Respected energy economists Cornwall Insight expect no return to pre-Covid power prices before the late 2030s at the earliest.

Despite Europe’s & the world’s continuing surge in renewable generation, the globe’s step-change in electrifying of heat, industry and transport will keep tariffs high for another decade, Cornwall believes. British businesses and homes must simply reconcile themselves to the trend, analysts imply.

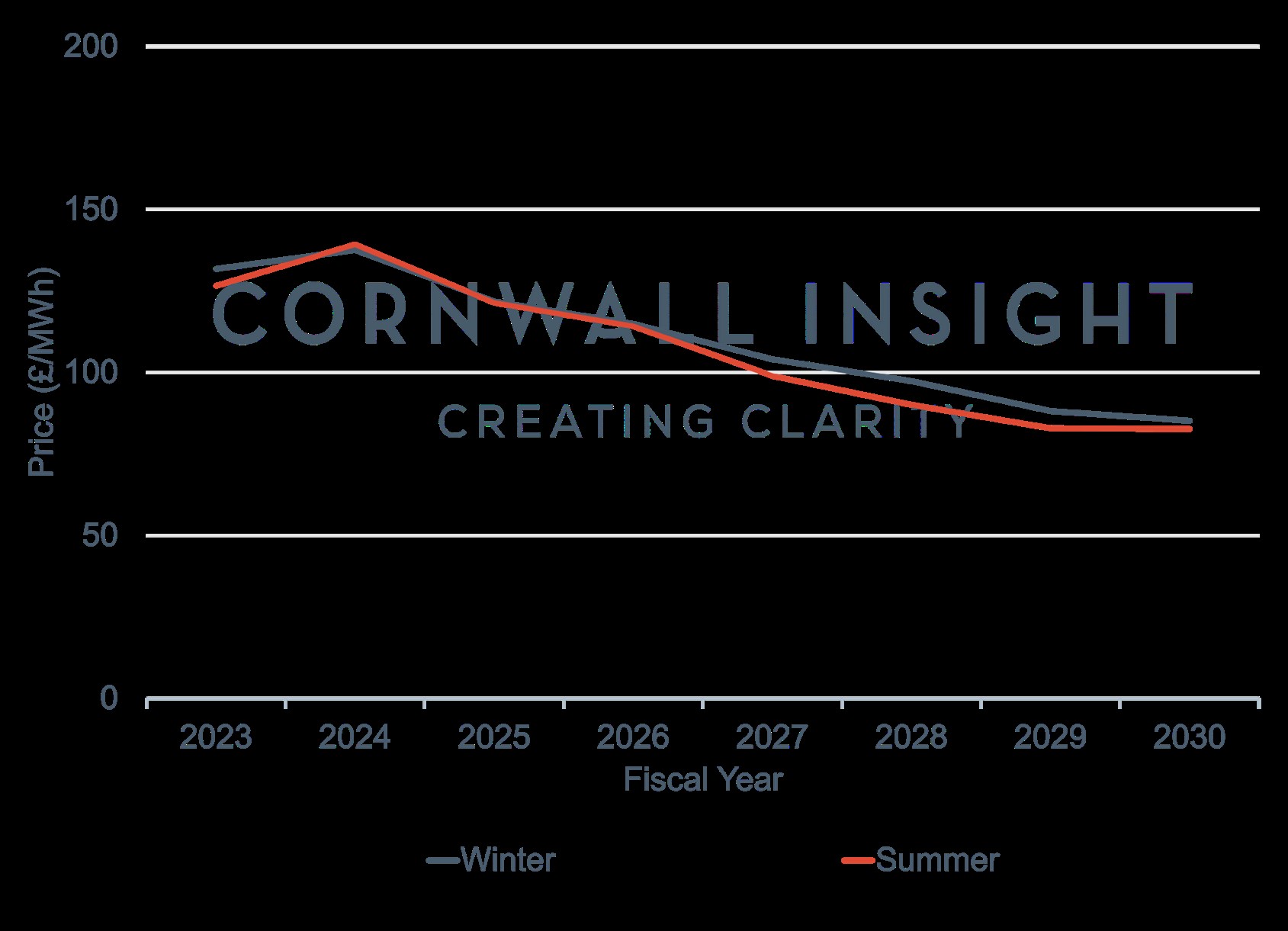

The consultancy’s latest GB Power Market Outlook to 2030 predicts more green power sources will push UK wholesale prices downward, falling below £100/MWh by 2028, two years earlier than previously thought.

But by the late 2020s, more renewable energy sources will be countered by increasing demand, as electrification spreads across the nation’s economy.

Gas generation capacity must be retained to preserve system stability and consistent supply when winds are low, Cornwall’s analysts say.

The deteriorating state of French nuclear generation over the next decade is also a worry. Downtime intervals will lengthen as Paris’ ageing fleet is patched up, the report says, leaving the UK to export more power to the continent.

The effect on wholesale rates will be a continued plateauing of prices at post-pandemic levels.

Power price forecasts – average price per fiscal year

The firm’s predictions underline the critical importance of long-term preparedness as Britain progresses towards Net Zero goals. Batteries and long-term storage must be urgently developed, it says.

Tom Edwards, a senior modeller at Cornwall, commented: “Our latest long-term power forecast reveals a changing and complex landscape for the energy market in Great Britain.

“The challenges of rising power demand, increasing exports and reliance on gas continue to keep our power price forecasts above historical levels for many years to come.

“Despite these concerns, we continue to be optimistic about the positive impact of low-carbon, cost-effective energy sources and favourable gas price trends. We are pleased to see prices are expected to fall below £100/MWh sooner than previously anticipated, which offers consumers a glimpse of the benefits of the ongoing energy transition.

“It is of utmost importance that the government and other decision-makers fully comprehend the urgent and pressing need for continued investment in renewable energy sources and innovative solutions.

“The time to act is now. We must invest in long-duration storage technologies, nuclear power and Carbon Capture Usage and Storage that can effectively bridge the gap between intermittent renewable generation and maintaining a consistent energy capacity. This will bolster the chance of success in our transition to a sustainable future.”