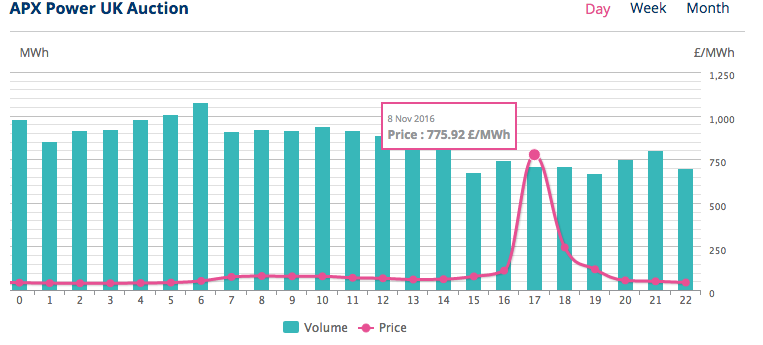

National Grid’s second capacity market notice saw day ahead prices spike to £800MWh and balancing market prices soar towards £2,500MWh.

The system operator issued the call yesterday (7 November) at midday for 4.30PM as demand appeared set to outstrip supply by 87MW. The notice was subsequently cancelled just after 3pm.

Speaking at a Policy Exchange briefing later that afternoon, National Grid executive director, Nicola Shaw, said those price spikes indicated that the capacity market was doing its job.

Taking part in a panel debate on whether current energy policy requires major surgery in the face of rapid change, the focus of a new Policy Exchange report, Shaw cautioned against wholesale change.

“I have sympathy [with those who perceive inertia within government departments responsible for energy] but also, be careful what you wish for,” said Shaw. “We don’t want intervention all of the time, there is a balance to be struck.”

National Grid was “focused on finding ways to make the [current] market work and I do think the market is working”, said Shaw.

“The capacity market notice is one example [of a functioning market] – providing information to which people react: Coal ramped up because prices were high and they could make money out of it,” she said.

“That is how things balance without us having to intervene all the time and I would rather be in that world than a world in which we have to intervene more.”

Looking longer term, Shaw outlined a looming skills crunch as the energy system becomes digitized.

“I think the algorithms for balancing are going to get more complex. If you have a bright child,” particularly those with strong maths and physics, said Shaw, “point them in our direction.

“We are going to need a lot of skilled people. The technology required is beyond an individual brain or system – they will be multiple – and making those systems work will be a challenge both for National Grid and the industry in general.”

Meanwhile, according to APX data, prices on the day ahead market for Tuesday look set to match Monday’s peak.

Related articles:

Free 2016 demand-side response report

National Grid issues first capacity market notice

Energy suppliers step up DSR aggregation efforts

More than half of I&C firms mulling energy storage investment

Limejump boss: Big six will have to acquire aggregators or lose relevance

Battery storage: positive outlook?

National Grid must provide a plan for battery market, says SmartestEnergy

Three policy tweaks that could enable 10GW of battery storage

Demand turn up: What worked, what didn’t?

Public sector unconvinced by demand response

Dong Energy: ‘Be careful where you stick your flexibility’

Aggregators: firms shouldn’t fear disruption from demand-side response

Can National Grid hit its 2020 DSR target?

Trinity Mirror targets £1m revenue from demand response

Who needs an EFR contract? Somerset solar site installs ‘grid scale’ Tesla battery

BEIS tightens capacity market rules in bid to build large power stations

Ofgem moots swift cap and floor regime to cut embedded benefits

Tempus Energy close supply business

Hitting on-site generation ‘will drive up bills and fail to incentivise new gas’

Major changes to capacity market and distributed generation charging regime proposed

Higher credit cover and penalties for capacity market providers

Ofgem: Energy flexibility will become more valuable than energy efficiency

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.