Government has launched a consultation on phasing out unabated coal by 2025. It seeks views on how and when the UK’s remaining eight coal-fired plants should be brought offline, but has some concerns over security of supply implications.

Government has launched a consultation on phasing out unabated coal by 2025. It seeks views on how and when the UK’s remaining eight coal-fired plants should be brought offline, but has some concerns over security of supply implications.

It will only implement proposals, i.e. mandate that coal shuts down completely, if sufficient new gas is constructed. Although BEIS says its analysis suggests taking action on coal will not create risks to security of supply, in some scenarios, the timetable to build replacement new gas plant would be much tighter than previous dashes. One of the key questions asked by the consultation is “whether in the context of the reformed Capacity Market and concerns over security of supply, it will now be necessary to put in place powers to suspend the proposed obligations on coal”.

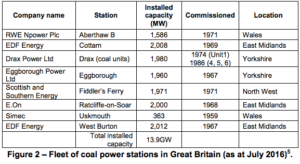

Some nine gigawatts of coal has already closed over the last four years as economics have collapsed. The remaining plants make much of their revenue by ramping up when margins are tight and by taking ancillary services and capacity contracts from National Grid. The eight remaining plants, at 13.9GW, represent about 15% of UK generation capacity. The BEIS consultation accepts that they are likely to close in the near term under current market conditions, so its consultation in effect is an attempt to set a predictable timetable without further undermining UK capacity margins. It may actually serve to extend the operating life of the UK’s coal fleet.

Government announced last November that 2025 was the cut-off date for unabated coal, with restrictions in place from 2023. However, since then there have been questions about what constitutes abatement – and BEIS seeks views to that effect in the consultation.

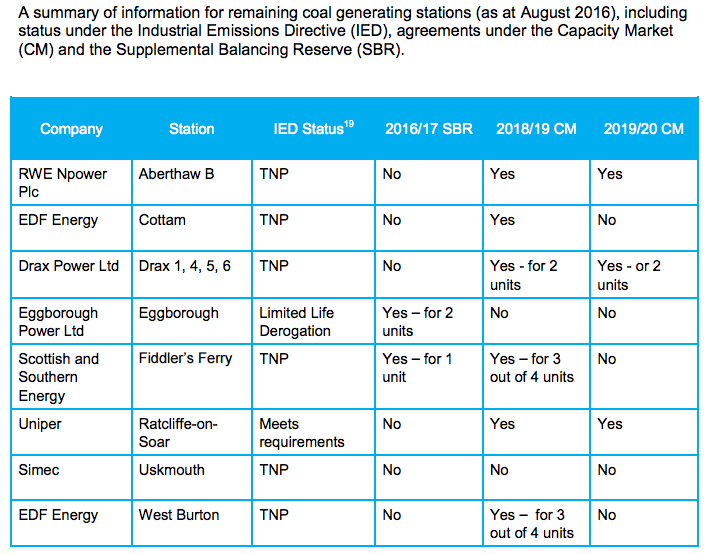

Most UK coal plants are expected to come off the system well before 2023. The EU Industrial Emissions Directive limits emissions and particulates. Plant operators have had to choose between cleaning up their power stations – which is expensive – or opting out and closing by 2023 at the latest. In its consultation, BEIS said EU directives still stand and will be implemented while the UK remains a full bloc member.

Other derogations include a national transitional plan, which gives member states four years to implement the directive, an option taken up by some coal plant operators, and an emissions performance standard (EPS) as set out in the Energy Act 2013. The EPS sets an annual limit on emissions out to 2044 at a level equivalent to 450gCO2/kWh for a plant operating at baseload – something coal plant looks unlikely to do for much longer.

The consultation also moots possible exemption for plants that adopt co-firing of biomass.

BEIS seeks views on four areas: i) Possible approaches for placing obligations on unabated coal plant from 2025; ii) Whether and how it might go about constraining coal generation before 2025, and its assessment of the impacts; iii) Whether, in the context of the reformed Capacity Market and concerns over security of supply, it will now be necessary to put in place powers to suspend the proposed obligations on coal; iv) The wider impacts of these proposals.

Click here for the full document.

Related articles:

UK loses 11.4GW of coal and gas capacity in three years

Even doubling capacity market outturn ‘unlikely to build new gas’

Major changes to capacity market and distributed generation charging regime proposed

Ditch coal earlier, forget small nukes and mandate energy storage and DSR targets

Engie to close 1GW Rugeley coal power station

Capacity auction fails to incentivise new gas plant

UK facing blackouts when coal closes, engineers warn

National Grid buys 3.6GW back-up power to meet winter demand

Rudd confirms 2025 hard stop for coal

UK to lose another 2GW of power as Eggborough set for colosure

Drax to halt CCS investment, seeks more biomass support

No CCS, no heavy industry, MPs warned

Free report: Demand-side response 2016

Click here to see if you qualify for a free subscription to the print magazine, or to renew.

Follow us @EnergystMedia. For regular updates, sign up for the free newsletter.