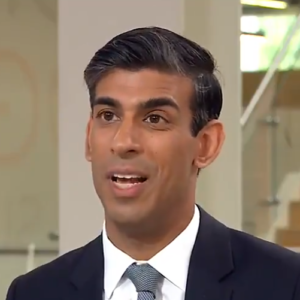

Under-fire millionaire Chancellor Rishi Sunak was today reportedly contemplating an Easter break in California with his billionaire wife, on the morning that 54% energy price rises led a fusillade of attacks on Britons’ living standards, said to be unprecedented in seventy years.

Up to ten oil refineries in Essex, Southampton and the West Midlands were blockaded from dawn by protesters from Just Stop Oil, Insulate Britain, Extinction Rebellion & related groups, as the Conservatives continued to resist a windfall tax on oil companies now posting record profits and dividend pay outs, buoyed by twelve months of record wholesale prices, not least from North Sea operations.

Labour claim a one-off levy on North Sea majors could raise £ 7 billion to insulate 19 million British homes, already among Europe’s leakiest, and save up to £400 per year from average heating bills.

They point out that Sunak was heavily implicated in the Conservatives’ most recent of two botched programmes of mass home insulation. The Chancellor axed in early 2020 the Green Homes Grant scheme, with 90% of its £1.5 billion budget unspent.

Reliefs announced last month by Sunak in response to rocketing home energy prices include only a £150 per household rebate against council tax in bands A to D, and a loan worth £200 per year, repayable over five years. The loan will not become available until October, when a further Price Cap hike takes effect.

Adding to today’s ratcheting attacks on living standards is the Chancellor’s 4% rise in National Insurance charges, intended to pay for adult social care.

Premier Johnson’s indecision and inability to quell in-fighting between his Conservative ministers over turbine aesthetics in England’s shires, over fracking and the cost and pace of greening Britain’s power, are all delaying publication of the government’s energy security strategy, promised in knee-jerk response to Putin’s violation of Ukraine.

Today the Association for Decentralised Energy repeated again today its strong support for Net Zero.

The 150-member organisation called on Johnson’s government to increase support for long-term solutions, including energy efficiency, heat networks and flexible energy technologies. All were needed to protect consumers from price fluctuations.

ADE head Lily Frencham underlined the need for radical reforms, including accelerating the march towards renewables. “The best way to protect customers, and to offer them a positive experience, in the long term will be through moving more quickly towards the Net Zero future we need”, she said.

“Though the price cap has historically played a role in ensuring customers had a good experience, it is not (and will not be) the way to address the challenges the market faces.

“We need to accelerate deployment of measures we know work – such as energy efficiency and low carbon heat.”

“These reduce energy consumption and as a result, energy bills. Additionally, as the UK’s homes and businesses become more efficient, overall energy demand will fall, in turn helping to push prices downwards”.

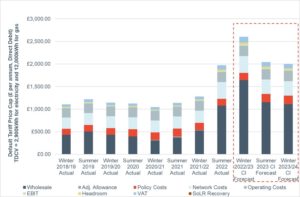

Analysts Cornwall Insight today predicted the winter price cap due in October will add a further £600 to average home bills, entailing a doubling of prices in a little over twelve months.

Cornwall Insight: Tariff Cap levels since 2018, & forecasts for next 3 caps

Source: Cornwall Insight analysis

Dr. Craig Lowrey, a principal consultant at Cornwall, foresaw yet another significant hit to households’ finances in October. Systemic remedies were needed, to avoid Ofgem’s capping mechanism merely deferring rises, not eliminating them.

“Some compromises might be needed on the speed at which fossil fuels are phased out”, Lowrey wrote. “However, ultimately we cannot let the current energy crisis derail our efforts to reach net zero by 2050 and the growth in low carbon and renewable energy.”

“The energy market is a different place even from two months ago, let alone four years ago when the cap was introduced, with these latest figures further highlighting that the cap serves to defer wholesale price increases – not eliminate them.

No help targeted at poorer homes is contemplated by the Chancellor, a former Goldman Sachs banker; absent from his spring statement was any increase in Universal Credit.

In other news, it was reported that consumers in Conservative-run Britain were being offered less government protection than European neighbours against the continuing energy shocks.

France’s government has pegged tariff rises for home supply at no more than 4%. Belgium had dropped VAT at least temporarily on domestic tariffs, Italy has freed up Euros 8 billion in help with bills, and Czechia is indexing benefits to follow energy prices,

Reviews of Sunak’s spring financial statement last week were savage, even from habitually right-leaning Fleet Street.