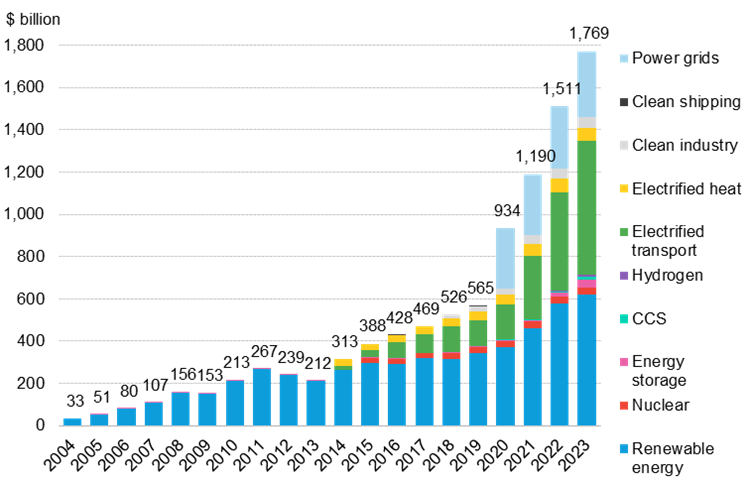

Investments in the world’s switch to a low carbon economy surged 17% in 2023 to a record $1.77 trillion, but still run at around a third of what Net Zero calls for, figures published today by research provider Bloomberg NEF reveal.

EVs and e-mobility are now the largest sector for spending in the energy transition, growing 36% last year to $634 billion, according to the firm’s influential Energy Transition Investment Trends 2024. The figure includes spending on vehicles and battery making, as well as associated infrastructure.

In second place, renewable energy generation saw an 8% increase last year in new investment to $623 billion.

At $310 billion, grid and transmission investments made up the third largest sector. Grids are a critical enabler for the energy transition.

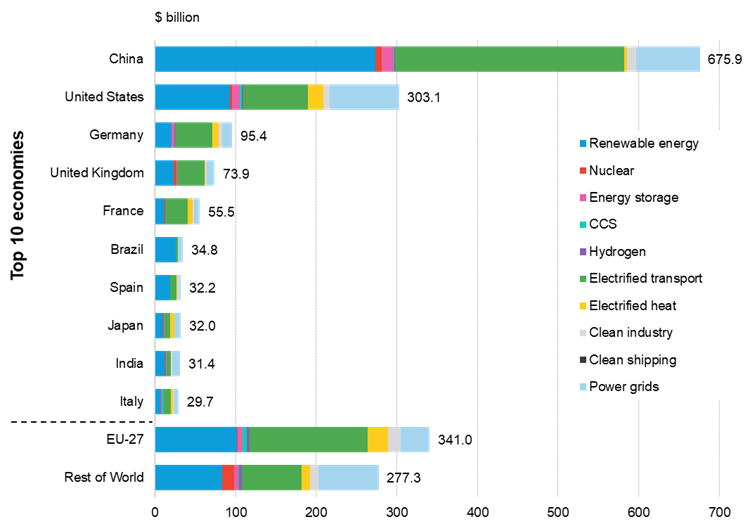

China remained the world’s biggest single green power investor, its $676 billion outlay making up 38% of the global total. But that 11% drop on 2022 reflected its faltering economy. The total was surpassed jointly by the US, Europe and the UK.

“Last year brought new records for global renewable energy investment. Strong growth in the US and Europe drove the global rise, even as China sputtered”, commented Meredith Annex, co-author of BNEF’s report.

Despite a year of supply chain constraints, record totals of offshore wind capacity also reached financial close.

Global energy transition investment by sector Source: Bloomberg NEF

Overall global renewables spend of $135 billion in 2023 could reach $259 billion next year, according to Bloomberg.

World invests only a third of what it needs to

But the consultancy cautions that global green investments continue to lag far behind UN-sponsored goals to achieve Net Zero by mid-century.

Bloomberg says energy transition spending needs to average $4.8 trillion every year from 2024 to 2030 to align with BNEF’s Net Zero Scenario, a UN Paris Agreement-aligned trajectory from its New Energy Outlook published in 2022. This is nearly three times the total investment observed in 2023.

“Our report shows just how quickly the clean energy opportunity is growing, and yet how far off track we still are,” said Albert Cheung, BNEF’s deputy CEO.

“Energy transition investment spending grew 17% last year, but it needs to grow more than 170% if we are to get on track for net zero in the coming years,“ Cheung added. “Only determined action from policymakers can unlock this kind of step-change in momentum.”

Top 10 economies for 2023 energy transition investment, plus the EU-27 and rest of the world

More details here.