Almost six in ten industrial and commercial (I&C) firms are considering investment in energy storage, according to a survey by The Energyst.

Almost six in ten industrial and commercial (I&C) firms are considering investment in energy storage, according to a survey by The Energyst.

Across all sectors, the demand-side response survey polled just over 200 people. There were 106 complete responses from the I&C sector. Of those, 58% said they were considering investment, or have invested, in forms of energy storage, including batteries.

In the public sector (51 complete responses), 45% said they were considering investment or have invested in energy storage.

Of those polled across all sectors, around three quarters are not involved in any kind of demand-response activity. However, almost nine in ten (87%) said they would be interested in doing so if it did not disrupt core business.

The findings come as National Grid steps up its demand-side response push while building a new route to market for battery storage.

The system operator last week procured 201MW of sub-second enhanced frequency response (EFR), the vast majority of which will be delivered by batteries. By 2040, National Grid has predicted that up to 18GW of energy storage will be online (although its scenarios range from 3.6GW to 18.3GW).

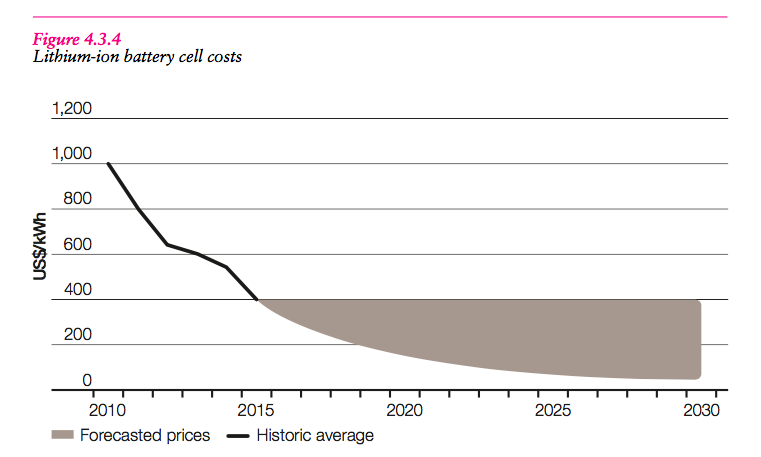

Meanwhile, it predicts that battery storage costs will halve over the next three years.

However, more than 1.3GW of energy storage prequalified for the EFR tender, leaving a gigawatt of project potential without a contract. Smartest Energy has called on National Grid to maintain the momentum and signpost its intentions to the sector in terms of procurement.

Meanwhile, Scottish Renewables has urged policy and market makers to help developers stack multiple revenue streams together by aligning tenders for the various services batteries can provide and by making their technical requirements more compatible.

Battery storage will be covered at The Energyst’s Demand-Side Response conference in London next week. We have negotiated extra capacity at the venue and can offer a few free tickets to end users that can provide balancing services. Click here for details.

Related stories:

Free demand-side response conference

Grid buys 201MW of enhanced frequency response

Battery storage: positive outlook?

Demand-side response: Give us your views

National Grid must provide a plan for battery market, says SmartestEnergy

Can National Grid hit its 2020 DSR target?

Limejump boss: Big six will have to acquire aggregators or lose relevence

National Grid buys 3.6GW of back-up power to cover winter

Three policy tweaks that could enable 10GW of battery storage

Decc, Ofgem and National Grid must make battery storage stack-up

Ofgem: Energy flexibility will become more valuable than energy efficiency

National Grid boss: future of energy is demand not supply

National Grid says impact of solar requires greater system flexibility

National Grid signs 20MW demand-side response contract with battery storage operator

National Grid says UK will miss 2020 targets, predicts big battery future

Major changes to capacity market proposed

Hot technology: energy storage via heat battery

Western Power Distribution ramps up demand-response trials, calls for participants

Smart grids ‘require local control and businesses must play or pay’

National Grid must simplify demand response to scale UK market

Energy Technologies Institute: Let private firms run smartgrid trials

Flexitricity blasts transitional capacity market as Npower plots supermarket sweep

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.