Renewables investor Thrive has launched a joint venture with developer Aura Power that aims to deploy and operate 40MW of behind-the-meter battery storage at industrial and commercial firms over the next 18 months.

Renewables investor Thrive has launched a joint venture with developer Aura Power that aims to deploy and operate 40MW of behind-the-meter battery storage at industrial and commercial firms over the next 18 months.

The two are targeting businesses that spend a minimum of £50k/month on power, that plan to remain at the same premises for the next ten years, and that have spare import capacity. The smallest battery they will install is 500kW and they require sites to have a similar minimum average load.

Thrive, originally set up by Triodos Bank, funds, owns and operates a 105MW portfolio of wind, hydro and solar assets. MD Matthew Clayton says it has earmarked around £20m to reach the 40MW storage target, and says the firm is currently in negotiations with around a dozen companies. “Some of those negotiations are moving quite quickly, hence forming the joint venture,” he said.

Aura Power, which operates across the UK and Ireland, Canada, Portugal and Italy, has developed UK storage projects including a 15MW battery at Lockleaze, near Bristol and a 10MW battery at Nevendon, Essex.

Klondike

The buzz around battery storage reached fever pitch as solar subsidies came to an end, and led to DNOs being swamped with connections applications.

However, that gigawatts of storage have not subsequently materialised suggests appreciation that storage economics are more challenging, given the need to stack multiple services, a rapidly changing landscape, and limited visibility on most existing potential revenue streams.

This is compounded by the fact batteries have started to cannibalise some of their own income. Firm frequency response (FFR) prices have dropped considerably over the last two years, with incumbent providers now bidding even more aggressively to see off a wave of new entrants, driving prices down further.

But Thrive is confident it can deliver mutual returns. Clayton told The Energyst that while “revenue uncertainty is a colossal head scratcher for the whole market, generation as well as storage”, the firm takes comfort from market fundamentals: increasing renewables penetration and declining centralised fossil plant will necessitate greater flexibility.

“We are not hanging our hats on individual revenue streams, but on the fundamental need for flexibility, and our view is that behind-the-meter is where the value lies.”

Clayton believes that the “requirement for flexibility and frequency response is very much there” both for National Grid and DSOs, however it is ultimately repackaged.

“Our aim is to embed pieces of kit into hosts that have the flexibility to deliver a broad range of services and therefore revenue streams going forward,” he said.

“Being able to pool the benefit with the host in terms of cost savings, stability to their system, plus access to different revenue streams, feels like a pragmatic approach to [mitigate] uncertain aspects of the market.”

Portfolio approach

Clayton added that taking a portfolio approach, steadily building small assets rather than “one enormous asset”, also mitigates cannibalisation risk due to falling battery prices.

“If we had built something big two years ago, we would struggle to compete with new technology today,” said Clayton.

“That trend will continue, so a pipeline of relatively modest investments feels like a safe way to navigate the market that allows us to take advantage of equipment cost reductions along the way.”

Batteries required

Battery developers and flexibility providers have stated bold intent in recent weeks.

Anesco announced it plans to deploy another 300MW in the next two years. UK Power reserve is building out 120MW. BESS has raised the money to build 100MW by the year end. Start-up Pivot Power thinks it can deliver two gigawatts, suggesting it can build up to 500MW within 18 months.

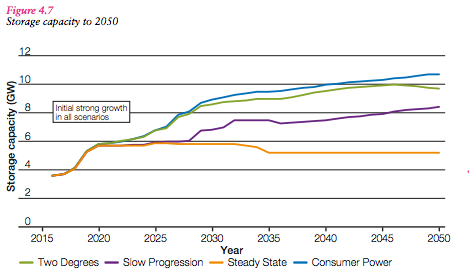

But even if all that has been announced materialises, it may still be short of National Grid’s predictions of around 6GW of storage, including Dinorwig and around a gigawatt of other existing batteries, by 2020 (after which it sees the market flattening for a few years).

Clayton thinks there is enough opportunity to go around, particularly behind-the-meter at I&C sites.

The joint venture’s launch PR cites analysis by Cornwall Insight that suggests there are more than 8,000 UK businesses with annual electricity contracts of 10GWh or more and which are likely to be spending at least £1m a year on power.

Clayton said deploying and optimising a battery at those businesses will yield “in the 10-20% range” in benefits or bill savings.

“The number of consumers of a scale that can benefit from battery storage outstrips the ambition that has been stated by others,” he suggested.

Interested in battery storage and demand-side response? Please take The Energyst’s relatively short survey and help inform our 2018 flexibility market reports.

We are particularly keen to hear from end user organisations providing DSR or considering/implementing battery storage. In return we will give you a free copy of the report.

Take the survey here.

Related stories:

DSR and storage: Give us your views to inform new market report

National Grid to bring storage, wind and distributed energy into Black Start

FFR: Prepare for a ‘material drop’ in revenues

Energy storage ‘will wipe out battery storage’

Restore pools megawatts of industrial load with 18MW Tesla battery, plans UK replica

Free report: Battery Storage 2017 – A business case for battery storage

Free report: Demand Side Response 2017 – Shifting the balance of power

Read more than 300 DSR and battery storage stories published by The Energyst here

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.