Goldman Sachs remains committed to target net-zero financed emissions by 2050 and is making good progress towards the goal it outlined to a year ago, chairman and CEO David Salomon said in a blog last week.

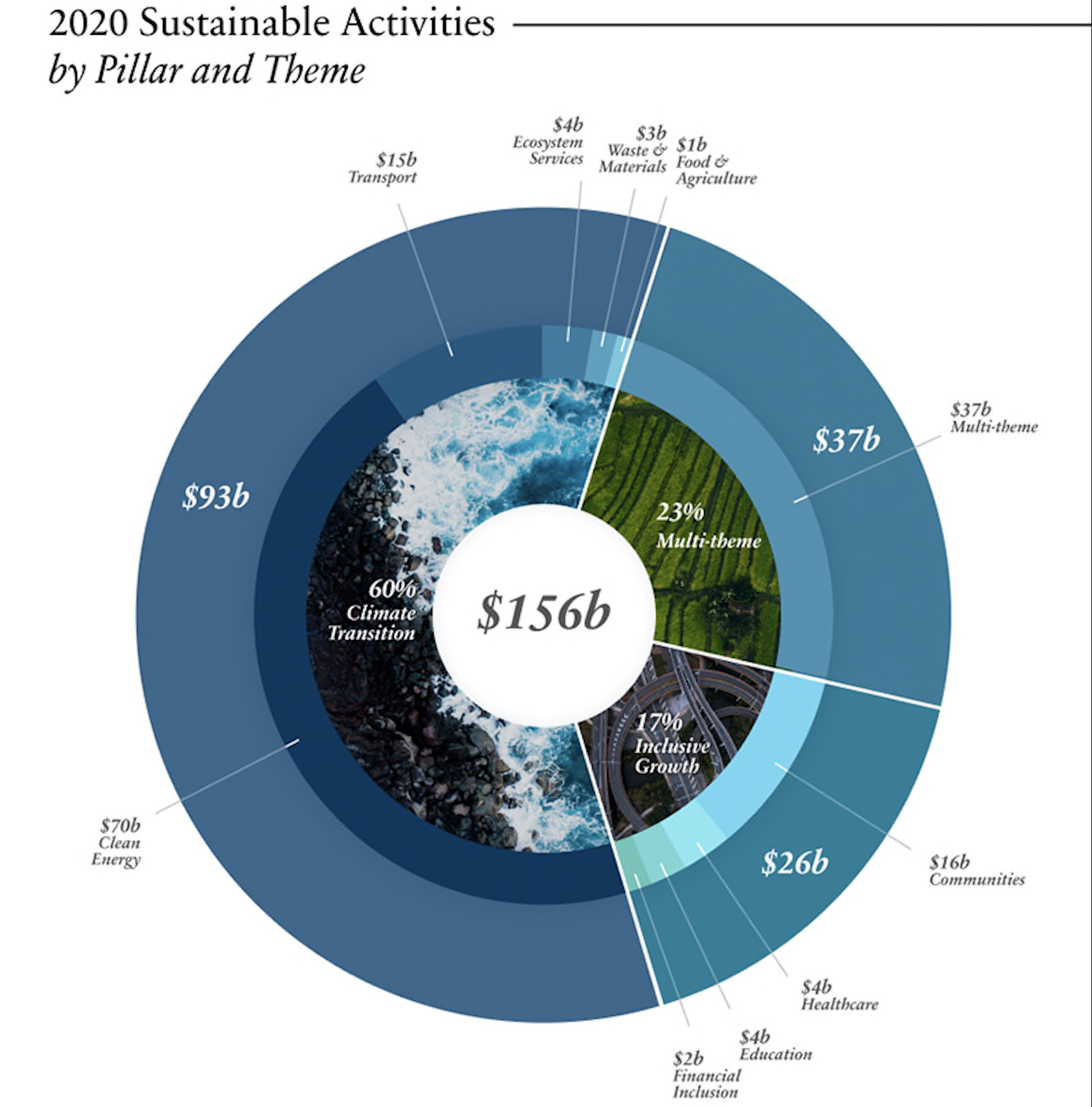

The company’s sustainable finance expenditure in the past year was $156 billion, Solomon said, including $93 billion dedicated to the climate transition. This represents more than a fifth of the $750 billion Goldman Sachs pledged to spend by 2030 in financing, investing and advisory activity to nine areas focused on sustainability and climate.

Solomon said the bank has been asking clients to disclose their climate data in line with the recommendations of the Sustainability Accounting Standards Board (SASB) and the Taskforce on Climate-related Financial Disclosure (TCFD), to help them set ambitious targets. Goldman Sachs disclosed its own emissions under these frameworks for the first time last year.

Solomon said his company had “incorporated a low-carbon tilt into all of our active quantitative equity funds”, helping clients to manage their exposure to climate transition risk. He pointed to the contribution Goldman Sachs made to renewable energy through the Renewable Power Group, active in the US, and India’s ReNew Power.

Goldman Sachs issued its first-ever sustainability bond last month and will announce interim, sector-specific climate targets before the end of the year.

Earlier this month, Goldman Sachs Asset Management appointed Margaret Chinwe Anadu as global head of sustainability and impact.