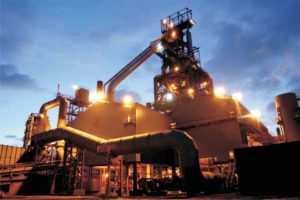

Large industrial and commercial businesses have most to lose from spiky winter energy prices, but there is not much more they can do in terms of mitigation and demand response, according to the British Ceramic Federation.

According to energy experts polled by New Power, the price spikes will be worse this winter than most. I&C firms will bear the brunt and should prepare to take action, said respondents.

The problem is, many major energy users have little room to manoeuvre.

“Those that can may come offline. But many of our members run continuous processes and so can’t necessarily forego power at short notice,” says technical director Andrew McDermott. “So spiky prices are a problem in the short term and there is very little some members can do to mitigate that.”

There is also a “pernicious” longer term impact.

“Whether it is a genuine risk or perceived risk [to security of supply], it starts to jeopardise investment and erode business confidence and these are often global businesses,” says McDermott. “To rely on large users to come off the system at peak times to satisfy demand elsewhere in the economy is a bit of a sticking plaster.”

Will spikier prices and rising non-fuel aspects of energy bills drive large industrial firms to be more energy efficient – and to invest more in onsite generation?

“Energy makes up to 35% of production costs. It is such a big chunk that if you don’t have your eye on that ball you won’t be in business too long,” says McDermott.

Onsite generation and demand response

Spikiness will lead energy intensive firms to look “ever more closely” at demand response and onsite generation, thinks McDermott.

The problem with the latter is that planning permission does not always allow renewable generators to be sited, or for back-up generators to be run at will. In addition, emissions generated from diesel gen-sets can be captured by the EU ETS.

In terms of demand response, he says members already switch off when possible to avoid Triads and red zones, “so peak times are naturally avoided.”

While there is suggestion that the financial incentives provided by National Grid are perhaps insufficient to scale demand response, McDermott disagrees.

“The feedback from our members is that, for those that can [participate], the incentives are there. That is not the issue. For most, it is simply that they need the energy and cannot switch off at short notice. Where they can, they are switching off anyway,” says McDermott.

“Demand management tools are great, but we need to have enough generation so that we are not reliant on big users coming off at short notice.”

Related stories:

Energy intensive users ‘to be refunded energy policy costs’, says Cameron

Free download: Demand side response report 2015

SSE brings 735MW gas plant back online for winter

Winter is coming, says Nat Grid; Flexitricity warns demand response cannot be rushed

Smart grids ‘require local control and businesses must play or pay’

National Grid plots superfast grid balancing service

National Grid moots demand side response rule changes as winter power margins tighten

National Grid flags demand response changes, urges suppliers and TPIs to deliver

National Grid must simplify demand response to bring in UK businesses

National Grid launches major demand side push

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.