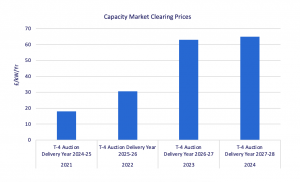

GridBeyond secures 264MW in T-4 Capacity Market auction at a record high of £65/kW

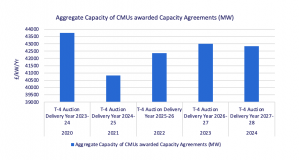

The provisional results of the T-4 2027-28 Capacity Market auction were published on 27 February with a total of 42,831MW in capacity agreements awarded to capacity market units at a record high clearing price of £65/kW.

Launched in 2014, the Capacity Market is a mechanism introduced by the government to ensure that electricity supply continues to meet demand by offering to pay providers for making supplies available at short notice. The latest T-4 auction cleared in Round 2 with 42.831GW procured (lower than the target procurement capacity of 44GW) across 540 CMUs. GridBeyond cleared 264MW, including 12.2MW of long duration new build units.

Launched in 2014, the Capacity Market is a mechanism introduced by the government to ensure that electricity supply continues to meet demand by offering to pay providers for making supplies available at short notice. The latest T-4 auction cleared in Round 2 with 42.831GW procured (lower than the target procurement capacity of 44GW) across 540 CMUs. GridBeyond cleared 264MW, including 12.2MW of long duration new build units.

By fuel type the majority of the awarded capacity will come from:

By fuel type the majority of the awarded capacity will come from:

- Gas (66.97%),

- Interconnector (15.38%)

- Pumper storage (4.38%)

- Demand side response (2.64%)

- Battery storage (2.37%)

Separately the T-1 Capacity Market auction cleared at £35.79/ kW/year. GridBeyond has secured 254MW – the largest T-1 position for demand side response – in the auction, which took place on 20 February. In total, 7.6GW of capacity was awarded across 277 capacity market units.

Mark Davis, GridBeyond Managing Director for UK and Ireland commented:

“Flexibility plays a crucial role in our electricity system and these auctions are increasingly beginning to shape what our power system could look like towards the end of the decade. But it’s essential that they begin to deliver capacity at scale that is either low-carbon or capable of rapid decarbonisation.

“The aim behind the Capacity Market is to provide an incentive for generators to invest in assets that can provide guaranteed capacity when called upon or face penalties. The auction falling short of its target capacity reinforces the need to push forward with the next generation of flexible energy assets.

“Through our Capacity Market Clearing House GridBeyond has supported a large number of clients and generators in matching short or long positions regarding their capacity obligation so that they avoid the penalties that the delivery body can bestow whilst also optimising their revenue opportunities.”

About secondary trading

One aspect of the capacity mechanism that has not yet received much attention is the secondary trading of capacity agreements. This is when units to transfer their secured Capacity Market agreements to other parties.

While few secondary trades have occurred to date, the need for secondary trading may grow over the next few years as more capacity reaches the end of its life and the proportion of new build capacity, securing agreements prior to being built increases, given that generation assets generally take longer to build and could be subject to project or planning delays.

Recently the government also confirmed plans to make the Capacity Market more aligned to the UK’s net zero goals by increasing penalties for failing to deliver obligations under a stress event from 1/24th of clearing price to 1/4th but this comes with no change in the penalty cap (200% of monthly CM revenue and 100% of annual CM revenues).

Since 2020 GridBeyond has helped a large number of customers and generators to access the Capacity Market through its Secondary Trading Clearing House. This supports participants to clear obligation commitments they can’t meet or receive an obligation if they were unable to gain one thereby avoiding costs and/ or gaining unplanned revenues.