LCP partners Rajiv Gogna and Chris Matson outline the impact of Covid-19 demand destruction on the balancing market, and what it may hold for the future.

Covid-19 has impacted every part of the economy and the power system is no different.

The reduction in demand caused by lockdown, combined with the ongoing increases in renewables, has made the system harder to manage meaning that National Grid is having to take more actions to keep the electricity system stable.

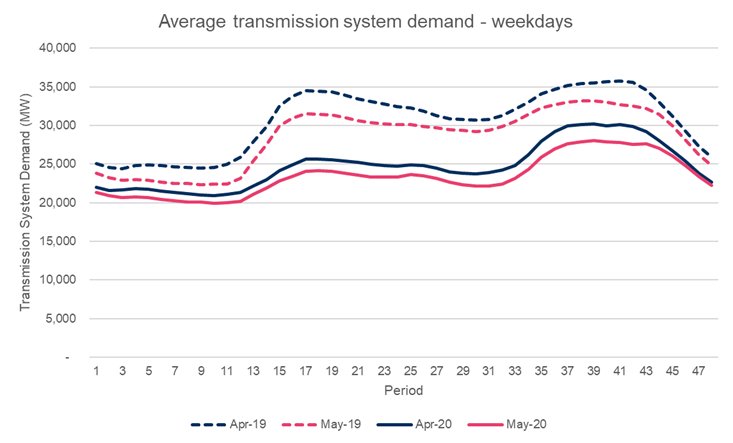

This has resulted in higher costs and therefore higher Balancing System Use of System (BSUoS) charges. This decrease in demand can be seen in the graph below which shows weekday demand in April and May this year compared to last year. Although the Electricity System Operator (ESO) has always had to take actions to keep the system stable, the extremely low demand (below 20GW) means National Grid is taking significantly more actions to maintain system stability.

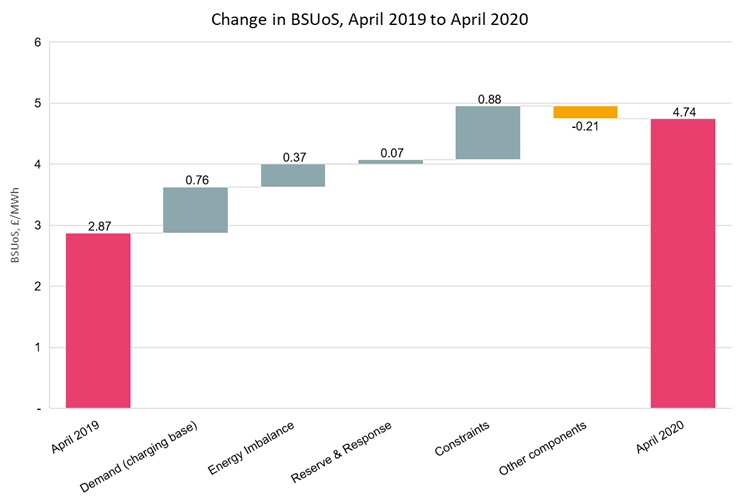

So let’s look at the main drivers increasing the cost of BSUoS in April, compared to last year:

- Reduced charging base: BSUoS is charged to transmission connected generators and customers on a MW hour basis. This drop in demand also means there’s a corresponding drop in generation so the BSUoS charge has to be collected from a smaller pool.

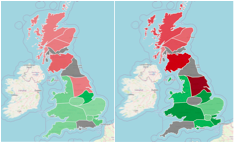

- Locational constraints: National Grid routinely takes actions to address location network constraints (where transmission cables can’t carry all of the power from one part of the country to another) but lower demand is amplifying this issue. The Scottish constraint usually has the biggest impact on constraint costs as wind power can’t be transported to demand centres in the South. However, we are now seeing a significant increase to the cost of managing the

System flagged volumes taken through the BM in May 2019 (left) v 2020 (right). Dark red indicates high turn down volumes, dark green indicates high turn up volumes England/Wales constraint, with around 50% of all balancing charges coming from this constraint alone. The heatmap (left) shows the levels of system flagged actions in May 2019 vs May 2020, with zone 8 on the east of England needing 22x the volume of SO turn down actions.

- Energy imbalance: We’ve seen an increase in energy imbalance costs through the associated bids (to turn down) and offers (to turn up) to satisfy the Net Imbalance Volume (NIV) in each period. Less dispatch from CCGTs and lower gas prices have made offers cheaper, but bids more expensive as there are fewer units available that are running, meaning National Grid must often call on units with renewable subsidies and pay them the equivalent value to switch off.

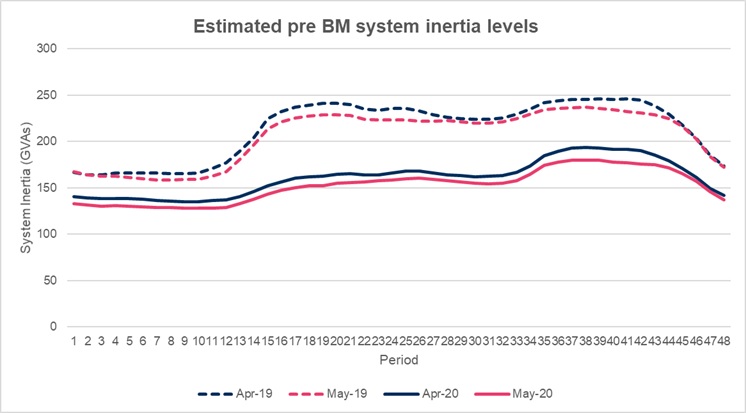

- System Inertia: While not specifically broken out as a cost, inertia levels in April/May 2020 have been significantly lower than the corresponding period last year, largely due to lower levels of synchronous generation running. As such, there have certainly been more actions taken to address inertia constraints

As we move into summer, the impacts of reduced demand become more pronounced, impacting balancing charges further, and tools such as the recently deployed Optional Downward Flexibility Management (ODFM) are likely to be utilised further.

National Grid has published its forecast for the period May – August, stating that BSUoS charges could be an extra £417m (compared its pre-Covid forecast) which would equate to an 84% increase. However, National Grid look to have made some cautious assumptions in its forecast with high CCGT prices, static market dispatch and the same wind levels over all simulations. We’ve used our own analysis of recent market behaviour and stochastic modelling to forecast BSUoS charges over this summer and we see lower additional BSUoS charges than National Grid is forecasting.

Looking ahead to the same period in 2025, LCP’s modelling shows that residual demand levels (the demand to be met from non-renewable sources) are due to be lower than those seen in 2020 due to higher renewable capacity on the system – rather than lower demand. As such, COVID-19 has given us a peek into how the future system will need to be managed, and the challenges that will be faced. This decrease in residual demand is likely to mean that higher BSUoS costs passed through to consumers will become more of the norm, though a number of factors such as new ancillary services, size of charging base, locations of build out, Project TERRE and smarter systems will play their role in determining these costs too.

LCP’s full analysis of summer 2020 balancing costs is available here.

For further information on LCP’s power market forecasts (including our long term BSUoS forecasts) or if you have any questions please contact rajiv.gogna@lcp.uk.com.