Demand from big corporate power buyers has pushed prices of REGO certificates up by a half in less than four months, the latest ‘Green Certificates’ poll by consultancy Cornwall Insight has revealed. Market sentiment points to the UK’s upward price trend continuing for at least the rest of this year.

Renewable Energy Guarantees of Origin (REGO) are the longer-established British forerunner of the EU’s equivalent GoOs, or Guarantees of Origin. Recent intensifying calls from such as Scottish Power, Good Energy and British Gas have invited regulator Ofgem to step in, injecting greater simplicity and directness into the industry’s currency of declaring power purity.

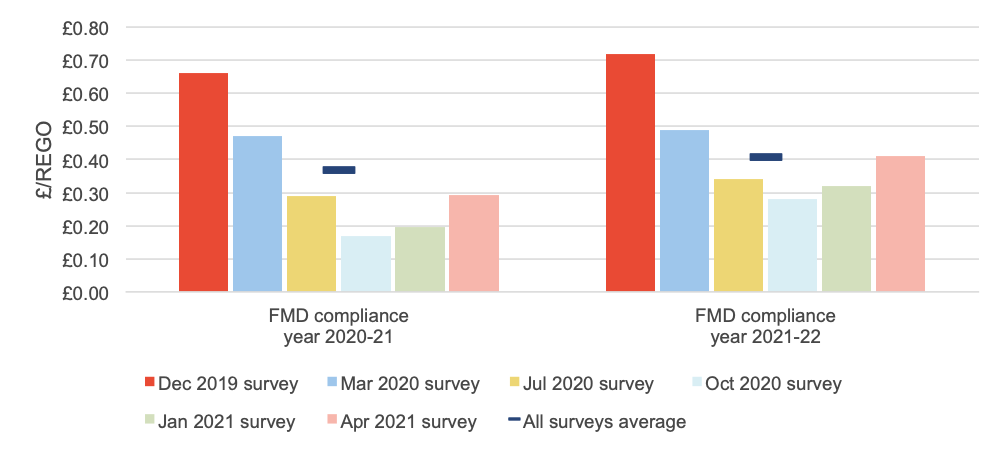

Cornwall Insight’s latest survey focused on Fuel Mix Disclosure (FMD) contracts, promising delivery to big firms and traders over the next three years. The consultancy quizzed 58 buyers and wholesalers in the fortnight to early May.

Though market prices have yet to recover to pre-lockdown levels, overall REGO averages for FMD delivery were up to 50% higher than reported the January 2021 survey, said analyst Luke Ansell.

“Demand outlook was also positive among participants, with 64% reporting increased demand for REGO backed supply products in the past three months”, Ansell noted.

Presented in aggregate below, the survey found that the average REGO price rose above £0.40 for the first time since lockdown:

Critics of Britain’s system of REGO issuance say its flaws promote a false market, in which pieces of paper are assigned disproportionate value, in preference to valuing truly any carbon-absence in the underlying power.

Rival consultants Baringa in April advised their clients Scottish Power & Good Energy that no REGO should be assigned to any volume of electricity without direct authentication that it was generated according to a PPA linked to 100% clean generation.

For some smaller generators producing energy under the feed-in-tariff scheme, the financial reward of REGOs may not be enough to outweigh the administrative burden” Baringa concluded.