Growing competition from the US and the EU for investment in renewable energy could divert crucial financing away from the UK, slowing the nation’s journey to Net Zero, Cornwall Insight conclude.

Analysis contained in the respected consultancy’s report ‘Race to net zero: Rebuilding Investor confidence in the UK’ highlights the impact of subsidy and policy schemes worldwide, such as the US’s Inflation Reduction Act (IRA) and the EU’s Green Deal Industrial Plan (GDIP). Both schemes, offering steady support to renewables generators, look set to give both blocs a competitive edge over the UK.

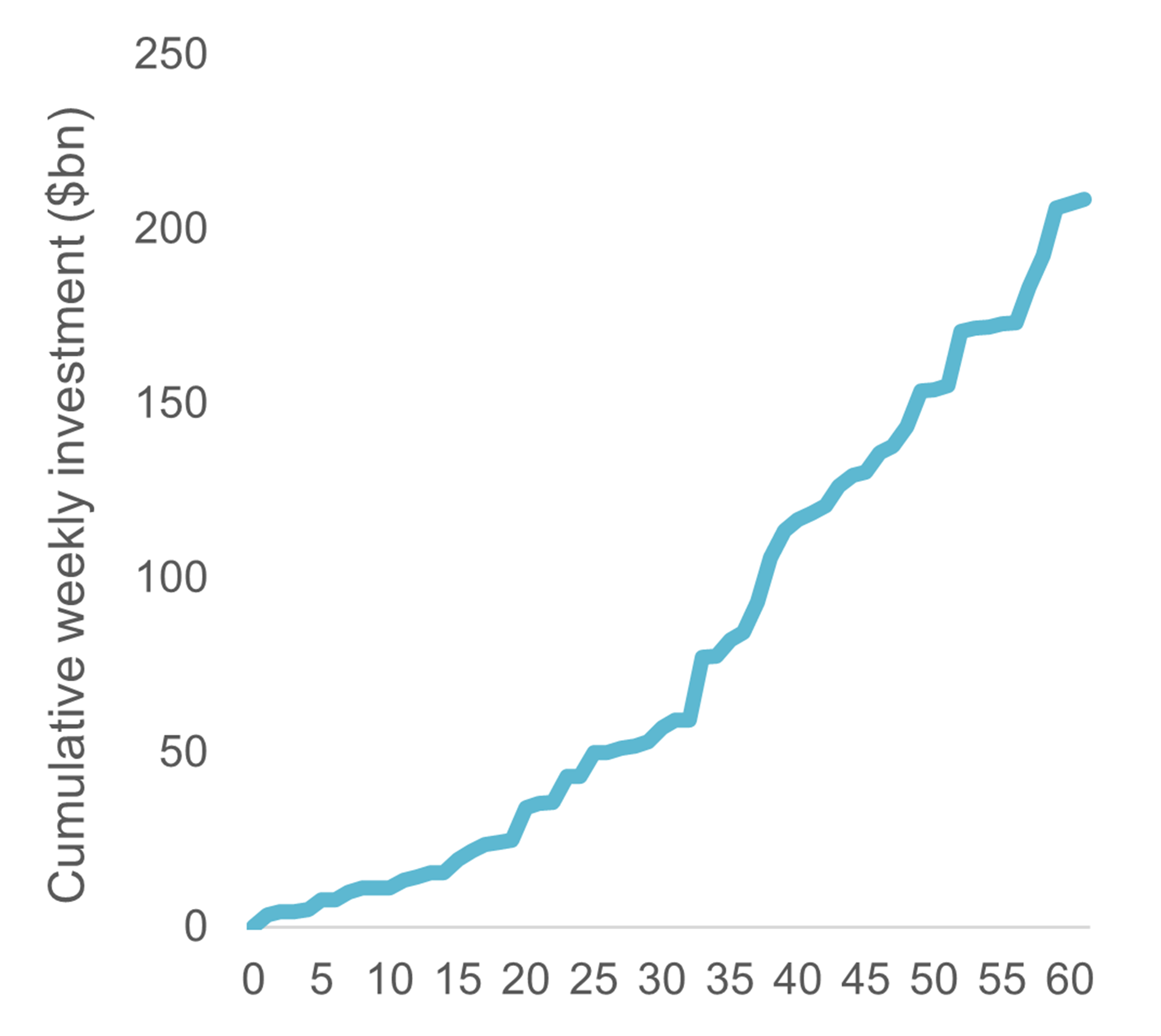

The US has witnessed a surge of investment in green projects following the introduction of the IRA, Data analysed by Cornwall Insight quantifies big financial incentives totalling $369bn for Net Zero technologies and infrastructure over the decade to 2032.

With a limited global pool of renewable investment, this could cause significant damage to the UK’s net zero plans, especially with challenges like rising inflation, supply chain disruptions, and labour shortages already hindering investment.

Figure 1: US investment in renewable energy in the first 60 weeks since the passage of the IRA

Source: American Clean Power

Source: American Clean Power

The UK government has announced short-term changes to its renewable investment incentives, in response to the underwhelming outcome of the fifth Allocation Round (AR5) of its Contracts for Difference (CfD) scheme. Securing only 3.5GW of new capacity earlier this year against 11GW in the previous round, AR5 plumbed record low levels of renewable investment. Concerns over the low probable returns their funds will yield are accepted as one of the core reasons for low developer enthusiasm.

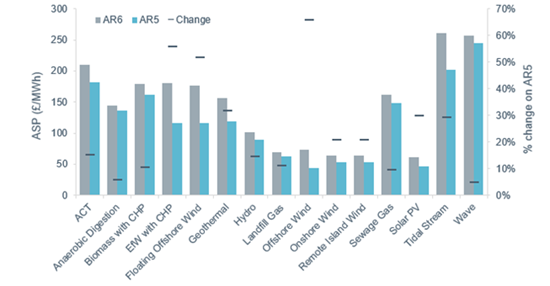

With the sixth Allocation Round due next year, the government has responded with changes. By raising Administrative Strike Prices (ASPs) – the maximum Strike Price which a technology can achieve – the government hopes to regain interest and competition in the scheme.

Figure 2: ASPs for AR6 and AR5 (in 2012 money) and percentage change from AR5 to AR6

Source: GOV.uk

Despite these adjustments, uncertainties persist regarding long-term reforms and the suitability of the CfD.

Britain’s government is actively exploring reform options through the Review of Electricity Market Arrangements (REMA) to create enduring market structures for a fully decarbonised and cost-effective electricity system by 2035.

Also under imminent Whitehall review are features of future CfD rounds. Separate pots defined more tightly around specific technology types are under consideration, such as seen with offshore wind in AR6 and the inclusion of non-price factors in the CfD scheme, with the proposed introduction of Sustainable Industry Rewards (SIRs) in AR7, AR8, and AR9.

Cornwall research analyst Jamie Maule observed: “The UK’s position as an attractive destination for renewable investment is at risk of slipping, with the potential for significant setbacks in achieving net zero targets.

“Once a trailblazer in global renewable energy investment, the success of the Contracts for Difference (CfD) scheme is now challenged by escalating capital costs, low administrative strike prices, and intense global competition. While short-term incentives play a role, the enduring incentives in the US and the EU threaten to divert funds away from the UK.

“Right now, the UK is certainly not a lost cause for investors“, Maule went on.

“But it must act clearly and decisively if it is to rebuild investor confidence and maintain progress towards net zero. Timely government policies and proactive decisions are crucial. Waiting for events, like the lack of offshore wind bids in the last CfD allocation round, is a luxury the UK can ill afford.”