The government will likely miss its goal for 50GW of offshore wind capacity operating by 2030, new calculations from respected consultants Cornwall Insight predict. Net Zero goals set for by mid-century will thus become harder to reach.

New economic modelling carried in the firm’s latest GB Benchmark Power Curve forecasts capacity of Britain’s marine turbines will grow from 12.5GW by next April to 47.1GW in 2030, narrowly missing the government’s 2030 goal.

Cornwall’s analysts do not explicitly blame PM Rishi Sunak for allegedly weakening confidence among investors in offshore wind, as a consequence of his rowing back at the Conservatives’ conference this month from some consumer-facing elements of Net Zero commitments.

Instead the consultants cite persistent cost inflation as the main cause slowing turbine deployment.

Higher costs were behind the failure in September of the government’s 5th auction round for Contracts for Difference (CfD) It attracted no bids from developers of offshore wind. An administrative reserve price set by D-ESNZ’s officials at £44 per MWh was criticised as being unrealistically low.

Cornwall says rising input prices are also behind the cancellation in July of Vattenfall’s Norfolk Boreas project, at 1.4 GW one of the UK’s largest offshore wind farms. Vattenfall in 2022 agreed in a CfD round to build the park against a record low price of £37.50 per MWh.

Even with depressed deployment, Cornwall’s analysts confirm offshore wind is forecast to become the largest source of electricity in capacity terms by 2028, making up 26% of the GB generation capacity by the end of the decade.

But slower progress in commissioning offshore wind parks will raise carbon emissions, the say, cutting the chance of meeting carbon targets and ultimately extending the time it takes to reach Net Zero,.

Alongside less wind in the electricity generation mix, the firm’s report forecasts power prices will linger at least 60% above pre-2021 averages until 2030 and likely beyond.

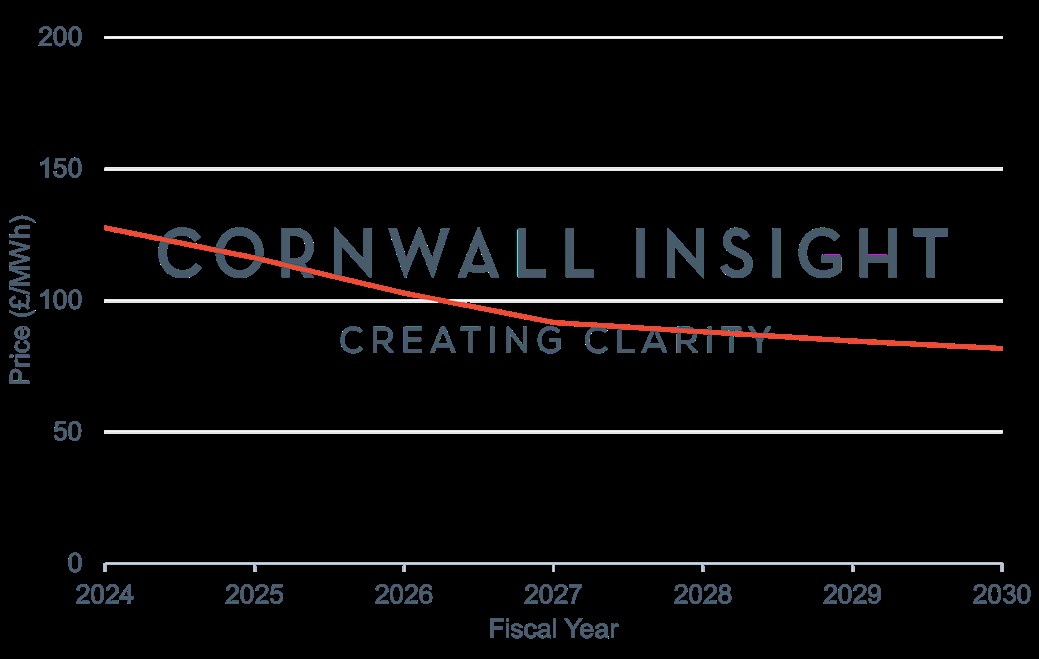

Cornwall’s modelling in its third Benchmark Power Curve this year shows little movement from recent estimates. Wholesale prices are still expected to peak at nearly £130 per MWh in 2024, before falling to a low of just over £80 per MWh by 2030. See graphic below.

While being a big drop on recent benchmarks, those levels remains substantially higher than the £50 per MWh or less prevailing in 2020, before the world began awaking from Covid and Putin assaulted Ukraine.

Tom Edwards, a senior modeller at Cornwall Insight, observed “Offshore wind delays, spurred on by cost worries and project setbacks, pose a roadblock to reaching Net Zero.

“We can see the country is travelling in the right direction towards a renewables-based electricity system, however, our estimates continue to show it is simply not fast enough to deliver on government targets.

“Time is of the essence, and it is critical that the government reassess its commitment to accelerating renewable energy adoption, which includes being more flexible when setting auction parameters to reach the UK’s offshore wind goals.

“Rolling back our net-zero ambitions and slowing our transition away from fossil fuels is likely to be a costly delay that will not only see us fall further behind in decarbonising the country but will leave consumers shouldering the prolonged burden of high prices. Without a resolute commitment to a greener and more sustainable future, achieving net zero emissions and pre-crisis energy bills becomes an increasingly elusive goal.”