Greater volumes of fast responding assets, such as batteries, may start to erode frequency response prices. The question is by how much and how soon. The Energyst asked market participants.

“Our modeling shows storage has a major role to play – and if battery costs keep coming down then you will have an oversupply of frequency response services,” says Restore’s Louis Burford.

“But National Grid’s challenge remains – inertia is continuing to come off the system – and the challenge around rate of change of frequency (RoCoF) will increase as that happens,” he says.

“So the demand for frequency response will increase, but [prices] will depend on the volumes of assets able to quickly help control frequency.”

However, Burford believes there will have to be a floor price for frequency response.

“Otherwise you would start to see the mandatory frequency response providers, large power stations, finding it is not commercially viable for them,” he says.

Engie’s head of demand response services, Mark Cavill, agrees. He says the fact Engie is reinvesting in pumped storage assets illustrates its belief that frequency response offers a long-term revenue stream.

“Due to RoCoF, or a lack of inertia in the system, frequency response is inherently required by the market to manage events. So I think frequency response will [continue to] be a high value service,” says Cavill.

“What will become more important to Grid is the dynamic nature of that response and also the closeness to real time in terms of managing system frequency.”

Cavill therefore thinks static frequency prices will continue to erode as the premium passes to faster responding dynamic frequency.

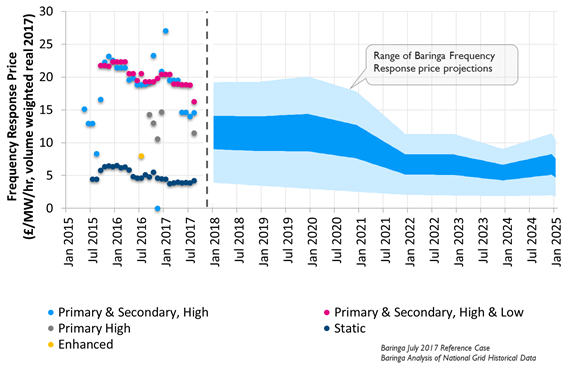

However, Baringa Partner’s Eamonn Boland suggests falls for even the most technically capable frequency response could be significant.

“There is a material drop in frequency response revenues in our projections,” he says.

“A public reference point is last summer’s Enhanced Frequency Response prices clearing at an average of £8/MWh for a response within one second and that compares to the similar provision in the commercial market of £18-£22/MWh.”

Boland points out that STOR revenues have settled at around a quarter of their peak rates seven years ago.

“We forecast in our modeling a similar downward pressure on frequency response pricing.”

Eamonn Boland, Louis Burford and Mark Cavill were among market participants taking part in panel sessions at the DSR Event on 7 September.

The conference – sponsored by National Grid, BIU, Enernoc, Engie, Eon, G59 Professional Services, Restore, UK Power Reserve & Total – examined challenges and opportunities for businesses and public sector organisations in unlocking flexibility.

Speakers from NHS Scotland, Marks & Spencer, Welsh Water and Unite Group outlined their DSR experiences to date, while battery storage applications, risks and revenue streams were also discussed.

The conference marked the launch of The Energyst’s 2017 DSR Report: Shifting the balance of power, which contains a survey of businesses and public sector organisations around DSR and storage, as well as the views of market participants on challenges and opportunities.

The conference marked the launch of The Energyst’s 2017 DSR Report: Shifting the balance of power, which contains a survey of businesses and public sector organisations around DSR and storage, as well as the views of market participants on challenges and opportunities.

The report is available as a free download here.

Related stories:

Strong SME appetite for DSR but sector ignored by aggregators

Free DSR and battery storage conference

20 firms outline what it stopping them providing DSR

Battery storage: Finance a challenge but businesses predict 3-7 year paybacks

Energy storage ‘will wipe out’ battery storage

UK Power Networks outlines smart grid plans

Can National Grid hit its 2020 DSR target?

National Grid adds 500MW of flexibility in 2016, more to come

Eon: Avoid DSR sticking plasters and long-term contracts

WPD launches DSR aggregator business

As solar subsidies wane, investors plan 2.3GW of battery storage projects

Free report: DSR and battery storage

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.