Britain’s biggest distributed network operator today reaches out to small owners of storage assets, launching its platform to trade flex capacity and set prices in near-real time.

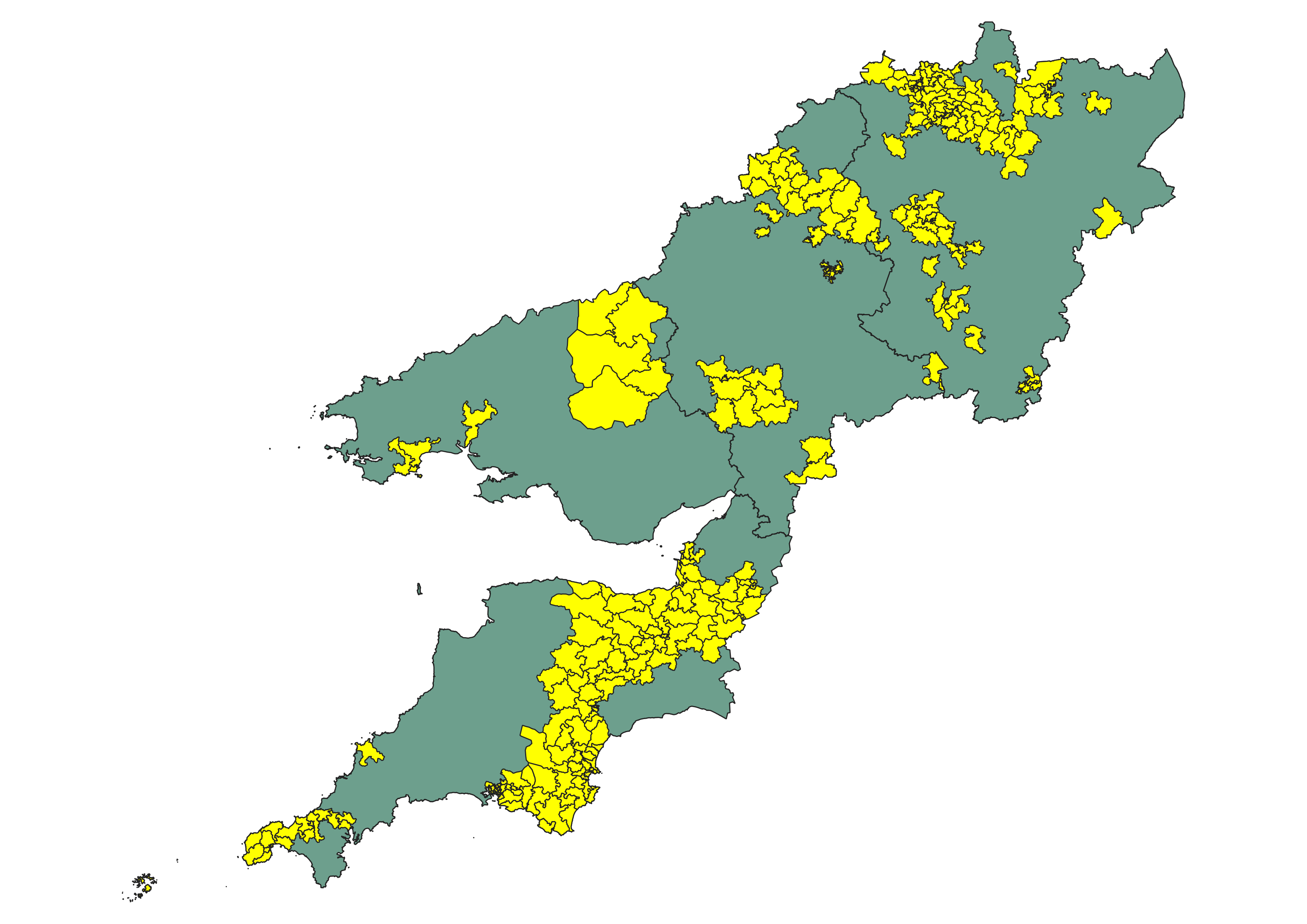

Serving eight millions Midlands and Welsh homes, Western Power Distribution sees the two-year trialling of its IntraFlex bourse as leading to today’s UK “first-of-a-kind”.

Going commercial today, IntraFlex lowers entry barriers to owners of assets such as EV chargers, permitting them to dip into Britain’s expanding market for flex trading.

Collaboration in trials since 2020 with seven owners of storage asset created for WPD a marketplace where different types of flexibility could compete on a level playing field.

Signalling flexibility needs seven days ahead of use, WPD implemented different pricing strategies to understand how the asset owners would respond.

In phase one, the DNO recorded 241 trades. A volume of 50.51MWhs was bought at an average price of £386 MWh. Phase two saw a total of 1,198 trades, with 774 MWh of flexibility purchased.

With the market determining the price of flexibility, savings of up to 4% emerged on the cost of flexibility through price competition.

While previous flexibility auctions have focused on big commercial users and generators, IntraFlex allows smaller kit such as EV chargers units and home-scale batteries to compete on price against diesel generators for the first time. A continuous near-term market is thus created.

Seven days to flex mini-batteries

WPD says such market arbitrage enabled by Flexibility Service Providers (FSPs) is needed to release national benefits of £16.7 billion each year in reduced costs to customers. The figure comes from the Carbon Trust and Imperial College in their GB Flexibility Report of last May.

Roger Hey, WPD’s electricity system manager said: “Intraflex has proven to be a ground-breaking project with some compelling evidence for the future of what a market for flexibility could look like, with competition emerging and the potential for reductions in cost to consumers as a result.

“In the future, we can expect to see much more near real-time flexibility services being procured from domestic energy suppliers and those supporting the transition to net zero such as EV charging providers.”

“IntraFlex has been really positive for us”, endorsed Welsh Power’s commercial optimisation officer Ryan Goddard. “Closer to real time procurement makes sense to us and it’s good to see where markets are heading”.

“Conceptually, it works. You are not stuck with a contract that you signed for four years at a certain price. With all the volatility in commodity and energy markets at the moment, some contracts you sign into can be unprofitable at some point if things change significantly – so that is really good. Also, it promotes competition where competition exists.”

William Beaufoy, senior engineer for EV Energy, a participant in the trial, said: “We were very happy with NODES market. I would say they are probably the best organisation that we have integrated with. We found the NODES interface good as well for placing bids. Our commercial team were very happy with that – so more of that, please.”

Richard Sarti, sales director of NODES, another trial participant added: “The Intraflex project paves the way for a standardised market design for the activation of flexibility, where different forms of flexibility, such as low carbon technologies, demand side response and storage can compete on a level playing field via an independent marketplace. This will enable the DSO to buy flexibility at the lowest price offered on any given day, whilst enabling different forms of flexibility assets to offer their availability across multiple markets.”