Cielo Energy provides businesses of all sizes with expert commercially focussed consultancy advice and support on the energy market. We work with companies from energy suppliers and generators to major consumers and tech businesses to offer cost effective support in navigating and profiting from the energy markets.

advice and support on the energy market. We work with companies from energy suppliers and generators to major consumers and tech businesses to offer cost effective support in navigating and profiting from the energy markets.

When is a good time to lock in energy prices?

The simplistic and flippant answer is to sell at the top, or buy at the bottom in order to maximise the value to your business – but in reality, that’s not a valid or realistic expectation. Traders may enter and exit a trading position many times, taking profits or losses along the way, but for any business expecting to hold a position until delivery choosing the right approach will be different for each business.

Cielo Energy offers a bespoke approach to help answer the question for your business, taking an holistic approach to establish the best approach based on your specific circumstances.

Zoom out from the complexities of the day-to-day price movements and focus on what you’re trying to achieve at the corporate level. How do energy prices impact your business’ ability to deliver its products and profits? How often can you adjust prices to customers? How much margin variance can you tolerate, and over what time period? Do your strategic objectives align with your operational implementation? These questions are more important for most businesses in establishing when to hedge than following the market, although they tend to get very little attention.

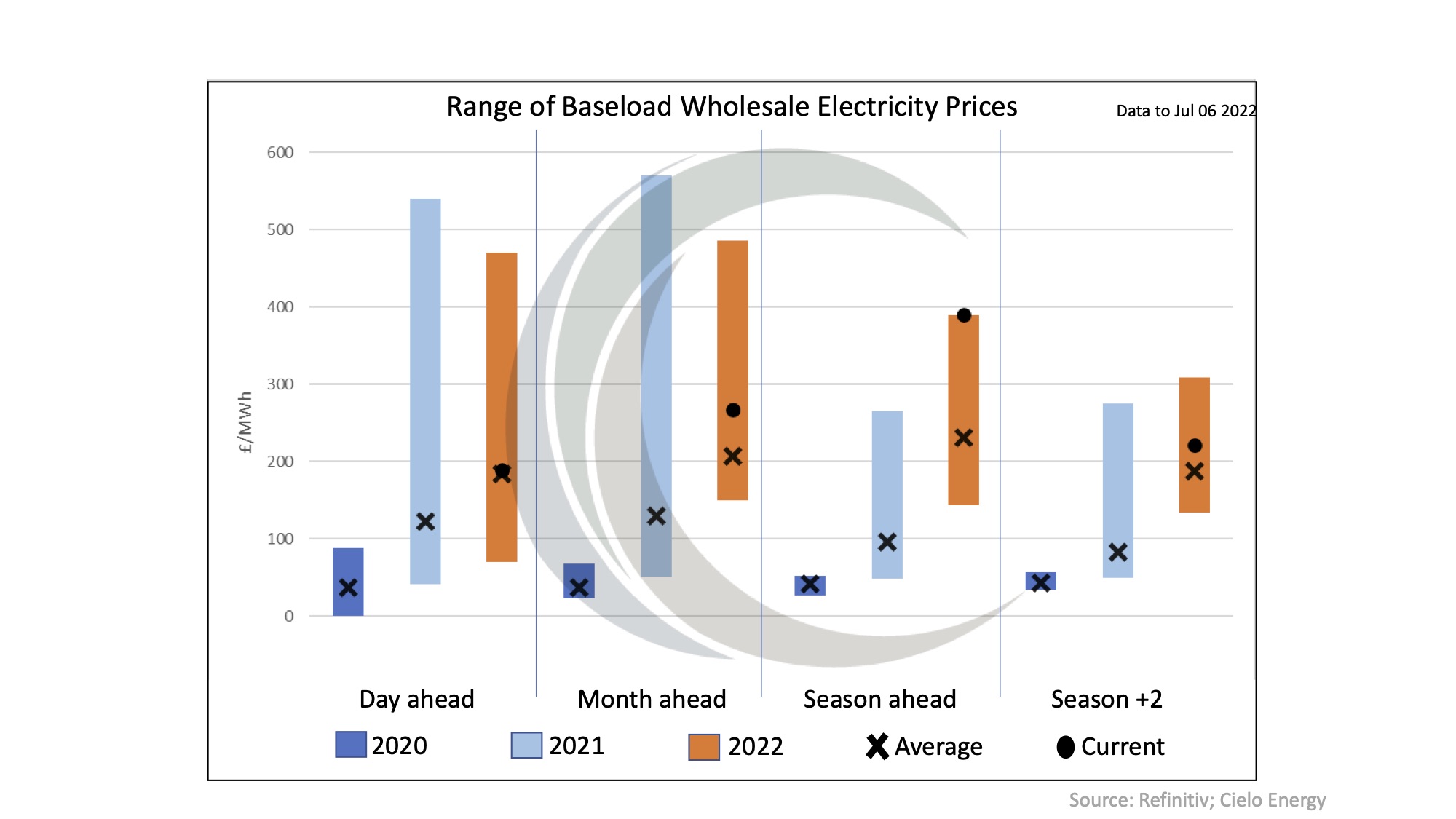

The sheer volatility in energy prices makes picking a price problematic to say the least. The chart below shows the range of wholesale electricity prices for different delivery periods over the last 3 years. The sheer scale of price movements between the lowest and highest days is huge, with a clear increase in the range of prices since Covid given global events. Until recently longer-term prices were significantly below short-term prices; but deliveries for the coming winter are at all- time highs now demonstrating the shifting market sentiment.

The risks of ‘getting it wrong’ in trying to time the market are much larger now than they have been historically, simply because the market price moves more quickly and has tended to be upward trending recently. This means understanding what you’re trying to achieve and being clear on what exposure you can and cannot tolerate has never been more important. Trading / Hedging strategies that were fine in history may not be so in future.

Get in touch to see how we can help info@cieloenergy.co.uk or visit our website