New research from Bain & Company finds that the majority of the world’s largest banks are failing to disclose their financed carbon emissions or interim targets, despite the sector’ promises to reach net zero emissions by 2050. The research finds that:

- Only 65% of the world’s leading banks have pledged to achieve net zero financed carbon emissions by 2050

- Just 45% of the sector has disclosed their financed emissions and made their 2030 targets public, with those who have only shared partial data

- Many leading banks rely on data that is insufficiently granular to properly inform strategy

The world’s banks face three major strategic challenges to reaching net zero emissions by 2050, according to Bain & Company’s research. As financed emissions—those associated with an organisation’s lending or investment activity—represent at least 95% of a bank’s overall carbon footprint, it is essential to prioritise granular measurement of these emissions along with a long-range strategy to capture value from the carbon transition.

The new study reveals that many banks have the opportunity to build a more accurate baseline of emissions in their lending and other financed portfolios as there is a risk of over- or under-estimating financed emissions by up to double when using loan data that is not granular enough. This critical but complex task of measuring financed emissions makes it challenging to understand where and when value will emerge in the carbon transition and which strategy is best for a bank to capitalise on it.

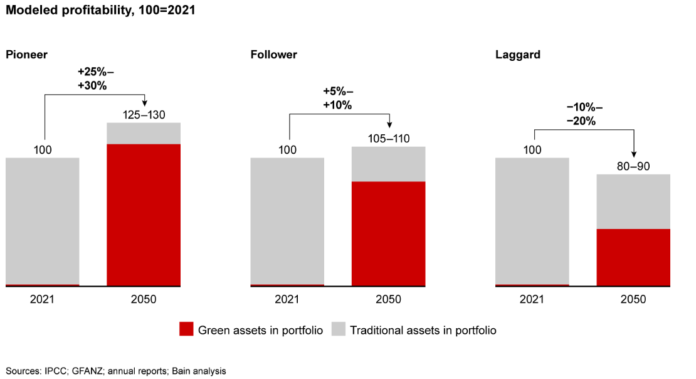

Bain & Company predicts that banks that tackle these challenges head on—which it calls ‘pioneer banks”— will see profits grow by between 25% and 30%. In sharp contrast, banks that either delay or adopt a passive approach tied simply to following regulatory requirements will see profits eroded by between 10% and 20%.

Pioneer banks will ensure they invest in high-calibre emissions tracking to help their clients transition and make smarter strategic decisions, actively steering their portfolios based on both financial indicators and carbon footprints. By moving quickly, pioneer banks will shift a much larger percentage of their portfolios to green assets — up to 85% by 2050. In turn, their cost of funding and risk will be far lower than those of slower-moving competitors, who will be increasingly penalised by markets and investors for higher exposure to traditional industries and projects.

“Banks have a pivotal role to play in limiting global warming to 1.5°C, and industry-wide initiatives, such as the Glasgow Financial Alliance for Net Zero, are critical,” said Camille Goossens, Bain & Company’s global lead for sustainability and responsibility in financial services. “This critical topic requires banks to invest in reliable granular data and to increasingly adopt longer-term adaptable strategic thinking. Each bank will also need to decide on the posture it wants to take in order to unlock value.”