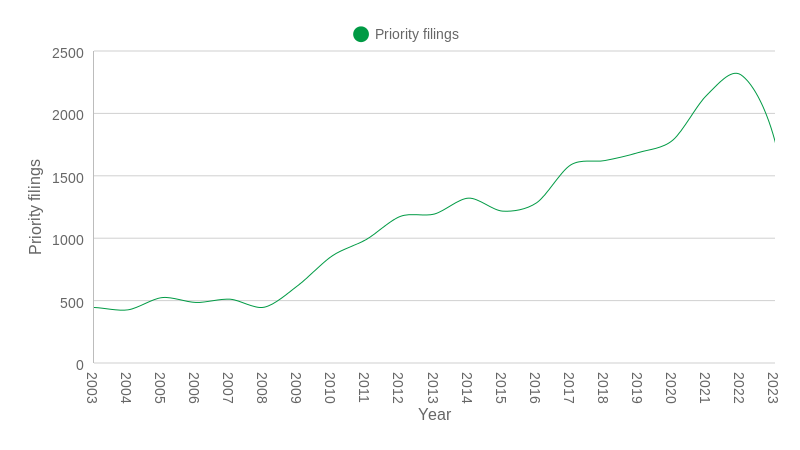

Global innovation investment in lithium-ion (Li-ion) battery technology has fallen for the first time since 2015, according to the latest patent data* reported by Appleyard Lees.

From an all-time peak in 2022 (2,309 patent filings), applications fell by more than 20% to a total of 1,778 in 2023.

However, innovation activity remains higher than at any time prior to 2020 and filings relating to cathode materials and battery management systems are accelerating at pace.

These are among the findings in the fifth annual edition of the now-published Inside Green Innovation: Progress Report** from the leading intellectual property firm.

Appleyard Lees’ partner, David Walsh, said, “Far from reaching saturation, the momentum in intellectual property activity in battery technologies indicates that investment and competition will remain strong for the foreseeable future.”

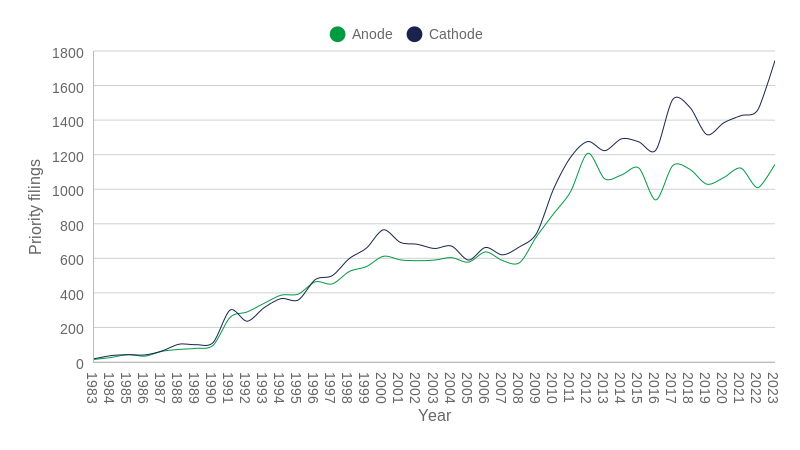

Electrode active materials: cathode outpaces anode

While innovation in anode materials is high – remaining above 1,000 annually since 2017 – its cathode technology counterpart has raced ahead, with 1,745 in 2023 (an almost 20% year-on-year rise). The importance of this element for managing battery performance and cost in electric vehicles and large-scale storage is a key factor.

Research and development are now focused on materials that can deliver higher energy density alongside safety and stability, including nickel and cobalt-free technologies. In 2023, nickel-related patent applications pulled ahead sharply, with 292 compared to 147 for cobalt.

In other technological developments, battery management systems (BMS) reached an all-time peak, with 706 patent filings in 2023. Innovations focus on performance factors including optimising energy distribution, balancing charge levels between cells and predicting remaining battery life.

In addition, BMS innovation is also extending to the Internet of Things (IoT) and cloud connectivity to offer real-time, remote monitoring.

Chris Mason, partner at Appleyard Lees, added, “As batteries scale up in capacity and application, from household devices to industrial grid storage, the sophistication of BMS will determine how effectively we can harness their potential and value.”

Countries and companies

Companies leading the pack in the latest patent data for battery technologies include Samsung and LG Energy Solution, though the former is ahead by a ratio of almost 3:1 (206 versus 73) – a role reversal of the previous year’s figures.

Other companies vying for position in the battery technology innovation stakes include Toyota, GM Global Technology Operations and Panasonic.

And for electrode active materials innovation, the dominant territories are Japan and South Korea, though the latter has now emerged as the leader in global filings in this area of technology – recording almost 40% more patent filings than Japan in 2023 (925 versus 670).

European patent attorney at Appleyard Lees, Kealan Fallow, said, “Rising patent filings in battery management systems, potentially fuelled by interest in AI inventions and an increased recognition that efficient real-time management of battery cells can enhance many critical properties and characteristics, suggestions that innovation remains strong in this sector.”

*Inside Green Innovation: Progress Report – Fifth Edition, examines patent filing data through 31 Dec 2023, the latest date complete filing data is available from public sources.

**Appleyard Lees’ Inside Green Innovation: Progress Report – Fifth Edition is available to read here.