The Climate Action 100+ Net-Zero Company Benchmark offers detailed, comparative assessments of individual focus company performance against the initiative’s three commitment goals: reducing greenhouse gas emissions, improving governance, and strengthening climate-related financial disclosures.

While there is growing global momentum around companies making ambitious climate commitments, the Benchmark assessments show that companies still have a long way to go in delivering on these promises. No focus company assessed performed at a high-level across all of the nine key indicators and metrics that were used to evaluate each company. Further, the assessments show that no company has fully disclosed how it will achieve its goals to become a net zero enterprise by 2050 or sooner. This includes establishing short and medium-related targets to deliver ambitious emissions reductions within the next decade.

While some companies in a range of sectors are ahead of their peers in making progress towards some of the disclosure and decarbonisation strategy indicators, all companies have more work ahead. Specifically, the company assessments reveal that:

- Alignment of value chain GHG (Scope 3) emissions often remain a blind spot.

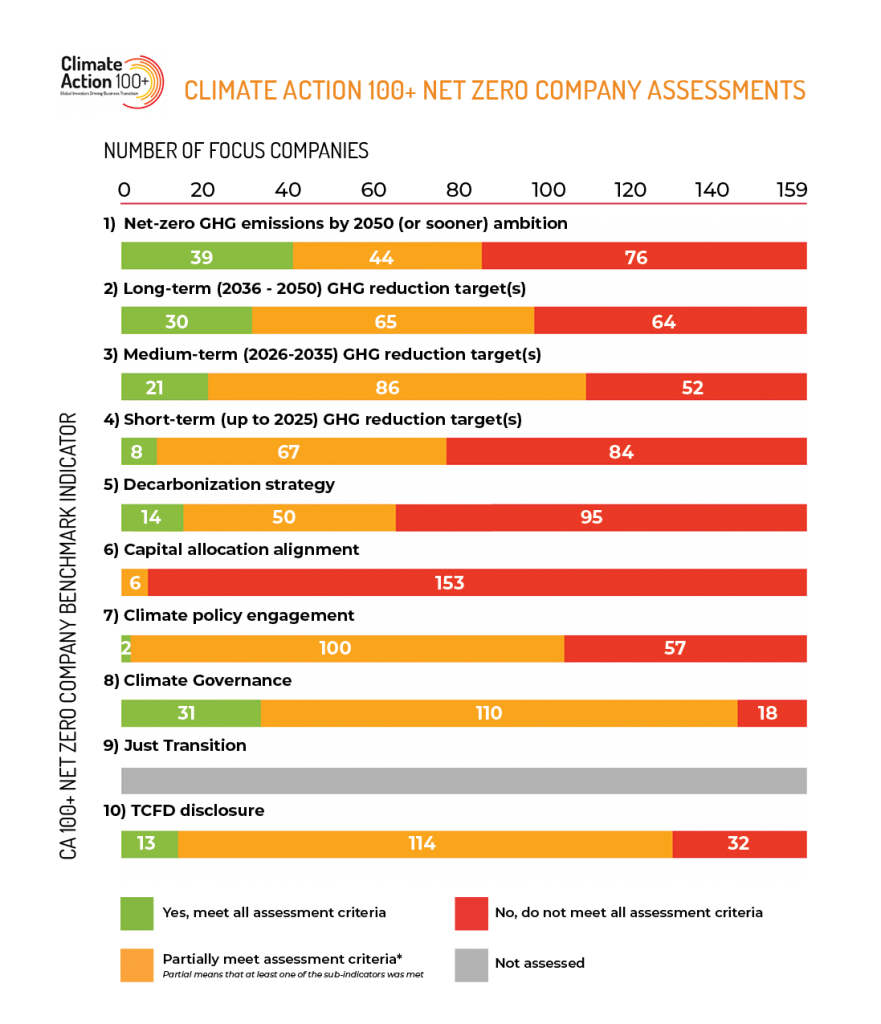

- Overall, 83 of the focus companies (5 % of the total) assessed have announced an ambition to achieve net-zero by 2050 or sooner. However, roughly half of these commitments (44) do not cover the full scope of the companies’ most material emissions.

- Long-term ambitions need to be backed by clearer strategies and robust short- and medium-term targets.

- There is a critically important need for corporates to establish more robust short- and medium-term targets to achieve their ambitions;

- While 107 companies have set medium-term targets (2026-2035), only 21 meet all assessment criteria; 75 companies have set short-term targets (up to 2025), but only eight meet all assessment criteria.

- Future investments need to be more clearly aligned with the net zero transition.

- Only six companies explicitly commit to aligning their future capital expenditures with their long-term emissions reduction target(s), and none of these companies has committed to aligning future capital expenditure with the goal of limiting temperature rise to 1.5 degrees Celsius.

- Corporate boards and executive management teams need to improve climate change governance.

- 139 focus companies assessed (87%) have board-level oversight of climate change, but only a third of companies tie ‘executive remuneration directly to the company’s emission reduction targets.

- Ambitious 1.5-degree pathways are often missing from climate scenario planning.

- Almost three quarters (72% of the total) of companies assessed commit to align their disclosures with the Task Force for Climate-related Financial Disclosures (TCFD) recommendations and/or support the recommendations. However, only 10% use climate-scenario planning that includes the 1.5-degrees Celsius scenario and encompasses the entire company.

The Benchmark does not specifically score or rank companies, nor does it use overall numeric or alphabetic rating.†

The Benchmark has been designed to add further depth to investor expectations of corporate progress, and inform and improve investor engagement strategies to drive faster climate action. Additionally, it aims to define the key elements of a robust ‘net-zero aligned’ business strategy. The relatively low performing companies reflect the fact that most of the world’s largest companies are still in the early stages of the shift to a net zero economy. In bringing much needed clarity to what a ‘net-zero aligned’ business strategy entails, the Benchmark helps to set the baseline against which future delivery can be assessed.

Over the coming months, Climate Action 100+ will build on the company assessments released today by publishing sector by sector analyses. The Benchmark will continue to evolve as a key measure of corporate progress on climate action and net zero alignment, and will be updated and revised with the latest available data, and stakeholder input and feedback. The next iteration of the Benchmark will be published in 2022.

† Leading climate research and data organisations, including Transition Pathway Initiative(TPI), Carbon Tracker Initiative (CTI), 2° Investing Initiative (2DII) and InfluenceMap (IM) have been central to the overall development of the new Benchmark and the indicators used to assess focus company alignment with the initiative’s goals. TPI conducted the company disclosure research and analysis, supported by its research and data partners the Grantham Research Institute on Climate Change and the Environment at the London School of Economics (LSE) and FTSE Russell. The Benchmark was undertaken through the leadership and support of the Climate Action 100+ Steering Committee, and the collaboration of investor signatories and experts from AIGCC, Ceres, IIGCC, IGCC, and PRI.

Stephanie Pfeifer, CEO, Institutional Investors Group on Climate Change and Climate Action 100+ Steering Committee member, said, “Investors involved in the initiative expect the world’s largest carbon emitting companies to demonstrate a genuine commitment to rapidly transforming their business model if they are to maintain shareholder support. This requires robust and ambitious short, medium and long-term targets, with net zero 2050 as the North Star. While ambitious targets are critical, they are not enough on their own and be underpinned by credible strategies to achieve them.”