The European Court ruling and subsequent suspension of the Capacity Market (CM) stunned the market. What are the implications?

Most large suppliers are working out their positions. For aggregators, what happens to payments, whether customers should or will respond to stress events this winter – and what happens to agreements secured for next winter and beyond – are questions they need answered in days rather than months.

For generators, some of the same questions apply. Large power stations must commit to transmission capacity months ahead of time. Given the cost and the uncertainty, some market commentators suggest operators of old coal and potentially gas plant may consider closing them down.

But for now, that’s unlikely.

This winter

“In the short term, i.e. this winter, system impact is likely to be minimal,” said Ben Irons, a former executive director at Aurora Energy Research and director of strategy at Centrica Energy, now director at Habitat Energy.

“Profit impact for recipients of CM revenue will be painful, but the more important question at system level is whether it changes behaviour,” he added.

“Even for plant that depends on the CM payment for its survival such as low merit thermal, I would not expect the removal to cause it to temporarily cease generating, mothball or close immediately.”

Irons said that is because most costs are unrecoverable in the short term, that it takes time to close a power station and that winter is the most lucrative time to generate. “Loss of CM revenue would be a hit, but ceasing to generate would only cause a bigger profit loss,” he suggested.

Irons reasoned that generators may also wish to carry on meeting their obligations in case the CM is reinstated – or some other incentive introduced.

He also suggested any loss of CM revenue is unlikely to directly affect wholesale prices in the short term.

“If there was an opportunity for disadvantaged plants to bid differently to earn more in the merchant markets to recover lost CM value, they would already have been doing it,” he said.

If their bidding behaviour does not change, “nor do power prices. This winter’s prices and shape are likely to look much the same as they would have with CM still in place”.

Winters to come

However, that may change if the Capacity Market was taken out of the picture longer term. If so, and older thermal plant decides to shut down in spring and new build projects are shelved, there would be less spare capacity, leading to increases in price and volatility, said Irons.

A more volatile wholesale market could provide upside for flexible assets, including batteries. However peaking plant, which have higher rating factors in the CM, would likely gain less overall, Irons suggested.

“In general though, this is bad news for an industry desperate for a stable policy regime,” said Irons. “It increases market risk and cost of capital, and that’s ultimately bad for the consumer.”

Aggregators’ views

Flexitricity founder and chief strategy officer, Alistair Martin, agrees it is unlikely large plant will close immediately.

“We’re right on the edge of winter. I think coal will stick around to see what it can get out of it.”

Martin also agrees with Ben Irons that there is potential upside for flexible technologies that can access merchant markets.

“While we didn’t see [the court judgment] coming, we’ve long recognised that the value of flexibility moves around the market. It spent a long time in reserve services, moved into the Capacity Market and much will head into the Balancing Mechanism,” said Martin.

However, Martin said the “smart move” for government would be to “find a way through this” and reinstate the Capacity Market, albeit in an altered state.

Procedural issue?

Secretary of State, Greg Clark, noted that the ruling is based on a “procedural matter; the Commission’s process for granting State Aid approval”, and not the policy itself. That may indicate that government hopes to go through due process, get the policy re-stamped and carry on.

But Martin is not so sure.

“It’s naïve to say this is just a procedural thing,” he said. “There is an issue of substance [over contract lengths/disparate treatment of technologies] and I would question whether it is wise to go back for State Aid approval not having addressed that issue – especially since the evidence base has shifted in the last four years.

“I think it would be quicker if the government was to do it right, which is to address the central issue that has dogged the CM since inception.”

Martin thinks DSR providers “would absolutely” be able to deliver on 15-year contracts. “Alternatively, they could just say one-year contracts for everyone,” he said.

One year contracts “could achieve the build of power stations, if that is what is needed to keep the lights on”, Martin suggested.

“That approach is what we understand international experience to show. Investors, above all, say they want certainty. A good track record can provide that better than a mechanism undermined by its own mistakes.”

Ecstatic?

Martin commended Tempus Energy and its chief executive Sarah Bell for taking on the case – and winning. Bell suggested aggregators are “ecstatic” about the ruling. Martin said that was not the first word that sprang to mind.

“We can’t ignore the period of pain we must now take customers through,” he said. “The outcome we don’t know either. We do know that something that was done wrongly has been found out. But in order for us to be ‘ecstatic’, we need to have a good outcome – and that is in the hands of the government.”

Will DSR still respond?

Martin noted that the billion pounds due to be paid to capacity providers for delivering this winter is “quite a lot of money” in an industry with slim margins. He said aggregators seek clarity on what they are expected to do in the event of a system stress event.

“Do we ignore it or help to keep the lights on?” and if customers respond, how will they be paid?

Meanwhile, must aggregators still go through satisfactory performance days three times over winter, he asked.

Another aggregator with a significant CM position agreed these are important details.

“Beis is telling us it is very confident, it knows what to do, and everything will be fine,” he said.

“It is planning a special T-1 auction [T-1 auctions do not have the same contract disparity issues as they do not award long-term agreements]. It appears confident of getting fast track approval for that,” he said. “Maybe not in time to meet the timetable of the auction that was planned for January, but soon after.”

Stress

However, the aggregator said things were likely to take months rather than weeks to become clear.

He agreed with Flexitricity that suggesting customers respond to stress events without guarantees that they will be paid might be optimistic.

“Beis suggested ‘if there is a CM notice this winter, you may wish to consider meeting obligations as if they still stood, because we might end up paying you for them’. Personally, I can’t see how that would work. Surely suppliers are going to stop collecting money if the CM is suspended?”

However, that may prove to be a moot point.

“Government’s one apparent bit of contingency planning [for losing the court case] was to ask National Grid if the system could cope without the CM this winter. Grid said we’ll be fine, so a stress event this winter is unlikely anyway.”

Re-runs?

The aggregator said it was good news that discrimination between technologies has been recognised, but thinks the government “does not have the bandwidth” to make massive changes to the policy.

The problem is, if the Commission’s due process finds the policy does require changes, “nobody wants to have to re-run auctions and rip up existing agreements – and if you say the original design is not valid, you would probably have to do that”.

That would prove problematic. As would attempting to claw back payments already made to customers (though the Early Auction payments would not be affected as the EA, conducted in February 2017 for delivery the following winter, received separate state aid clearance).

However, he said Beis is “definitely selling expectations that the show will be back on the road with all the previous commitments maintained.”

Lastly, he said suppliers taking part in the Beis briefing had asked about implications for retail price cap calculations and whether the CM component would now be removed from the equation.

“They didn’t really get a clear answer,” he said, though The Times reports otherwise.

What next?

While government hopes to restart the Capacity Market as soon as it can, the freeze might be a good opportunity to consider the end game, said Erik Nygard, chief executive at aggregator Limejump.

Although aggregators with CM positions must now manage customer and investor trust and revenue issues, he said the long-term implications of the judgment could be positive.

“In the short-term, removal of a guaranteed revenue stream will force people to think more creatively about how to derive some level of certainty without the Capacity Market being there,” said Nygard. “The problem is, you don’t know how it will develop. But long-term, I think this is potentially very good. I do believe businesses and innovators will find a way to make this work.”

If the ruling expedites change, and “large coal power plants come off the system faster, that might lead to a market opportunity”, said Nygard.

“Ultimately that could be a lot better approach than relying on the Capacity Mechanism – which is a once a year process and not very market-driven.”

“If the Capacity Market helps drive investment and security for a period of time and is designed the right way, it could definitely have value,” said Nygard. “But, in my view, mid-to long-term, it needs to move to a market-based system.”

Is the Capacity Market actually needed?

For the foreseeable future, most of those interviewed agreed an amended Capacity Market, or something similar, is required.

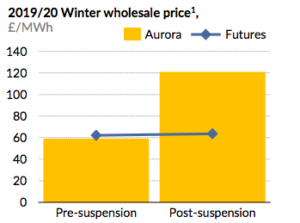

Consultants Aurora suggested wholesale prices would double to around £120/MWh next winter without the CM in place. It pointed to a rise of £1.4/MWh on 2019/20 winter power price futures within 24 hours of the ruling by way of example.

“Aurora believes that the capacity market is pivotal in maintaining the reliability standard in the GB and as such, it is unlikely that the mechanism would be cancelled altogether without replacement,” it added.

However, one aggregator said government should better qualify its statement that system security will not be compromised this winter due to the suspension.

“That sends out the wrong message. If there is ‘no threat to security of supply’, people may ask why the Capacity Market is actually needed. The nuance is that generators have been paid their Early Auction payments over summer, enabling them to stay open.”

Money

If the billion does not come through next summer due to the suspension of the market “that is potentially a problem for next winter”.

He said clarity on payments would be useful “in days rather than weeks”. Payment suspension may cause cash flow issues for smaller firms with thin balance sheets. The EMR delivery body has said CM participants can choose to have their auction credit cover returned, but additional clarity there would be welcome, the aggregator added.

“If you have cover returned, but the situation is resolved and auction results still valid – do you have to pay it back, and if so, when?”

He accepted that expecting clarity on “day one” was unrealistic, “but we need to know these things in days rather than weeks and months”.

Good result?

Many of those interviewed think the Capacity Market will be reinstated before long without major changes.

Seb Blake, head of policy and markets at Open Energi, said Tempus and its action “did a good job” in escalating awareness that the CM “is not a level playing field”.

“If DSR is allowed longer contracts, that is positive impact for our industry,” he said. However, he questioned whether locking in 15-year contracts at low prices would be attractive.

“But from a legal standpoint that is not a good argument – you should treat things fairly and equally,” he said, “so we very much hope there will be changes in line with the objections that were raised.”

However, Blake suggested the biggest issue facing DSR in the Capacity Market is not contract lengths, but de-rating factors being considered under the five-year review.

“If de-rating [as proposed] is applied, that will have a greater impact on DSR revenues,” said Blake.

So, after inching its way through the European justice system for four years before bringing the Capacity Market to a complete stop, demand-side response providers might finally be able to bid for longer contracts because of the legal challenge, said Blake.

“But then, if de-rating factors are applied, we could actually end up being in a worse place.”

Useful links:

Client Earth’s analysis of case, process and what next

Related stories:

Tempus wins court case over Capacity Market bias against DSR

EMR delivery body confirms all capacity payments suspended, auctions shelved

Tempus Energy: DSR providers ‘ecstatic’ over Capacity Market judgment

Decc “confident” of beating Tempus legal challenge

Should Ofgem consider derating DSR plus battery storage?

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.