The bulk of the UK’s public sector estate remains unconvinced by demand-side response (DSR), shrugging off the best efforts of aggregators and energy suppliers, latest data suggests.

The bulk of the UK’s public sector estate remains unconvinced by demand-side response (DSR), shrugging off the best efforts of aggregators and energy suppliers, latest data suggests.

Despite historically low UK capacity margins – and National Grid spending significant amounts to try and drum up greater system balancing reserves – almost half of public sector organisations polled by The Energyst fear system balancing would disrupt their operations.

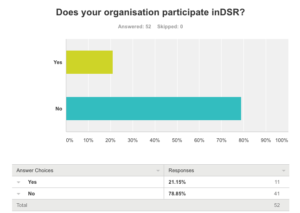

Public sector organisations made up 52 of the 218 respondents to the The Energyst’s 2016 demand response survey. Eleven of those public sector respondents (21%) participate in DSR, whereas 41 (79%) do not.

Across the public sector, some 82% said they had some form of onsite generation, which suggests potential to participate in demand-side response.

Around 72% said their aggregator or supplier had tried to convince them about the benefits of DSR provision, a much higher percentage than the survey average (roughly 50% across all sectors).

Meanwhile, 89% of public sector respondents said they would be interested in providing demand-side response if it did not affect their operation.

However, disruption to core operations was cited by almost half (48%) of public sector firms as the key inhibitor to balancing services provision. That suggests the public sector is even more risk averse than the broader survey sample, of which 37% cited disruption to core business as a reason for not participating in DSR.

Those statistics suggest that National Grid, suppliers and aggregators have to work harder in convincing the public sector that DSR provision need not affect everyday operations. They may also suggest a need to standardise a route for DSR through the complexities of public procurement.

See how the Crown Commercial Service is attempting to monetise public sector assets through demand-side response in our new 2016 Demand-Side Response repot. Download it free of charge, here.

See how the Crown Commercial Service is attempting to monetise public sector assets through demand-side response in our new 2016 Demand-Side Response repot. Download it free of charge, here.

Related stories:

Free report: 2016 DSR market report

Trinity Mirror targets £1m revenue from demand response

National Grid says 2020 demand response target “totally achievable”, mulls longer contracts

Can National Grid hit its 2020 DSR target?

Aggregators: firms shouldn’t fear disruption from demand-side response

Fear of disruption hobbling demand response uptake

More than half of I&C firms mulling energy storage investment

Grid buys 201MW of enhanced frequency response

Battery storage: positive outlook?

Demand-side response: Give us your views

National Grid must provide a plan for battery market, says SmartestEnergy

Limejump boss: Big six will have to acquire aggregators or lose relevence

National Grid buys 3.6GW of back-up power to cover winter

Three policy tweaks that could enable 10GW of battery storage

Decc, Ofgem and National Grid must make battery storage stack-up

Ofgem: Energy flexibility will become more valuable than energy efficiency

National Grid boss: future of energy is demand not supply

National Grid says impact of solar requires greater system flexibility

National Grid signs 20MW demand-side response contract with battery storage operator

National Grid says UK will miss 2020 targets, predicts big battery future

Major changes to capacity market proposed

Hot technology: energy storage via heat battery

Western Power Distribution ramps up demand-response trials, calls for participants

Smart grids ‘require local control and businesses must play or pay’

National Grid must simplify demand response to scale UK market

Energy Technologies Institute: Let private firms run smartgrid trials

Flexitricity blasts transitional capacity market as Npower plots supermarket sweep

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.