Three cities outside England may reap rewards from major green developments, under proposals announced coincidentally in recent days.

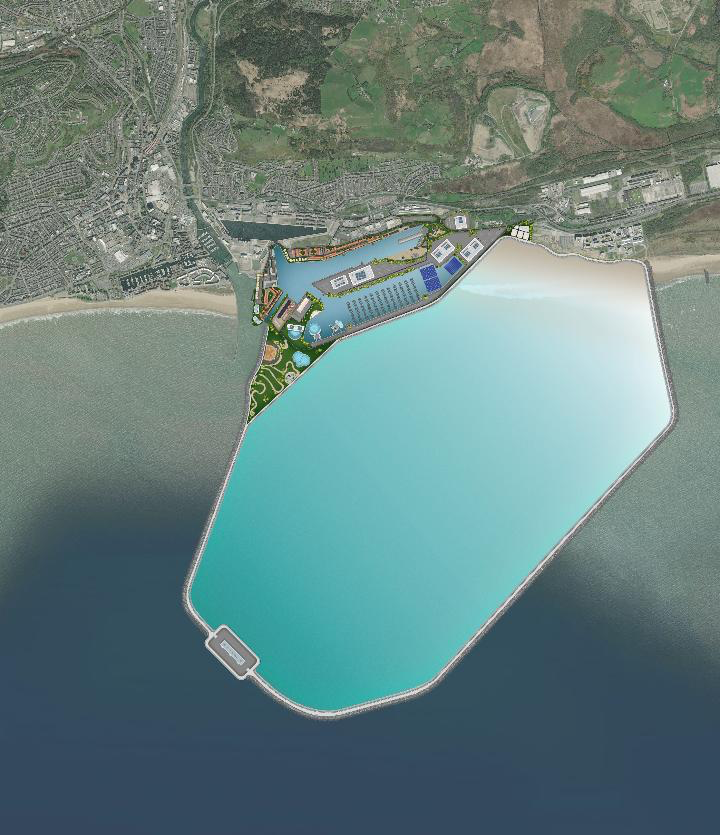

Blue Eden is Swansea’s latest £1.7 billion incarnation of its controversial tidal lagoon, this time extended with a proposed 72,000 square metre floating solar PV array, and a planned battery factory, with on-site storage providing stand-by power.

Welsh developer DST Innovations leads Blue Eden’s consortium, whose members include Associated British Ports and the city’s council. If consented, construction of the scheme would be phased over twelve years from 2024.

Turbines rated at 320MW mounted in a 9.5km lagoon wall would be the generating heart of the project. A 74,000 square metre data centre in Swansea’s Prince of Wales Dock will run on renewable power.

DST chair Tony Miles said Blue Eden could create 2,500 permanent jobs in Swansea and up to 17,000 elsewhere in Britain.

Meanwhile, Aberdeen City Council confirmed its choice of BP as preferred bidder and probable commercial partner to build and operate a solar PV plant, centrepiece for the city’s proposed hydrogen hub. Given a final investment decision for the concept in 2023, the scheme’s first phase may open in 2024.

Green power purchase agreements fulfilled from the array and the hydrogen source will supply energy initially for Aberdeen’s buses and trucks. Scaling up may follow, providing power for ships and trains, as well as potentially for export.

Edinburgh Airport completes the trio. Last week it signed an understanding with Danish energy firm Ørsted to achieve the hub’s Net Zero ambition by 2040.

Green hydrogen is at the core of possible solutions for the airport. It is owned by Global Infrastructure Partners, who also hold 50% of Ørsted’s Hornsea One offshore wind farm, at 1.2GW the world’s biggest yet commissioned.

Ørsted leads the Green Fuels for Denmark initiative, which includes a major decarbonisation plan for Copenhagen’s airport and its air and surface transport operators.

E-fuels and sustainable aviation fuels are GFD’s core. They rely on expansion of the nation’s electrolyser capabilities, timetabled for 10MW by 2023 and reaching 1.3GW by 2030.

One or two queries re the tidal lagoon. Giving a rating for “turbines” is obscure. How many turbines and what output over 24 hours? Naturally, tidal power may be reliable, but it is intermittent…

Once constructed, why 2,500 permanent jobs in the installation? Some peripheral activities, I guess.

And the renewable power comes from the floating PV cells on the lagoon? Not very clear.

Re Aberdeen, all the hydrogen comes from PV cells? What kind of acreage is envisaged and will it be onshore or offshore.

Good to know that Hornsea One is still the largest offshore wind farm in operation. Strike price £158.75, guaranteed for 15 years -and it still tripped out in that big blackout in 2019. Never heard why…

Many thanks, Dr P! Selecting the easiest-to-answer of your fine queries:

1. That turbines’ ‘rating’ is the developer’s headline number. Doubtless, DST Innovations would be happy to provide further details, via e: contact@dst-innovations.net They’ll have to, to Swansea’s planners, and almost certainly to National Infrastructure Planning – https://infrastructure.planninginspectorate.gov.uk/ , The developers are now referring to their baby as ‘Dragon Energy Island’.

2. Jobs. DST again.

3. PV generation, versus tidal generation. To be found in the planning submissions, among other places.

On Aberdeen, those details seem yet to be decided among the parties. The contract announcement advertised in July provides only high-level summaries – https://www.publiccontractsscotland.gov.uk/search/show/search_view.aspx?ID=JUN418941