Electricity storage projects at all stages of development – from planning application on paper to full operation, including trading – have surged to record levels in 2023, according to a new report from industry body RenewableUK.

In twelve months alone, the nation’s total for battery ventures at all phases of progress surged by over two-thirds, amounting to a headline capacity at year end of 84.8GW. At last year end, the equivalent figure was 50.3GW, as monitored in the trades body’s ‘Electric Pulse’ members-only survey.

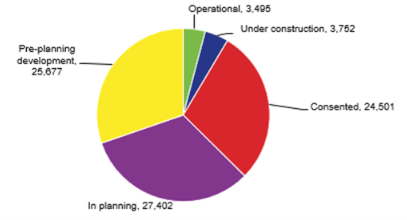

As 2023 closes, the industry group says British battery capacity, at both industrial and utility or grid scales, breaks down as follows;

Capacity now in full operation stands at 3.5GW. Projects in construction add a further 3.8GW. A further 24.5GW of projects with planning consent awaiting the first shovel to break ground. 27.4GW have more been submitted for planners’ approval. Behind them come a total of 25.7GW still on the drawing board, undergoing commercial design, talks of over land use and access, and technical feasibility.

Broken down, England leads the four home nations. At 50.8GW, it has 60% of the UK’s gross pipeline; this includes a 2.8GW project, the biggest battery and management system yet to be commissioned. With a gross total of 29.5GW across all projects, Scotland’s pipeline comes second.

The trend of developers seeking ever bigger batteries continues its relentless surge, the report notes. This year’s average unit size in the national power locker comes in at 80MW, up from the 54MW average seen only two years ago, and up from a tiny 2MW a decade ago.

Storage engineers regard a reference 50MW unit as carrying enough power to charge up 2,000 electric vehicles.

Batteries play a key role in modern energy systems, taking up the slack in despatch inevitable as intermittent renewables come to dominate generation. Power storage is the linchpin for grid operators, seeking at all times to balance the supply of electricity against demand in real time.

Barnaby Wharton, RenewableUK’s director of future electricity systems, commented: “These totals put us well on track to delivering the 30GW of flexibility which the Government says we will need by 2030 to ensure electricity supply always meets demand.

“Getting viable projects connected to the grid is a priority, and industry has welcomed progress on reforming the connections process.

“A two-thirds growth balance in projects coming forward this year demonstrates the huge appetite among investors to enter battery storage’s rapidly growing market.

“While the battery market is booming, we need investment in even larger projects to store energy for longer, unlocking further opportunities for us to scale up this cutting-edge technology. We’re still waiting for the Government to confirm how they will stabilise revenues for long duration projects.”

With a heavy majority of new battery projects yielding only two hours’ supply, some storage experts argue however that longer duration and capacity, and not simple power rating, should be the new focus for grid-scale units.

From provider Balance Power, commercial director Nick Provost recently argued that developers should be encouraged to shift focus to batteries capable of eight hour support were now more important in spreading supply risk across grid-connected systems. They could also minimise costs falling on DNO and transmssions operators to remove grid bottlenecks.