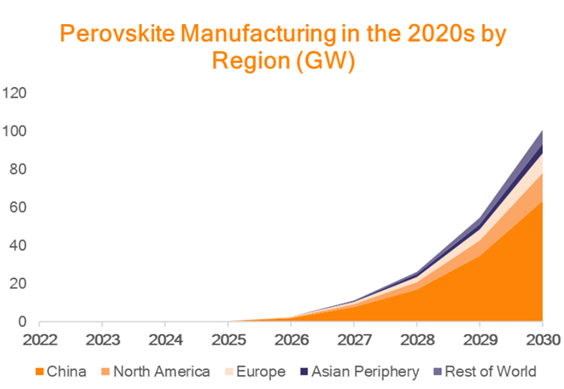

Perovskites’ development towards maturity as a viable force in the solar panel industry will take until 2026, but explode thereafter, new forecasts by Bristol-based analysts Rethink Energy predict.

By 2030 the technology will make up a 100 GW segment of solar panel manufacturing. By 2040, it will go on to dominate 85% of the industry’s output, adding close to 1 TW of manufacturing each year.

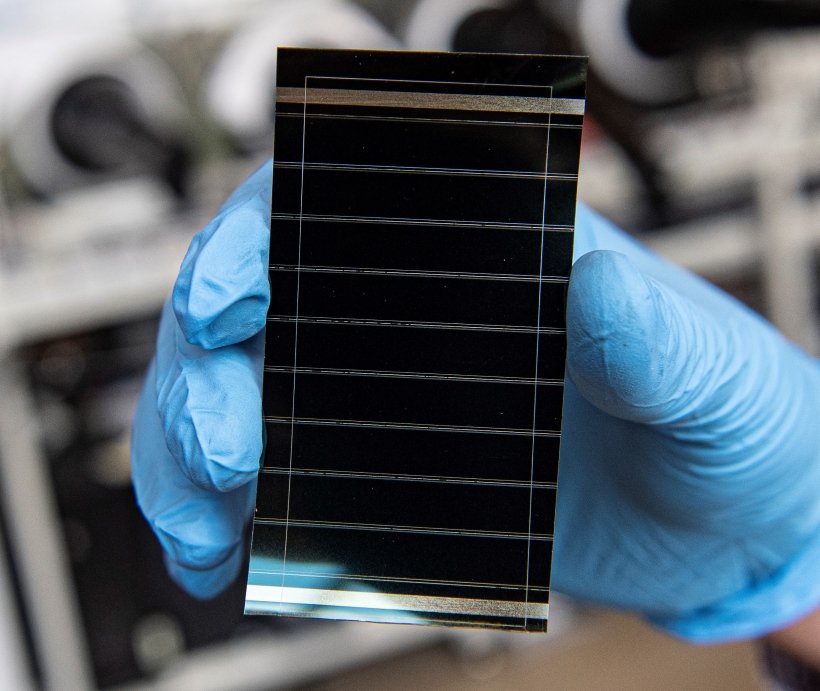

In Britain, Oxford Perovskite is the technology’s best known manufacturer, breaking efficiency records with product from its Berlin factory. Three months ago, the eleven-year old Oxford University spin-out claimed a new world record, converting 28.6% of photon energy into electricity.

Conventional silicon-based cells convert no more than 24% of available light energy into electricity. The Oxford innovators achieved their edge by coating their product with stabilised perovskite, a mineral previously regarded as too unstable for commercial exploitation.

In total, the report names 41 new or upcoming perovskite manufacturers. China dominates the list, though production is dispersed around the world.

Renew finds that a few more years of trialling are needed before the technology steps onto the global production accelerator. New companies spring up almost every month, researchers found. “Every one of the major silicon PV manufacturers will eventually enter perovskites well before 2030”, say the analysts.

“The reason that we are so sure that perovskites will happen this time is because they are starting to win in the efficiency stakes, and will certainly end up with less complicated supply chains and lower costs”, Renew’s authors declare.

“As each company works out how to ensure perovskite modules endure almost as long as silicon PV modules, and adhere to international lifespan ratings, then pretty soon after volumes will emerge in installations”.

Microquanta has five pilot installations already in China, while Utmolight has talked about GW-scale facilities soon to begin construction.

Commercial and industrial roofs will be the earliest locus for perovskite panels, the consultants believe. Ground mounted arrays supplying wholesale markets won’t feature until much later.

Many of the first Chinese panels will be used for export, Renew Energy believes. Outside China, the US will leapfrog Europe in manufacturing. Primarily this is because established module maker First Solar has acquired a perovskite company and because the US to date is the largest perovskite adopter outside Asia.

President Biden’s Inflation Reduction Act, already accelerating US solar manufacturing, will further favour the technology with incentives.

Europe will take an early lead in the technology, evidenced in Italy’s ENEL building factories both at home and in the US. The continent will be home to the majority of worldwide perovskite installations until 2028, and is will continue as its biggest deployment base until 2034, when China will overtake it.

For more information, read the report’s executive summary here.