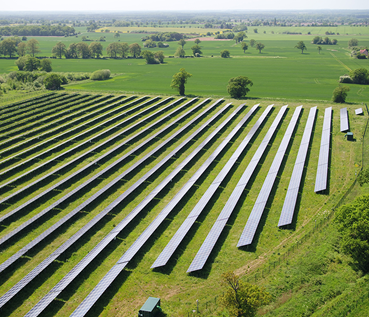

Solar farm operators ib vogt and financiers DIF Capital have signed a deal for future purchase of 720MW of consented solar PV sites, in what the parties believe is Britain’s biggest portfolio transfer of co-located solar and storage opportunities.

The vendor is Enso Green Holdings, a joint venture between Enso Energy and Cero Generation. No transaction price has been disclosed by either side.

Seven sites are included in the deal, with aggregate capacities of 380MW of solar and 340MW of battery storage. ib vogt will build and operate each site.

DIF’s investment is being done through its DIF Infrastructure VII fund, which will acquire a 90% interest.

Cero will continue to develop and deliver UK solar and battery projects in the joint venture’s existing 5GW pipeline. A further 5GW of early-stage opportunities beckon beyond that.

An early investor in British solar, Berlin-headquartered ib vogt operates in 21 countries, via 24 joint ventures. Worldwide it claims 2.9GWp in operation or under construction, and a global pipeline of over 40GWp.

Transfer of ownership of each project in the deal will happen once each site reaches the ready-to-build stage. The first two are now under construction, with ownership already transferred.

The remaining five sites are scheduled for acquisition this summer, and output should begin between 2024 and 2026. Every site is expected to benefit from CfD contracts or PPAs with corporate or utility offtakers.

DIF and ib vogt are currently in the process of raising a non-recourse debt financing facility to fund the construction of the portfolio. The 780MW total deal is DIF’s first direct investment in utility-scale power storage.

Farm initiators Enso Energy have delivered over 1.2 GWp of early stage projects since 2019. Their current projects range from Dorset to north Yorkshire.

Managing director Andrew King commented: “The sale of these ready-to-build assets is the culmination of a lot of hard work by the Enso and Cero teams.

“This transaction provides further evidence that co-located solar and battery storage projects connecting directly to the transmission network are attractive to funders and investors and will play an important role in the delivery of the UK’s net zero plans”.

Cero’s CEO Marta Martínez Queimadelos said: “We are delighted that DIF and ib vogt will be taking forward this sizeable portfolio into the next phase of its lifecycle.

DIF’s head of infrastructure Gijs Voskuyl said it continues to work with Enso and Cero to bring the remaining assets in the portfolio to ready-to-build stage. ”We are excited to make this investment in a partnership with ib vogt”.