There are quick bucks to be made from battery storage. But in three or four years, many assets will be in the bin, reckons redT chief Scott McGregor. He claims sustainable energy storage that can handle multiple functions for decades without degrading is now viable. Brendan Coyne reports

Predictions for battery storage penetration vary wildly. UK Power Networks recently reported it had received 12GW of connections requests in little over a year, much of it for batteries, much of it “highly speculative”. Western Power Distribution has 1GW of storage connections agreements on its network, with a further 1GW offered.

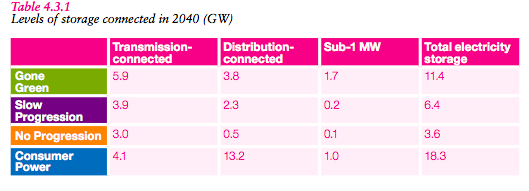

National Grid meanwhile, sees up to 18GW of all forms of electrical storage on the system by the 2040. Government predicts around 4GW of batteries by 2033.

But Scott McGregor, CEO of energy storage firm redT, believes market sizing predictions and the recent rush to secure frequency response contracts obscure fundamental truths. He says battery storage as opposed to energy storage is unsustainable – and many of today’s frequency response “arbitrage exploitation” opportunities may not exist in three years’ time.

Neither, he says, will some of the assets.

“The returns [for frequency response] are currently good. That’s nice, but they are batteries which will degrade and have to be thrown away – and that revenue opportunity will also run away pretty quickly.”

McGregor points to California, which he suggests is suffering a lithium hangover. Battery owners that piled into frequency response now spy other revenue streams. But, says McGregor, “they can’t access them because the battery is only warrantied to provide one service – and if they do more it will burn out”.

Yet most battery providers offer ten year warranties.

“Lithium is very good if you focus it on a short cycle, not very often. Do that and it will last you ten years,” he says. “But if you try to frequently perform multiple functions, the lithium will be gone in a few years.”

That poses a problem, given the need to ‘stack’ revenue streams together to build business cases and secure finance.

McGregor thinks the solution is flow-based energy storage, potentially in tandem with lithium or lead acid as a hybrid.

“The energy technology, such as a flow machine, is your workhorse. It will handle 60-80% of the work all day long: shifting solar, providing long duration services. Your lithium will provide short spikes of power. Combine the two and the lithium will last ten years, potentially even 15,” says McGregor.

Flow to grow?

Flow batteries store energy in liquid form. McGregor claims the electrolytes in his firm’s machines “never degrade”, making them “infrastructure assets”. He believes that will bring debt finance into the storage market.

“It is very hard to finance a battery. If your battery degrades, you have to throw out 100% of that capital cost. So it is not a long-term asset.”

“Utility industry debt finance is what expanded the renewables industry significantly. Storage will be the same,” says McGregor. “All of it is equity financed at the moment. Once you prove that storage is around for 20 years, debt will pile in.”

Moreover, when investors realise there are assets that can provide multi-services over decades without degradation, “they will wipe out those short return assets,” says McGregor. “That is starting to happen.”

McGregor claims current flow paybacks are “seven to nine years, which in terms of an infrastructure asset, is a pretty good return”.

Solar and storage

At a large-scale, solar and storage can deliver power “at around half the cost of Hinkley C”, claims McGregor. For industrial and commercial (I&C) firms – particularly those with expiring power purchase agreements (PPAs) – the combination is also complementary.

“They can [instead] use that solar to handle overnight demand load – it’s a massive commercial opportunity,” says McGregor. Equally, he says businesses that can no longer secure PPAs due to daytime export limitations on distribution networks, should consider storage.

Private wires are another significant market opportunity, McGregor believes.

“If you are an I&C firm with a lot of roof space, solar and storage means you can sell power to all the businesses within your estate,” he says. “We are seeing a lot of interest there, it’s a very exciting area.”

Policy void?

As well as finance issues, firms surveyed by The Energyst about battery storage suggest policy uncertainty is hindering investment. But McGregor is sanguine.

“Irrespective of whether government does anything or not, the policy of increasing renewables is going to drive storage,” he says.

“People are concerned, but while good policy can make markets more efficient, that’s actually irrelevant. The increase in solar and wind is going to make storage mandatory.”

Scott McGregor will speak at The Energyst’s DSR conference in London, 7 September. Reserve your ticket here.

Help us create a snapshot of DSR and energy storage for our next free report – take our 5 minute survey here.

Related stories:

Demand-side response and battery storage: Give us your views

Private equity firm buys 35MW Port of Tyne battery storage project

National Grid plots major overhaul of balancing services

WPD agrees 1GW of energy storage connections, asks how big can market get?

National Grid awards £66m of battery storage contracts

As solar subsidies wane, investors plan 2.3GW of battery storage projects

As solar generation makes history, National Grid starts to feel the burn

UK Power Networks receives 12GW of storage applications

Limejump and Anesco partner to connect 185MW of capacity market battery storage

Centrica: Floodgates to open on storage in 2017

Vattenfall to build 22MW battery storage plant at south Wales windfarm

VLC Energy to connect 50MW of battery storage in 2017 after EFR contract win

Greg Clark calls for carmakers and energy firms to deliver battery storage

More than half of I&C firms mulling energy storage investment

Capacity market too low for large gas, but gigawatts of DSR, batteries and CHP win contracts

Battery storage: positive outlook?

National Grid must provide a plan for battery market, says SmartestEnergy

Who needs an EFR contract? Somerset solar site installs ‘grid scale’ Tesla battery

Ofgem: Energy flexibility will become more valuable than energy efficiency

National Grid says UK will miss 2020 targets, predicts big battery future

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.

I have a 8kw east west solar set up with solar edge inverters, the maximum allowed by the electricity provider. I have roof space for another 10kw. I wish to store energy, and, if possible, go off grid. Is your electrolyte storage a possibility for me?

Hi John – yes – please get in touch with our team and we can look into it for you enquiries@redTenergy.com or 0207 061 6233

A California lithium hangover due to batteries piled into frequency response???

This is very confusing because California didn’t even have a market for frequency response until very recently, since releasing that service, the frequency response market in California has paid near $0 in most cases, because in California there’s a large over capacity. So almost NONE of the energy storage systems installed to date and planned in the future are based primarily on frequency response revenues, but instead are for capacity, flexible capacity (ramp management), and behind-the-meter demand reduction. The primary drivers of California’s energy storage market has always been for multiple hours energy storage not power compensation. There doesn’t seem to be any kind of slow down, with the scale, speed of installation, new favorable market rules (see CAISO proposal for load shifting product) and new drivers (see Aliso Canyon) happening every year. Because the application space is changing rapidly, there’s an expectation that future batteries will be cheaper and higher performing, and lack of experience operating batteries, the projects acquired so far have not given credit for projects with lives greater than 10 years. That should change. The opportunity for redox flow batteries (or machines) will come (if they can hang on long enough to get to the right costs and reliability), when the market matures and the project timelines expand beyond the current 5-10 years to 20+ years like the rest of the utility equipment.

Seven to nine years of payback is not what C&I customers are expecting. 18 – 36 months max is more realistic. Size, weight, costs vs life cycle performance are significant drivers that all storage technologies need to master including flow machines. Size and weight are a challenge today and all the investment into the sector is being pushed towards lithium, to get costs below $100/kWh from the $135/kWh for cells today.

Specifically the topic of power versus energy with batteries. Power is based on the PCS the designer selects. Energy comes from the size of the battery the designer selects. Lithium based solutions like any other storage technology can provide both power and energy at the same time, if the system is designed correctly.

It is a myth that batteries only provide power, not energy. We do 24 hrs plus of Solar + Storage designs and there is no complications with the same system also providing frequency/voltage regulation (a power application) to stack revenue.

The Lithium Titanate batteries now coming out have a claimed life of 20000+ cycles, even up to 100000 with lower C values. It’s early days so I imagine in a couple of years these will be even more impressive..

Another year has gone by now and there have been some serious fires caused by thermal runaway in lithium batteries. Vanadium is the future for energy storage. VRFBs have proven to be safe, have the advantage of being capable of multiple Charge discharge cycles each day, do not degrade so the value of your infrastructure doesn’t depreciate, and if you talk to the right people can be leased so the up-front cost is no longer a factor.

@Ian Marriott,, I can agree VFBs are certainly safer than almost any type lithium. However, they remain several times more costly to build and deploy than is necessary for them to become commercially attractive for wide-spread deployment.

(Ferro) Vanadium’s price history shows high volatility. If the VFB were ever to become cheap enough to deploy at scale, battery vanadium demand will rapidly exceed ferro vanadium demand sending vanadium prices into the stratosphere.

That’s what exponential demand for lithium batteries will bring about, starting in 3-3 years.

https://www.nhm.ac.uk/press-office/press-releases/leading-scientists-set-out-resource-challenge-of-meeting-net-zer.html

An inconvenient story that the Energy Institute ought to follow up?