water energy & environment’s new regular section brings you an eight-week overview of the latest market analysis of the power and gas markets from Energy Trader Daily.

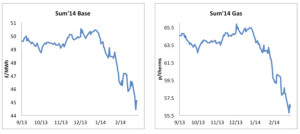

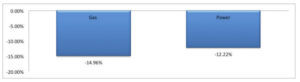

The front season gas contract (NBP summer’14) has extended its southbound trades on the year to over 8p/th in 2014, having traded relatively sideways in the first half of the winter 2013/14 trading season (Q4’14).

The Bearish impact of the changed weather models, half-way throughout January, triggered a selling trend in the whole-sale market after traders changed their

Bullish outlooks (based on a cold winter/high demand) to Bearish ones (pessimistic).

The front season power contract (UK baseload summer’14) made similar losses on the back of the gas market weakness and even more depressed coal prices. The £5/MWh plunge in 2014 reflected the declining cost of generating electricity, weakening the outlook for the power market which has also suffered from impact of low demand levels due to the abnormally mild-winter trading season.

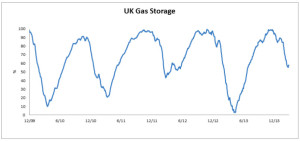

On the back of the summer stock build, higher UK gas storage levels, going into what was expected to be a repeat of the last winter 2012/13 led the market to foresee higher energy prices.

The market has thus far suffered from its preparation for a winter that has remained elusive, with only one trading month left for the winter 2013/14 trading season.

Energy Trader Daily

Energy Trader Daily (ETD) is the leading UK energy trading desk which examines market areas and utilises established methodologies, in order to deliver exceptional market intelligence, focusing on both fundamental and technical analysis. ETD has a wealth of knowledge, real time streaming direct to your desk, and an expert trading analyst team to help you manage future market uncertainties.