Three quarters of companies considering battery storage projects predict payback periods of between three and seven years, according to early findings of a survey by The Energyst.

Three quarters of companies considering battery storage projects predict payback periods of between three and seven years, according to early findings of a survey by The Energyst.

However, when it comes to securing funds, predictability of revenue is a concern for almost two thirds (62%) of those surveyed, while stability of policy worries almost half (48%).

Respondents include water companies, telcos, manufacturers, logistics companies, universities and local authorities. Of 54 survey responses so far, exactly half are looking at battery storage (24 companies considering projects, three have already invested).

A third (32%) of planned projects are sub-250kW, a third (36%) are 250kW-500kW while a quarter (24%) are 1MW+. Two planned projects are between 500kW and 1MW and two respondents did not specify project size.

Of those projects, roughly 20% are standalone, roughly 30% are collocated with renewables and roughly 50% are behind the meter.

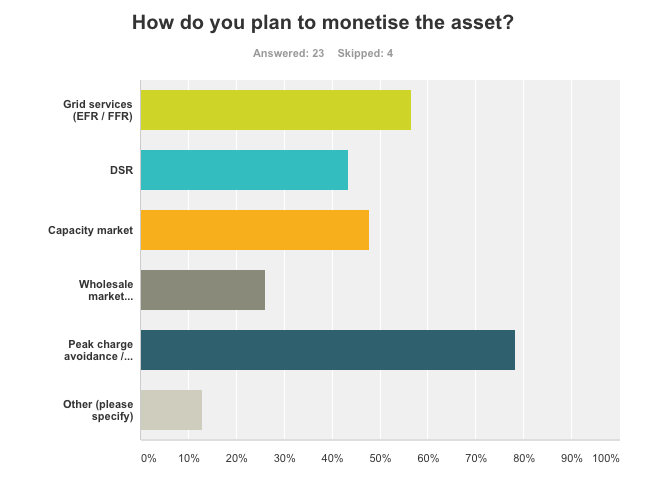

Respondents plan to stack multiple revenue streams to monetise their batteries, with peak charge avoidance/load shifting and faster frequency response services the most common denominators (see table).

A third of those polled say planned investments have three to five year projected paybacks, while almost half (46%) believe their projects will payback in five to seven years.

Two thirds of respondents will finance the battery internally, but only three in ten said they had experienced no problems in securing funds.

These early responses are part of a broader demand-side response survey and market report. As such, a different picture may emerge as the survey sample increases.

If you are an end-user providing or considering DSR, or mulling battery storage, please take the five minute survey here and help us create an accurate market overview.

Related articles:

Demand-side response and battery storage: Give us your views

WPD agrees 1GW of battery connections, asks how big market can get

Ecotricity to build 2.5MW battery storage project ahead of colocation plans

As solar subsidies wane, investors plan 2.3GW of battery storage projects

As solar generation makes history, National Grid starts to feel the burn

UK Power Networks receives 12GW of storage applications

WPD launches DSR aggregator business

Government sets out smart grid vision

Limejump and Anesco partner to connect 185MW of capacity market battery storage

Centrica: Floodgates to open on storage in 2017

Vattenfall to build 22MW battery storage plant at south Wales windfarm

National Grid awards £66m of battery storage contracts

VLC Energy to connect 50MW of battery storage in 2017 after EFR contract win

Greg Clark calls for carmakers and energy firms to deliver battery storage

National Grid mulls rolling all frequency balancing services into one scheme

More than half of I&C firms mulling energy storage investment

Capacity market too low for large gas, but gigawatts of DSR, batteries and CHP win contracts

Battery storage: positive outlook?

National Grid must provide a plan for battery market, says SmartestEnergy

Who needs an EFR contract? Somerset solar site installs ‘grid scale’ Tesla battery

Ofgem: Energy flexibility will become more valuable than energy efficiency

National Grid says UK will miss 2020 targets, predicts big battery future

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.