Beleaguered energy regulator Ofgem today faces fresh evidence of the costs its oversight of failed power suppliers has inflicted on consumers, in consequence of the record 29 retailers who’ve quit the market since wholesale gas prices started to rocket last year.

Respected analysts Cornwall Insight today released figures, claiming that home electricity bills will rise by an average £34 next year, simply to cover the share of increased Distribution Use of System charges attributable to the failed operators.

DUoS charges are the route by which Ofgem compensates continuing suppliers for taking on otherwise homeless customers, via Supplier of Last Resort (SoLR) allocations.

Pre-announced tariff hikes effective from April dwarf the racked up DUoS fees. EDF and Scottish Power two weeks ago revealed increased charges, shadowing exactly the 54% rise in the retail price cap sanctioned by Ofgem.

Cornwall release their technical analysis on the day new UK economic data shows consumer price inflation climbing 5.5% in the year to January, its strongest surge in three decades. Over 150,000 Russian troops poised on Ukraine’s border underpin continuing uncertainty in wholesale gas markets.

DNOs are usually required to give suppliers 15 months’ notice of increased fees, the analysis firm points out. But Ofgem has conceded to the DNOs a shortened two months’ notice, in the face of record costs racked up in consequence of the cull of suppliers.

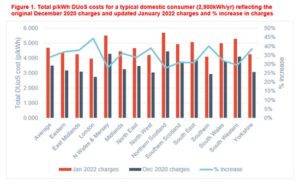

The DUoS increases vary by region, around a national average rise of 33.9%, nominally for 2022-23. In London and the south east the rise is over 40%, per Cornwall Insight’s analysis below.

Fuel poverty campaigners Citizens’ Advice complained in December that Ofgem’s decade of allegedly too permissive licencing of suppliers with weak business plans had invited failure, and imposed avoidable costs on end users and families.

Ofgem boss Jonathan Brearley has instituted a review of market regulation.

Tangential to Ofgem’s supervision of UK energy markets, the House of Lords’ economic affairs committee has launched its own inquiry into the investment climate for the sector. Submissions are due by 11 March.