Businesses will start to feel the full effect of energy price rises this winter, Npower has warned.

“Today we are seeing winter baseload power prices above £72/MWh and peak prices around £80/MWh. Whereas we have customers that locked in last winter at £35/MWh,” said Ben Spry, head of risk management services – Energy HQ at Npower Business Solutions. “Depending on their hedging strategies, they are now exposed to stuff at £70-plus. That shows how quickly the market can move.”

Spry said the effect of rising non commodity costs – such as government policies to support low carbon power generation, or security of supply over winter – have been “masked” to date by benign wholesale prices. But that has changed.

“We are now seeing bullish commodity as well as a step up in non-commodity,” said Spry. He points to a “huge bullishness” in most fuels, “but especially coal and carbon,” with the latter hitting 10-year highs in recent weeks on the back of reforms to the EU ETS.

“On top of that, there are a lot of gas outages,” said Spry. “That’s routine for this time of year, but low storage levels compound [the risk premium].”

Then there is ongoing concern around ageing nuclear fleets. “France always comes into focus around this time of year,” with Brexit uncertainty now also coming to the fore, said Spry. Currency weakness plus a high oil price is compounded by early weather forecasts that currently predict a cold November.

“It’s almost a perfect storm,” Spry suggested.

Cost predictor

While volatility creates opportunity for those on flexible contracts and with the ability to shift load, for many businesses “there has never been a more pressing time to start reviewing how you buy, use and manage energy”, said Spry.

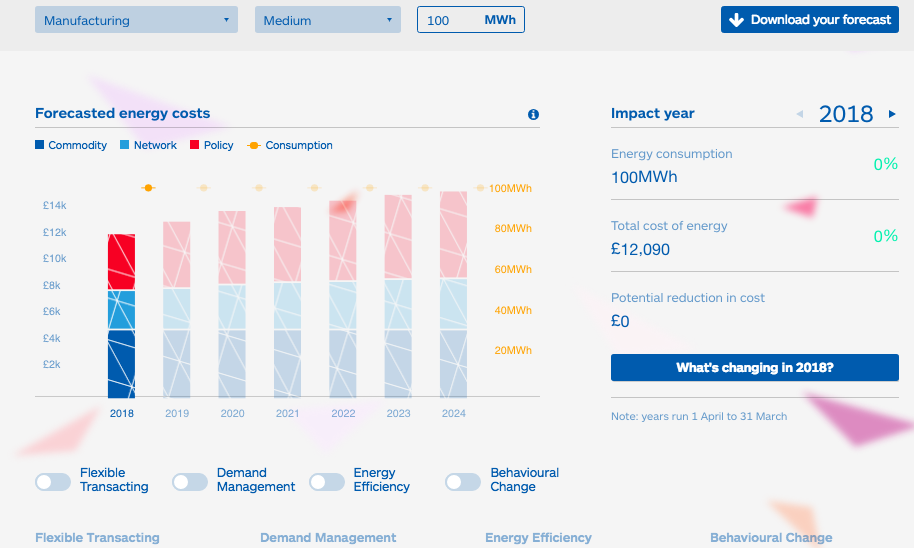

The firm has launched a cost predictor that enables businesses to predict energy price rises based on their profile and usage. It forecasts business bills out to 2024, breaks down commodity and non-commodity elements, explains what is driving rises and highlights savings that could be made through specific actions, such as energy efficiency, demand-side response and behaviour change. In some cases, it shows bill savings of more than 50%.

Spry said the calculator gives energy managers a useful tool to show finance departments what is driving cost and how increases might be mitigated.

He hopes it will also work as a marketing tool to bring businesses to Npower, which, like all suppliers is pushing harder into broader energy services over commodity sales.

“Will we be at the table if we are focused on supply? Absolutely not,” said Spry. “The industry is changing, it is becoming more decentralised. All sectors are going to be affected one way or another, but there is opportunity in terms of flexibility and cost avoidance.

“Different businesses have different appetite [for risk],” said Spry. “Flexibility solutions might not be suitable for everyone, but using the cost calculator they can see what’s coming. Then hopefully we can talk about the interventions we might make.”

- Ben Spry also features in The Energyst’s 2018 DSR Report, of which Npower Business Solutions was a sponsor. Download the report here.

Related stories:

Watchdog indicates SSE-Npower merger in the clear

Npower pays £2.4m for advanced meter failures

SSE merger: Npower says business customers will not feel billing pain

Amazon would be a good buyer for SSE+Npower

Click here to see if you qualify for a free subscription to the print magazine, or to renew.

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.

Sadly, the energy suppliers still want to blame low carbon power generation for price rises, which is absurd, when you consider that these are only 8% of the customers energy bill, where wholesale prices are 55% of the bill and have doubled in the last year according to this article. They are terrified by distributed energy, by customers generating their own energy and leaving them in the cold.