The hydrogen economy has recently experienced some hiccups in its growth story. Apparently, demand for this commodity is not rising at the pace it was envisaged back in 2020 when companies had aggressively announced their energy transition plans. As more industries, such as steel, transportation, and power, try to decarbonise their operations, the demand for low-carbon hydrogen is expected to grow. Nevertheless, the hydrogen economy is currently in its critical phase of its development, says GlobalData, a leading data and analytics company.

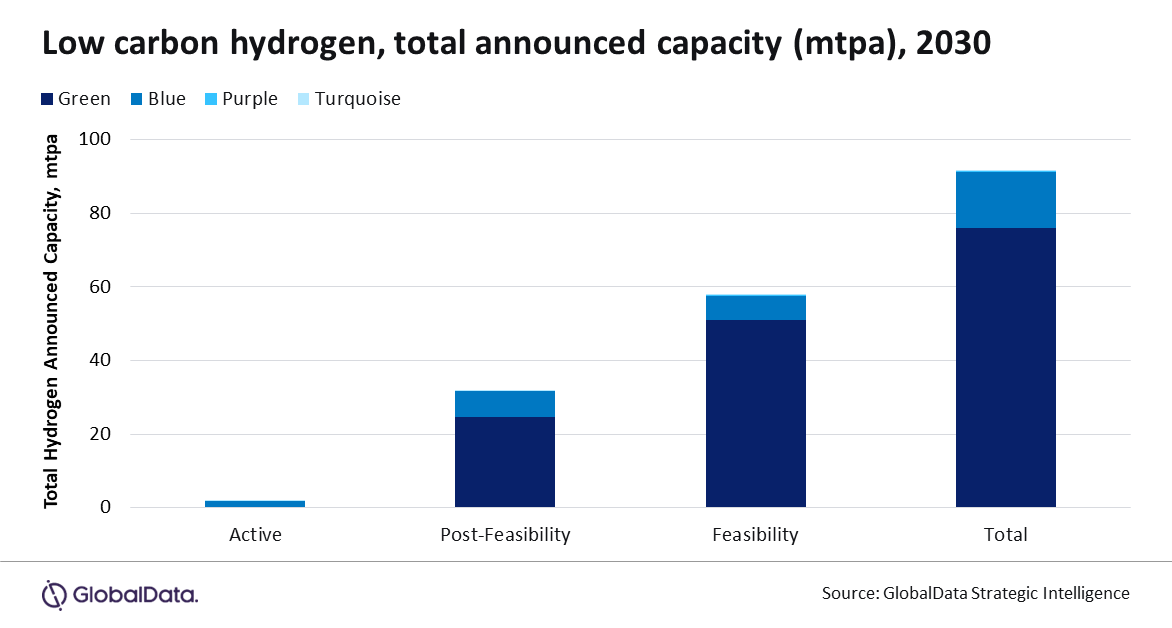

GlobalData’s thematic report, Hydrogen, reveals that about 83% of the low carbon hydrogen capacity coming online by 2030, is expected to come from green hydrogen plants, while the remainder is from blue hydrogen. Purple and turquoise hydrogen capacities are anticipated to be miniscule. Only about 2% of the total expected capacity by 2030 is currently operational.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments, “Low-carbon hydrogen is set to occupy a crucial role in the decarbonisation efforts of several energy-intensive industry verticals. As hydrogen is an essential feedstock in downstream oil and gas processes, switching to low-carbon hydrogen would help companies reduce their emissions footprint. It also has massive potential in the transportation sector, especially in marine and heavy vehicle applications, due to its energy density properties.”

Conventionally, hydrogen has been consumed in the oil and gas industry as a reagent in the refining sector and as a feedstock in the petrochemical sector. The demand from the oil and gas industry will remain the dominant driver for hydrogen in the foreseeable future. Additional demand for this commodity is expected to emerge from industries such as metallurgy, power generation, and transportation.

Puranik continues, “There has been a significant jump in low-carbon hydrogen project announcements in the last few years as industries unveiled plans to decarbonise their operations. Nearly 75% of these projects are in the feasibility stage of development. This reflects the momentum in new plant announcements within this market to reap from the global energy transition.”

Blue and green hydrogen production offers particularly promising growth potential for oil and gas companies pursuing energy transition. Companies are investing in this energy source for their long-term goals, with a preference for green hydrogen.

Puranik concludes, “Several oil and gas companies have announced new blue and green hydrogen plants, which are expected to be operational by 2030. Nevertheless, there is a need for the hydrogen distribution network to expand at scale, which includes the addition of new pipelines. The current scenario signals a critical phase for the development of the global hydrogen economy. Its fate and momentum in the coming years will be decided by how things pan out in the near future.”