Andrew Donald, Senior Business Development Manager at Powerstar, considers Future Energy Scenarios in the transition to net zero and government and investor appetite for battery storage. He considers the growing emphasis on Demand Side Response to enable the transition and modern battery technology’s role in securing sustainable power.

Andrew Donald, Senior Business Development Manager at Powerstar, considers Future Energy Scenarios in the transition to net zero and government and investor appetite for battery storage. He considers the growing emphasis on Demand Side Response to enable the transition and modern battery technology’s role in securing sustainable power.

In his foreword to last summer’s latest Future Energy Scenarios[1], Fintan Slye, Executive Director, ESO, highlighted key issues facing the UK’s energy mix – looking to a fully decarbonised electricity system by 2035, to help meet legally binding net zero target for 2050 – concluding,

“Never before has collaboration been more important – and, as our Future Energy Scenarios 2022 demonstrates, we must be ready to act now to secure a clean and fair system for all.”

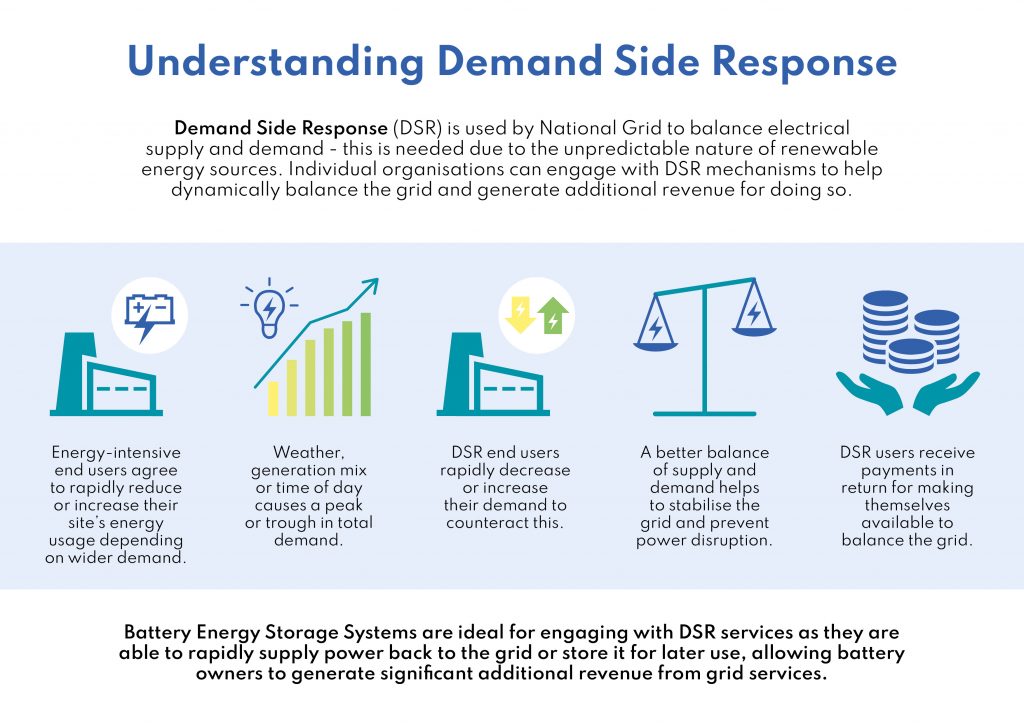

Of the four potential scenarios outlined, Leading the Way and Consumer Transformation call for 115GW of energy storage by 2035, a stark increase against the installed capacity of less than 30GW at the time of the report’s release. As the UK shifts to renewables, whichever scenario plays out will require investment in energy storage. In this context, and with the energy crisis a stark reminder of the critical need for energy security, the flexibility of Battery Energy Storage System (BESS) assets is compelling, particularly given their capability to engage in Demand Side Response (DSR) – to benefit both asset owners and the UK’s electricity infrastructure as a whole. Currently, only around 6% of industrial energy demand in the UK is shifted from peak demand using DSR, but this will need to increase to nearly 40%, and Behind-the-Meter BESS has a significant role.

Across the UK – particularly in energy intensive sectors and in the public sector – organisations are investing in and harnessing the benefits of BESS, to make the most of on-site renewable generation and maximise budgets by engaging in DSR and balancing services. In the current economic climate the benefits are clear: both financial and reputational. Companies engaging with DSR are at the forefront of the shift from fossil-fuelled centralised energy to a more distributed model. For BESS users, income is generated through a direct contract with the Grid, with the local Distribution Network Operator (DNO) or via an aggregator service. Where a guaranteed income is available, the stability offered through BESS is just as vital for energy managers as is maximising the asset’s potential to recoup initial outlay.

A crucial case for investment in BESS comes through reputational advantage. Headline data from KPMG’s report, the numbers that are changing the world[2], demonstrates the shift towards responsible investing with an emphasis on environmental and social governance: 76% of CEOs state that their organisation’s growth will depend on their ability to navigate the shift to a low-carbon, clean-technology economy, and there is forecast growth in the UK of 173% in the socially responsible investment market by 2027. The report states,

“Asset managers and asset owners see ESG and responsible investment as a smart way to achieve a competitive advantage.”

Perhaps the most compelling case for BESS investment comes from the recently announced government proposals for reforming the Capacity Market[3]. Focusing on security of energy supply and the transition to net zero, the proposals acknowledge the critical role battery technology plays in the move to greener energy, and the government press release expressly highlights a pillar of the proposals,

“Incentivising greener, flexible technologies to compete in CM auctions by offering multi-year contracts for low carbon flexible capacity, such as smart ‘demand side response’ technologies and smaller-scale electricity storage, supporting the move towards delivering secure, clean and affordable British energy in the long term.”

There is much to consider in the government proposals around the Capacity Market, but whichever Future Energy Scenario plays out, companies investing in BESS technology can make reputational gains and recoup investment through new revenue streams, while helping the UK to achieve net zero more rapidly and securely.

[1] https://www.nationalgrideso.com/document/263951/download

[2] https://assets.kpmg/content/dam/kpmg/uk/pdf/2019/07/numbers-that-are-changing-the-world.pdf

[3] https://www.gov.uk/government/news/reforms-outlined-for-britains-capacity-market-to-secure-a-clean-energy-future