water energy & environment’s regular section brings you an eight-week overview of the latest analysis of the power and gas markets from Energy Trader Daily.

water energy & environment’s regular section brings you an eight-week overview of the latest analysis of the power and gas markets from Energy Trader Daily.

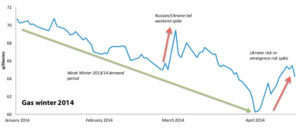

Following the recent market slump caused by a combination of the excess gas flows in the system, healthy storage levels, warm temperature forecasts and low demand levels, prices at the front end of the gas market softened in the first quarter of the year, before violently bouncing higher in early April.

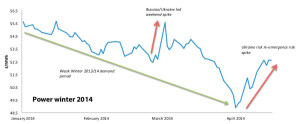

As the situation in Ukraine erupted and geopolitical risk returned to the forefront of the energy market, NBP winter ’14 prices surged more than 10% in early April, to trade back at the highs of mid-March, thanks to the added uncertainty of future gas supplies via Ukraine. In the power market, the upside pressure derived from the higher gas prices and general uptick in the energy sector led prices up by 8% in April.

The Winter ’14 Baseload contract, which also suffered from the excessive quarter one selling, managed to correct on the technical analysis front and trade back north of the £50/MWh mark, as a result of the renewed concerns over Ukraine. As the events in Ukraine become recurrent and the market experiences big spikes over weekends, the future outlook for the geopolitical risk vis-à-vis the Eastern State looks to become more subdued, as traders either shrug off the impact or hastily retrace exaggerated upside moves due to the current Bearish market environment.

Energy Trader Daily A leading UK energy trading desk which examines market areas and utilises established methodologies, in order to deliver market intelligence, focusing on both fundamental and technical analysis. ETD has a wealth of knowledge, real time streaming direct to your desk, and an expert trading analyst team to help you manage future market uncertainties.