The T-1 capacity market auction for delivery next winter has cleared at £6 per kilowatt.

The T-1 capacity market auction for delivery next winter has cleared at £6 per kilowatt.

The low price reflects the high level of capacity, 10.7GW, bidding for a target of 4.9GW, although around 5.8GW was awarded.

While auction volumes differed from last year’s T-1 auction, the clearing price was similar, suggesting some of those bidding saw it as a revenue top up.

The capacity market policy was originally intended to help provide security of supply and, where auctions award long-term contracts, help derisk power station construction.

The outturn for the this auction means around £35m will be added to customer bills next winter, in addition to capacity market costs for contracts awarded four years prior.

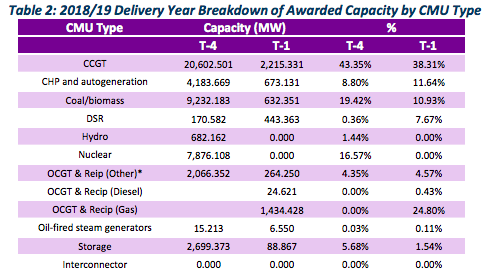

Gas took the lion’s share of contracts awarded, diesel took very little. Some 673MW of CHP and autogeneration won contracts; 632MW of coal and biomass; 443MW of DSR and 89MW of battery storage was successful.

See the EMR delivery body website for more details.

This article updated to reflect the actual clearing price from the indicated £5-£10/kW range, and higher volume procured over 4.9GW target.

Related stories:

Battery storage cut down to size as gigawatts qualify for capacity market

Early capacity auction clears at £6.95/kW

Shifting the balance of power: New, free demand-side response report

Government plans rule changes for storage and DSR in capacity market

Half of small generators ‘could give up capacity market contracts’ after Triad cuts

Businesses ‘shutting down from 4-7pm due to peak power costs

Capacity market ‘buying the wrong stuff because it’s joined up with nothing’

Capacity market too low for large gas, but gigawatts of DSR, batteries and CHP win contracts

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.

When and why did the t-4 auction volume fall from 49.3GW after the original auction to 47.5GW before the T-1?

The low clearing price of the T-1 capacity auction suggests that there are adequate levels of system margin – or capacity – available to deliver the electricity that the country will need for next winter. In the short term, the significance of this auction result is that we can expect a stable system over the peak months, and energy consumers can look forward to lower bills than had the auction cleared at a higher price. Looking further out, next week’s T-4 auction will give a clearer picture about market conditions in future years.

We’re hearing questions around the restrictions placed on the use of diesel plants in the capacity market, and why this didn’t impact the T-1 auction result. We believe that the repercussions of this will be more accurately reflected in the upcoming T-4 auction. The T-1 is designed as a ‘top-up’ auction to refine the delivery of capacity provided by previous T-4 auctions. The longer-term impact on diesel generation should become clearer in next week’s T-4 auction.

Those participating in the capacity market through demand side response (DSR) may feel uncertain about this T-1 closing value. The key to ensuring that they continue to benefit financially from participating in grid balancing will be to look for revenue stacking opportunities. To optimise income from DSR today you need technology; an optimised energy demand technology platform, with the ability to participate in the dynamic frequency response schemes offered by National Grid. Endeco offers this technology, as well as peace of mind, to industrial and commercial businesses that want a future-proof way to optimise income from the capacity market.

Michael Phelan, CEO, Endeco Technologies

How many years have the T-1 auctions been running?

Two.