The UK energy market has seen a significant increase in large scale battery storage systems. Multi-megawatt battery systems require significant investment and will need to operate for many years before offering the operator a return on capital. The introduction of such assets into National Grid’s various frequency response schemes is often an attractive proposition, especially for those without site demand for power.

National Grid’s Enhanced Frequency Response (EFR) & Fast Frequency Response (FFR) schemes can both reward operators for their ability to rapidly respond to grid frequency levels to both generate (discharge) for low frequency conditions, and consume (charge) in times of high frequency.

Traditionally while a battery can accommodate the fast response to charge or discharge, it cannot accept charge (high frequency) if the cells are already fully charged in anticipation of low frequency conditions.

The solution for many operators is keep the battery in a semi-permanent state of charge, allowing either charge or discharge response to be accepted.

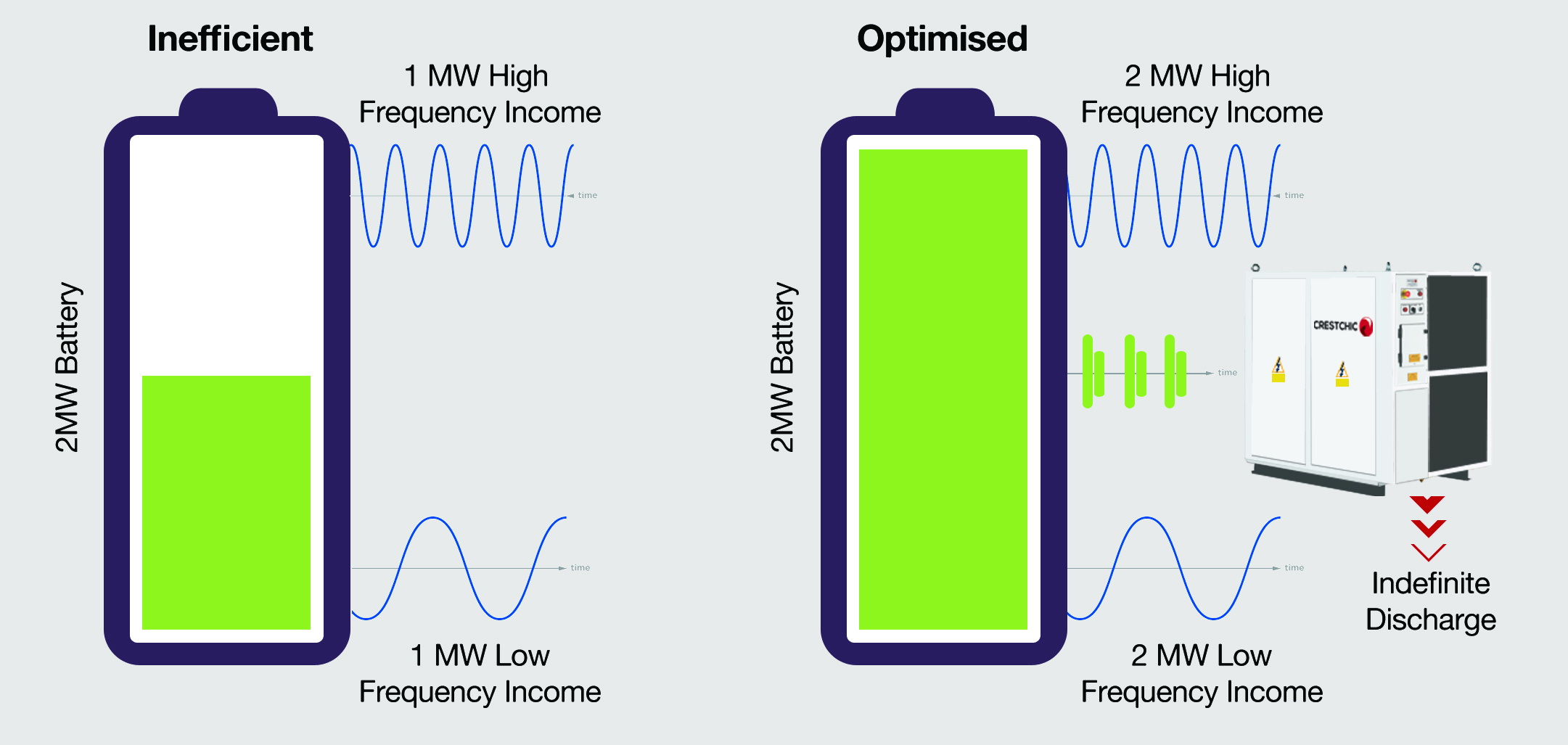

Unfortunately, the result of this operation is a battery 100% bigger that the actual income rating. Essentially, to both receive the EFR/FFR 1MW high and 1MW low frequency incomes, you require a 2MW battery. While the cost of battery storage has dropped in recent years, this is still a considerable capital outlay.

Capacity Market Re-Rating

Many operators also choose to introduce their battery systems into the Capacity Market (CM) to provide an additional modest, but stable, revenue stream. Unfortunately, National Grid’s recent announcement that new storage systems will be re-rated to a lower value, especially for short duration output batteries, further questions the viability of battery investment.

Batteries with only a 30-minute output duration are now only rated at 20% of their capacity, those at 1 hour only 40%. An operator deriving their primary income from frequency response with a partially charged battery, then halving the capacity, to only see a further significant rating reduction for CM participation, could also benefit from loadbank optimisation. As with frequency response, the loadbank will simply allow the battery to be charged to a near full state, thereby increasing its supply duration.

Loadbanks

Crestchic Loadbanks claims it is a world leader in the design and production of loadbanks. A loadbank is a device used to safely test power supplies by simulating operational conditions. Used across industry to replicate the conditions a generator or battery would experience in the event of a power loss, a loadbank is the ideal partner to optimise battery systems. By matching a loadbank with a battery storage device, Crestchic can allow your battery to remain close to 100% charged and therefore increase your FFR/ERF revenue by accepting the full income against the battery’s rated output. In times of high frequency demand the battery simply accepts the charge for an initial 10-13 seconds, until the loadbank takes over indefinitely draining the battery of it’s charge.

Loadbanks require little installation, are safe, reliable and designed for outdoor operation and continuous service.

Crestchic has over 48MW of loadbanks in frequency response service in the UK.

For more information on Crestchic, visit: www.crestchicloadbanks.com