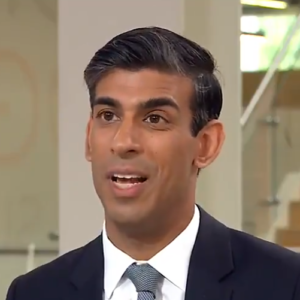

After weeks of denying he’d impose a windfall tax on North Sea oil and gas extractors, Chancellor Rishi Sunak today bowed to Ofgem’s fears of 40% of UK homes in fuel poverty by this Christmas.

A £5 billion Energy Profits Levy – the chancellor’s tip-toeing circumlocution for a temporary windfall impost on oil and gas firms, revealed today to last at least until September 2025 – will ensure every household will get at least £400 in a non-repayable grant this year.

The handouts replace the previous £200 interest-free loan, repayable over five years which Sunak had announced only three months ago.

In addition, eight million vulnerable households will receive a further £ 650, the chancellor announced, as part of a package now extended to £15 billion, a third of that targeted to protect households most exposed to rocketing energy bills.

Beyond the basic £400 available from October, around one-third of all UK households will benefit also from today’s additional measures, the chancellor told MPs at lunchtime.

A new, one-off £650 payment will help more than 8 million low-income households on Universal Credit, Tax Credits, Pension Credit and legacy benefits. Separate one-off payments of £300 will go to pensioner households and £150 to individuals receiving disability benefits

Relief for every household of £150 against council tax, already announced in February, will continue, the chancellor made clear.

The most vulnerable homes with disabled people will receive £1,200, including that council tax discount.

Around £5bn of the cash will come from the windfall-cum-levy on oil and gas majors. £10 bn more comes from central borrowing and taxation. Subject to continuing talks with electricity firms, including renewables-only retailers, their £3bn contribution may reduce the need for higher taxes & borrowing.

The new levy will see oilcos taxed at an extra 25% between for the next 60 months on what the Treasury deems ‘excess’ profits. The Chancellor sweetened the fiscal pill with investment relief which could, he claimed, offset 91% of the time-limited profit grab.

Targeting by the Treasury of today’s reliefs towards poorest homes and consumers at highest risk of Britain’s deadly’ eat-or-heat’ conundrum, lay at the heart of the Chancellor’s announcement.

The chancellor justified his more altered rigorous approach in the light of what he called ‘extraordinary profits’ being collected by oil and gas operators as a result of surging gas prices on world markets.

“We are following a sensible, middle ground, not ideological but pragmatic”, he told MPs.

Despite recent protests, electricity providers look unlikely to escape a time-limited profits grab from the Conservatives.

As the power sector also benefits from profits inflated through no increase its in risk-taking, the chancellor told the Commons, consultations with generators continue on an impost, and in the context of deeper reforms now revealed as necessary in UK power retailing.

Mendacious Johnson

The chancellor said the bulk of benefits in today’s package would be delivered direct into householders’ or benefit claimants’ bank accounts, without a need for form-filling.

Sunak’s shadow Rachel Reeves accused him of dithering, and inflicting £53 million of hardship on fuel-stressed homes, for every day since Labour had first proposed the windfall tax nearly five months ago.

For oil and gas producers, Deirdre Michie of Offshore Energies UK, protested that the extra £5 billion coming this year from the Energy Profits Levy would deter investment. It would come on top of £7.8 billion the sector will pay this year, up twenty times on only two years ago.

“This is a disappointing and worrying development for industry”, Michie said, “the shockwaves of which will be felt in offshore energy jobs and communities, and by consumers, for years to come.

“In April we welcomed the government’s British Energy Security Strategy, which pledged ‘Secure, clean and affordable British energy for the long term’.

“We thought long-term meant years or decades, but it seems to have meant just a few weeks”.

Two days ago, OEUK co-ordinated signatures from 31 firms and organisations in offshore oil, protesting against a windfall tax.