Listed energy efficiency fund SEEIT is eyeing £300m worth of asset buys and said it is in “advanced negotiations” for three developments valued over £100m.

Posting full year results, the fund, launched in December 2018 by Sustainable Development Capital Limited (SDLC), said it has £71m in cash available for investments. It aims to raise a further £60m through a placing and offer at 104p per share.

The company has 26 energy investments across the UK, Spain and the US.

UK investments include an initial 5MW of rooftop solar deal with Tesco across 19 stores, six of which are now complete and generating income, and the Huntsman Energy Centre at Redcar.

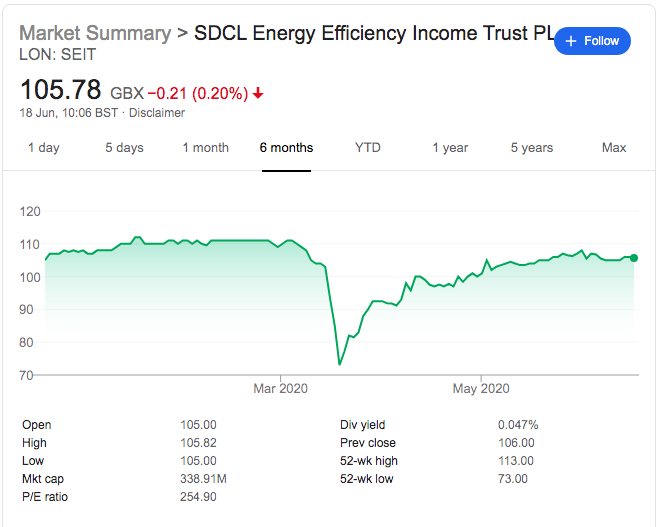

Despite its operations in countries worst hit by Covid-19, chairman Tony Roper said the portfolio had remained resilient despite a price plunge as global markets crashed mid-March.

The share price has since recovered.

Roper said resilience should continue going forward, because SEEIT has invested in providing essential energy services to sectors that have continued to operate during the pandemic. These include hospitals, food production and distribution, data-centres, steel production and banking.

“It is likewise anticipated that the linkage with such essential services will leave the portfolio relatively well placed in respect of the longer term economic impact,” stated Roper.

For the year to 31 March, SEEIT posted pretax profit of £11.6 million (2019: £0.4 million). Earnings per share were 5.2p (2019: 0.4p). It is paying a dividend of 5p and aims to increase that 10 per cent for the current financial year.