Any move by Chancellor Jeremy Hunt to extend to renewable power retailers the government’s windfall tax on excess energy profits would be unfair on low-carbon generators, analysts Cornwall Insight maintain.

On Thursday the new chancellor will announce in his Autumn Statement new measures designed to plug a gap in public finances variously estimated at between £45 billion and £70 billion.

Excess earnings streaming into coffers of fossil power companies, and estimated to exceed £200 Billion present an attractive target, with leaders of both BP and Shell dropping recent heavy hints that their own earnings deserve a bigger clawback into the Treasury.

When chancellor, prime minister Sunak failed to resist all-party pressure for a one-off swoop, introducing in May an ‘energy profits levy’, estimated to yield £ 5billion.

Speculation at Westminster is that Hunt this week will extend it by three years to 2028, and increase it to 30% from the present 25%.

Linking retail power tariffs to the wholesale price of feedstock gas, an anomaly reinforced by recent government support for bill payers, is increasingly seen as inconsistent with competition from feedstock-free renewables, which now account for around 40% of the nation’s electricity.

Now Cornwall Insight has intervened in the debate, comparing profits declared respectively by renewables generators or their controlling investment funds, by oil and gas super-majors, and by large electricity generators (GenCos).

The analysts conclude any windfall extension affecting clean generators would be “disproportionate and unfair”. The likely loss of confidence among green investors would exceed any short term gains to the Treasury, the respected consultants judge.

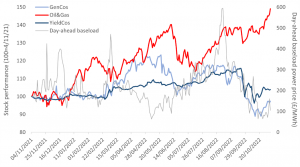

Comparing share price performance since November 2021 for all three types of firm, Cornwall finds that each type has performed differently, make a blanket extension of the windfall across all three unviable and economically ill-judged.

Cornwall’s key findings are:

- shares prices of fossil fuel firms have climbed to 150% against an index started last November.

- Renewable listed funds peaked at 115% of their November 2021 price and have since fallen back to the same level as early March 2022, shortly after Russia attacked Ukraine

- shares for big electricity generators remained largely constant until the invasion in February, after which they have broadly moved in sync with general equity markets

Dr Matthew Chadwick, Cornwall Insight’s lead research analyst said: These trends likely reflect the underlying sensitivities of different business models to interest rates, and to commodity prices for their place in the energy value chain.

“Renewables listed funds are very sensitive to rising interest rates in the UK, as they heavily impact discount rates for component project valuations.

Oil and gas companies, and large electricity generators on the other hand are more internationally diverse, with a wide range of exposure to discount rates, meaning inflation is less of a concern.

“The prices may also be impacted by energy buying strategies with renewables ultimately forward trading, or hedging, power to give some certainty of returns to capital investors, many of which dislike too much exposure to power price volatility. This may explain why we did not see a steeper climb in share prices beyond August, as large volumes of forward hedging in early-to mid-summer while prices climbed, saw them miss out on the super peak thereafter. O&G however, trade in the source commodity driving the whole energy value chain – gas – and have therefore been able to forward sell under ever increasing price levels since the end of 2021.

“This analysis is also instructive because we can view Renewable Listed Funds as a representative sample of the broader renewable project world, certainly for onshore wind and solar. If this is true, then it would be rash to assume that there are excessive windfalls to tax in this part of the market. And, if so, then the damage that undertaking such measures could have on investor confidence, and ultimately the increased risk premia on future investments in the medium- to long-term could exceed the benefits that a windfall tax might reap in the short term.”

The shambolic September budget of Liz Truss and Kwasi Kwarteng is thought to have inflicted around £30 billion of extra costs on public expenditure, including by accelerating inflation and making it more expensive for government to borrow from international investors.