiMnCoO2_based_18650_lithium-ion_batteries

I dont agree with Marek Kubik, he doesnt have all his facts in order. Our International Flow Battery Partner reached IRR’s in the UK of around 14% annually. And were best in classs for a major deal, Must say seems bias to me.

Lithium has a lot of questions to answer though, for gadgets its a great tech, but for grid scale they should not be used because there are alternatives.

lithium: has issues with fire risk, explosion and toxic gases. Siting these near residential areas is a serious concern.

It has issues over long-term viability, as the cells degrade (we all know this) so a 25 year lifespan will see its capacity fail, meaning more cost to replace the cells or run the whole thing very precisely to maximise its longevity.

It also has issues with its construction, using the planet’s rather limited supply of cobalt means we either use less efficient designs, or get to a stage where the cobalt runs out. And a lot of the cobalt is produced from mines uitilising child labour in Africa.

So for gadgets, its the only option. But we shoulnd’t be using it up to provide grid-scale storage.