National Grid’s annual Power Responsive report shows the electricity system operator used an increasing amount of demand-side response in 2018.

National Grid’s annual Power Responsive report shows the electricity system operator used an increasing amount of demand-side response in 2018.

However, greater competition in services such as short-term operating reserve (Stor) and firm frequency response (FFR) continued to drive down prices.

Meanwhile, demand turn up (DTU) attracted fewer providers and looks set to be revised or replaced by another negative reserve service.

Challenges and opportunities

The report details changes to ancillary services and the broader energy market and their effect on flexibility providers. Some of these are positive, such as the ESO’s steps to open up the balancing mechanism and its introduction of long-term contracts for FFR.

Others, such as Ofgem’s overhaul of charging arrangements, the suspension of the Capacity Market, and the impact of the Medium Combustion Plant Directive (MCPD) are causing market uncertainty.

As a result, flexibility providers have warned National Grid of a near-term risk that more demand-side response (DSR) providers could exit the market than enter.

For much of 2018, however, they piled into certain services in the hope of securing contracts.

More Stor

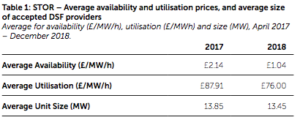

Stor is a mature service, with more than 3,300MW of unique capacity tendered from demand-side providers alone last year.

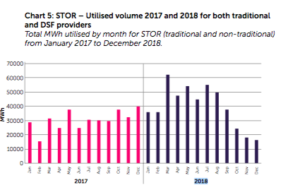

Competition within Stor has driven down prices paid and in 2018 National Grid used 49 per cent more Stor than in 2017. It said the impact of competition on accepted prices made using Stor more economic than using other tools.

Competition within Stor has driven down prices paid and in 2018 National Grid used 49 per cent more Stor than in 2017. It said the impact of competition on accepted prices made using Stor more economic than using other tools.

However, National Grid noted the MCPD and Specified Generator controls – which effectively prevent diesel generators from taking on new balancing services contracts without fitting expensive abatement – could have an impact on Stor from this year onwards.

FFR rush

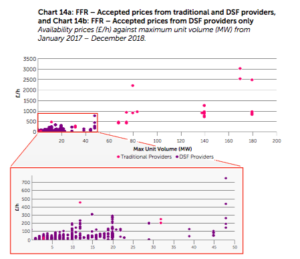

Aggregators have piled into firm frequency response, pushing out traditional providers: In 2017, 392 MW of dynamic capacity was accepted from demand-side response providers; this increased to 2720 MW in 2018.

Year on year, average static FFR prices fell 30 per cent to £32.46/hour. The average accepted price for dynamic FFR contracts fell by 64 per cent to £110.18/hour.

Year on year, average static FFR prices fell 30 per cent to £32.46/hour. The average accepted price for dynamic FFR contracts fell by 64 per cent to £110.18/hour.

The ESO said aggregators or virtual power plant operators may be finding efficiencies in their business models that enable them to undercut traditional providers, or that the larger power players are focusing on less pressurised returns in the intraday mandatory frequency response market.

Demand-turn up

National Grid launched demand-turn up to counter falling demand on the transmission system in summer. It’s a relatively simple service; providers must reduce exports to the grid, or increase consumption and are required to have basic metering requirements, a phone and Microsoft Outlook.

However, uptake was lower in 2018 than in 2017, with about half the volume of bids entered, and it was far less utilised. National Grid said it could be that the prices on offer were not sufficiently attractive and that an annual auction made price discovery difficult. It said DTU is ‘not viewed as an enduring solution’ for negative reserve and will be reviewed along with other services this year.

Triad

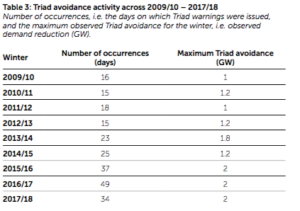

Transmission charges for large businesses are based on so-called ‘Triad’ periods, the three half hours of highest demand that are at least 10 days apart, between November and February (see this winter’s periods here).

Transmission charges for large businesses are based on so-called ‘Triad’ periods, the three half hours of highest demand that are at least 10 days apart, between November and February (see this winter’s periods here).

They are set retrospectively, so those aiming to reduce bills curtail demand or switch to on-site generation when they think a Triad period is likely, usually on a winter evening between 5pm and 6pm.

National Grid doesn’t have much Triad data, and can only see how people react to cold weather over winter. But as more people participate, it said Triad periods are getting harder to predict, so businesses are reducing their draw on the transmission system more regularly.

Up next

National Grid said it would continue to work on product revisions and introduce new market opportunities in 2019, such as wider access to the Balancing Mechanism and Project Terre.

The ESO will also examine exclusivity clauses, where changes could allow DSR providers to sell flexibility into other products and markets where they can still deliver contractual obligations – a move that would be welcomed by those with aggregated portfolios of assets.

See the Power Responsive annual report here.

National Grid will sponsor The Energyst’s 2019 DSR report and event. We will start surveying businesses that provide DSR – and those interested in providing DSR – next month, followed by qualitative interviews. If you would like to share insight from a provider’s perspective, please email Brendan@energystmedia.com

Related stories:

National Grid confirms 2018-19 Triad periods

DSR providers urge National Grid to go faster, Ofgem to go slower

Government details next steps for Capacity Market

Environment Agency makes MCPD u-turn on Triads

Payments voluntary while CM suspended says Beis

National Grid and Epex Spot to collaborate on weekly FFR auction

Terre and BM: Elexon opens market entry process for aggregators

National Grid to trial same day FFR auction

National Grid to bring wind and solar into FFR, details balancing system overhaul

Can the Balancing Mechanism offset FFR price erosion?

National Grid outlines plans to bring all flex providers into Balancing Mechanism

National Grid outlines plans for hundreds of millions worth of services

National Grid plots major overhaul of balancing services with frequency response first to change

National Grid mulls rolling all frequency response services into one

Demand turn up: What worked, what didn’t?

Faraday Grid: We come from the future to stabilise the power system

Click here to see if you qualify for a free subscription to the print magazine, or to renew.

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.